There’s been a number of significant level breaks/hits over the past week and it seems timely for a longer-term chart review. Here come the weekly charts.

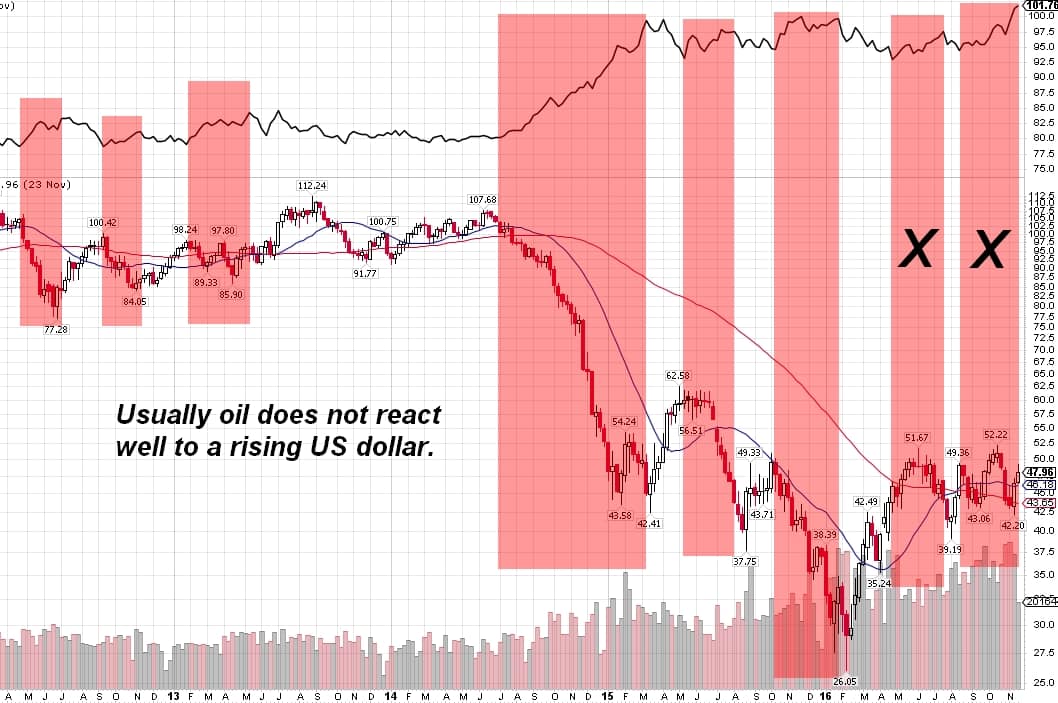

A lot of the charts coming up relate in some way to the US dollar so let’s take a look at that one first.

The USD chart has broken out strongly from a 2 year range. There’s no arguing with this breakout, the USD is going higher. Since a lot of commodity charts react to moves in the greenback, let’s take a look at some of the more popular ones.

Gold broke $1200 pretty hard this week. At the moment, there’s no clear low in sight, but the mid-channel line at $1150ish should bring some short-term support.

Directly opposite the USD is the Euro. The Euro broke down out of its shallow weekly uptrend channel and by all means should head lower from here. Whether it tests the underside of the channel a bit more before doing so is anybody’s guess.

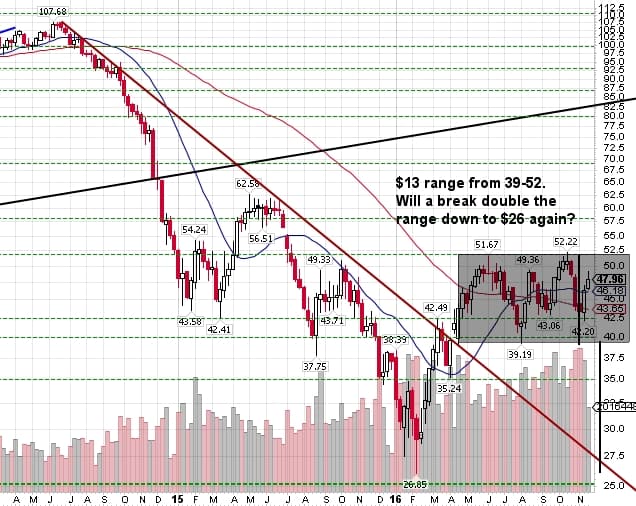

Next up, we have oil. Oil has been rangebound for most of 2016 and has yet to make a signalling move what it’s intentions are for future trade.

In relation to the dollar, a rising USD is usually not a friend to oil over the years. Interestingly enough, however, the USD rallies in 2016 haven’t amounted to much reaction except to cap upside.

Finally, to take a look at the 30yr bonds as represented by TLT. It’s had a pretty decent drop out of its rising wedge and appears to me to have settled into a channel having tested the potential low and held. Given the condition of interest-rate sensitive markets, it’s my opinion that they are ripe for a mean reversion event either through price or time.

Now I do have a trade for you, but this post is already getting a bit long in the tooth so I’ll detail it in a separate post. Have a great Thanksgiving weekend. Rest up for next week. Opportunities abound.