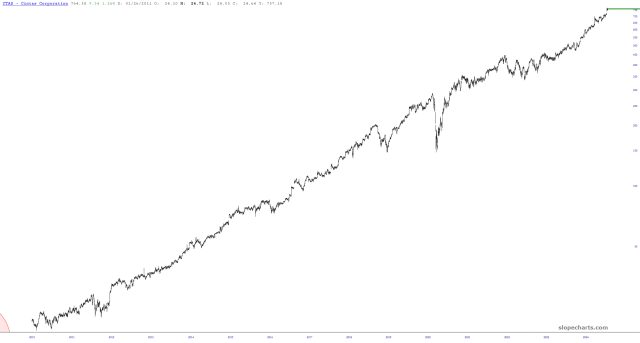

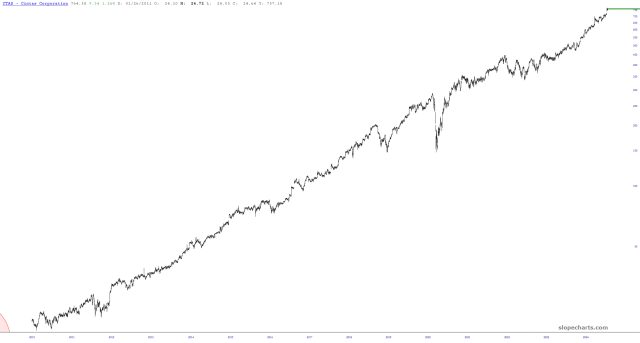

My hand to God, if you looked at this chart, you would have to assume the company has a patent on turning pig dung into gold bars. But, no………..they make uniforms. You know, like for nurses and police officers. Uniforms. Go figure.

My hand to God, if you looked at this chart, you would have to assume the company has a patent on turning pig dung into gold bars. But, no………..they make uniforms. You know, like for nurses and police officers. Uniforms. Go figure.

This week has been a ball!

I’d say this company will probably be gone inside of a year.