Tonight I’m going to forego the usual quest for thin reeds on which to hang the equity bear case, and instead offer up reasons why all hope is lost for now. So here goes…..

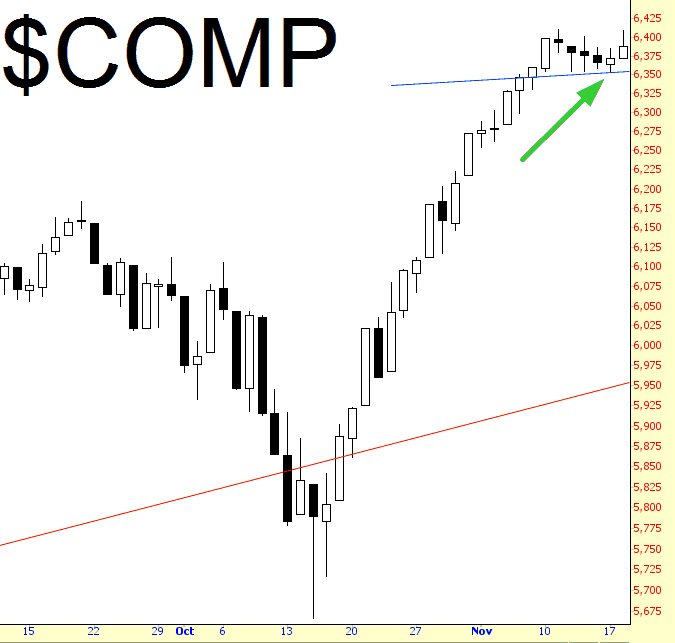

First, the Dow Jones Composite has penetrated and successfully tested its former resistance line. This resistance is now acting as support, as illustrated by yesterday’s test of the line and today’s acceleration up and away from it.

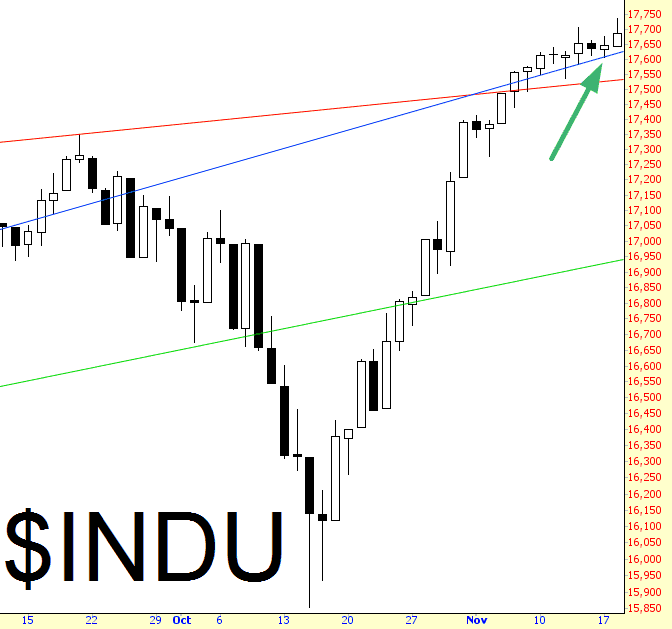

Next, the Dow 30 – one of the three components of the Composite – hit a lifetime high (as did many, many other indexes) and has also successfully tested its supporting trendline, which for years prior had served as resistance.

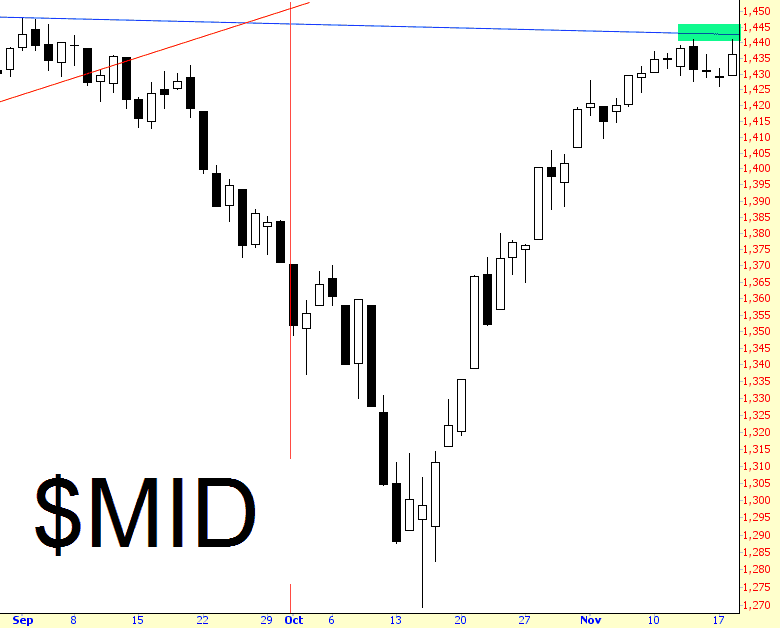

Third, the MidCaps, on which I pinned my fondest hopes for a fresh downturn, are dangerously close to breaking their descending trendline (and, soon thereafter, busting the series of lower highs):

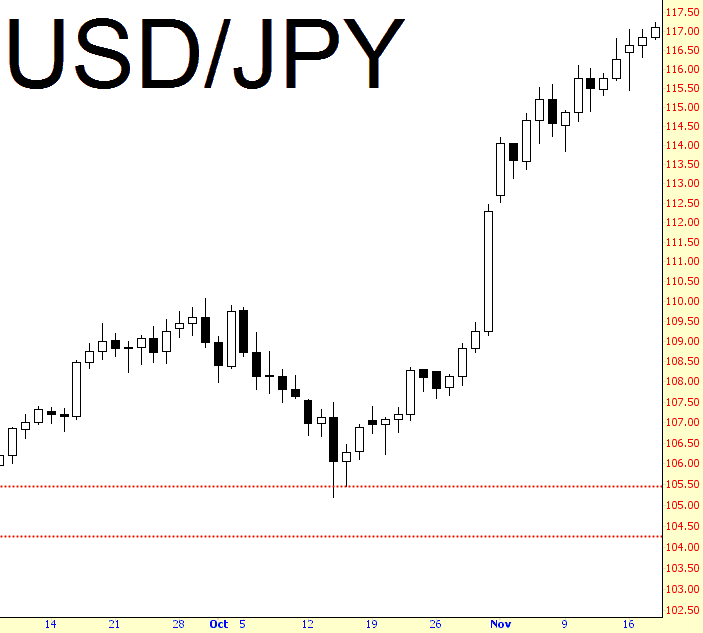

And lastly, the Japanese Yen – – which, perversely, has become more important than fundamental data here in the United States – – continues to wither away toward the Japanese Government’s target price of $0.00. The USD/JPY (whose denominator, the yen, is becoming ever-smaller) pushes higher. The “crush” on Sunday night is barely a blip now.

Having said all that, I think there’s still ample evidence for the prospect of renewed weakness, but you’ve heard all that stuff a zillion times already. I’ll let the above (depressing) evidence stand on its own.