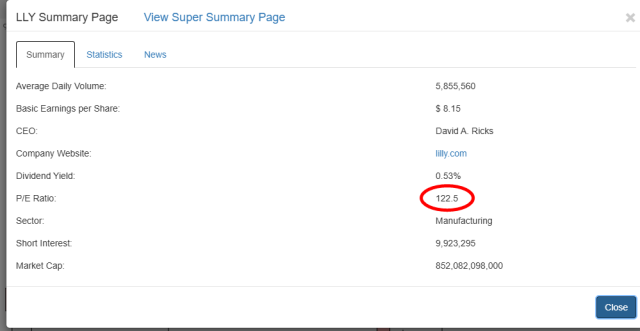

Eli Lilly has traditionally scared me. I mean, let’s face it, a totally evil company that sells drugs at 10,000 the times of the cost of materials which has the pathetic U.S. healthcare system over a barrel is a pretty damned good business model. It is sporting a P/E in the triple digits, which is normally what you would associate with a new biotech company at the cusp of curing cancer, not an ancient organization that sells stupidly named pills to the desperate.

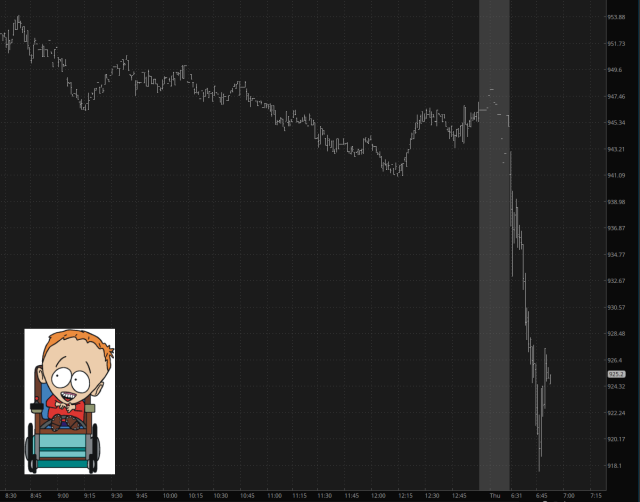

Still, I gave it a shot yesterday and acquired January $960 puts. We’re off to a good start, folks! Making money on a short is a good feeling, but doing so with a clearly malignant company is even better.

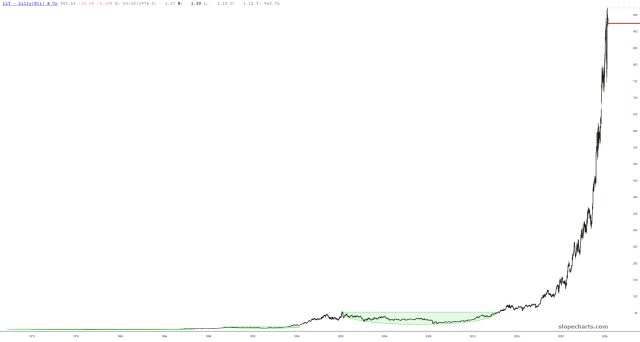

And let’s all agree, it has a long, long, long way to go. Fair value for this is probably 1/10th its present price, but the aforementioned broken health care system will keep that from happening.

As I said, though, we’re off to a good start, and I’ll cheerfully hold on to this sucker until the mid-750s!

By the way, I see equities have EXPLODED to the upside just now. GOOD! I’ve got cash waiting to get more aggressively bearish. Bid it up, bulls! You’re my new best buds!