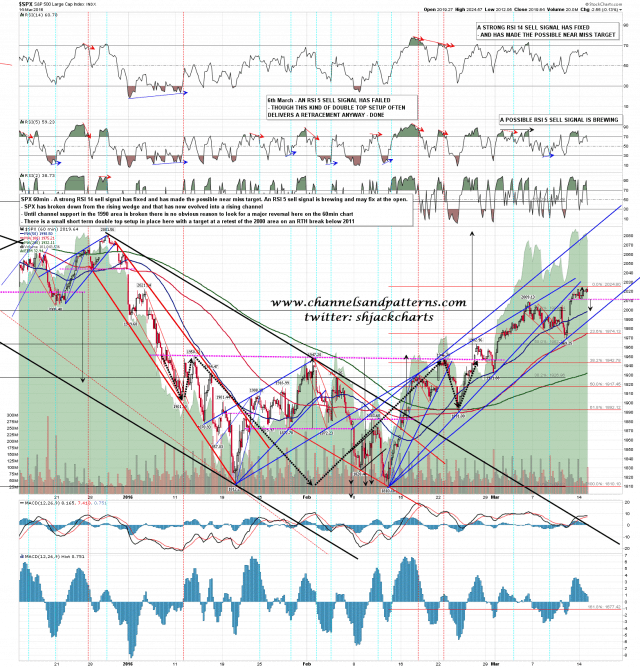

SPX is doing the retrace I was looking at yesterday morning and I have a small double top target in the 2000 area, with possible support on the way in the 2003/4 area at the weekly pivot. Unless bears can convert the weekly pivot to resistance, and then break rising channel support in the 1990 area, then I’m expecting this retrace to be a final retrace before the move to the possible rally high, ideally under the 2035 SPX ceiling that I was talking about yesterday morning, but possibly just a retest of yesterday’s high at 2024.57 and marginal new high, before at least a strong retracement and very possibly a rally high. SPX 60min chart:

ES Jun 60min chart:

What are the odds that SPX will make a rally high here rather than in the 2082 IHS target area? I’m thinking about 65% yes to 35% no, but either way I think we should see a significant short term high here. How far the retracement from that high goes we would then see.

I’m going to be doing a bit of promo work on theartofchart.net this week, highlighting a few of the very nice calls we’ve been making there in recent weeks on bonds, gold, SPX, USD, nat gas, sugar etc etc. I’ll go through some of those in more detail tomorrow but in the meantime there are some excellent free videos on our March Trader Education page and if you’re interested you can see those here.