Preface to all 21 parts: This is a special holiday weekend, because not only does it contain Good Friday and Easter, but it also begins the Slope of Hope's 20th year in continuous operation! Through the weekend, I will be sharing some of my favorite posts from the past, plucked from among the literally 30,000 posts I've created over the years. Here is one of them:

Those of you who have read my work for any meaningful length of time probably know by now that I tend to think in metaphors, analogs, and allegories. Perhaps it goes with being a visual thinker.

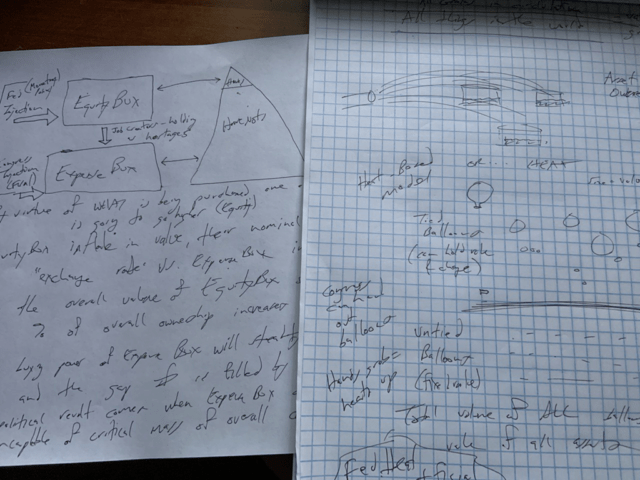

The truth is, I think about Slope and the topics therein almost constantly. When I swim, I am incessantly tumbling over ideas related to Slope (not just its features, but also the subjects we discuss). Sometimes I’ll try to work my thoughts out on paper, as I did here recently, and have been doing for days:

What I’ve been thinking about more than usual lately is what’s been happening in the economy with respect to asset inflation, the “haves” and “have-nots”, and the Fed.

Why am I even bothering with this? Because I think this is important, not only for my own comprehension, but also because I think our entire society is woefully ignorant of such matters. I believe literally 99% of the population has no clue what’s going on. Because we live in an age where the cover of the Economist looks like this, it’s time to pay attention:

After much thinking, and many laps, I have been going through all kinds of mental contortions with different allegorical constructs, and I’ve landed on one that I’m fairly happy with: balloons.

I’ll begin with a set of definitions, or rules, if you like, about how this model is constructed. As much as I’d like to provide vivid illustrations, I’m not much of an artist, and I’d rather rely on the written word for the mental picture I’m attempting to convey. Thus, here is my system:

- The totality of all wealth has, we can surely agree, an aggregate value. I’m talking about all the land, all the houses, all the shoes, all the yachts, the iPhones, the diamond earrings, the private beaches, the shares of Peloton, and everything else.

- I have broken up assets into three distinct classes: PA (Physical Assets), MA (Mental Assets), and SA (Spendable Assets).

- Physical Assets are, as the name oh-so-subtly suggests, things you can hold and touch. It’s “stuff”. Your house. A boat. The sofa I’m sitting upon while I type this, and the deck upon which it stands. I want to stress that these are man-made things. It doesn’t include natural objects such as rivers, mountains, platinum, silver, gold, and other naturally-occurring substances whose available quantities are fixed. They have value, but they are outside this model.

- Mental Assets are things of value which are human constructs, but cannot be touched, such as commodity contracts, shares of AMZN, and the like.

- Spendable Assets are means of exchange with no intrinsic value. People get paid. They buy food. They eat it. Repeat.

OK, so that’s the landscape of assets. Where do the balloons come in?

Well, collectively, they represent a “translation” of the assets into fungible form. In our model, PA, MA and SA represented by balloons, and their “value”, as it were, is their volume: that is, the space they occupy. The distinction is that SA – – currency, for our purposes – – are balloons with a mere one cubic centimetre of air inside of them. They are untied, and their volume remains unchanging.

The PA and MA – assets whose value can change – are tied and can range in volume from utterly empty to gargantuan, depending on how much air is inside them.

So, so far, here’s what we’ve got:

- The collective volume of all the balloons in existence is a certain amount;

- The collective sum of all physical and mental assets also is a certain amount;

- Our balloons are freely exchangeable among themselves (I could exchange my 2,000 empty balloons for your one 2,000 cc balloon representing a share of Amazon)

- Parts 1 and 2, for our purposes, are equivalent to one another at all times.

Balloons, as any child can confirm for you, are filled with air or some other kind of gas, and as such, they can get bigger or smaller depending on how hot the gas is.

If the gas is quite hot, the balloon will grow larger, and as it chills, it will shrink, approaching even the tiny state of the nearly empty “SA” balloons.

One thing that can heat up these balloons is a whole bunch of hands reaching, grasping, and tugging at a given balloon which everyone wants. If, say, the Tesla balloon gets really popular, then all those greedy little hands grasping for it are going to heat it up, and it’s just going to swell from the effect.

So far, we’ve got a pretty clean little system. There are natural assets, which simply “are”. They exist, they aren’t manufactured, and there is a certain amount of them. Those are outside the model.

Within the model, there are the physical assets, represented by PA balloons, mental assets, which are the MA balloons, and spendable assets (or currency), representing by nearly-empty SA balloons.

Excitement swirling around any given asset makes it swell up, and disinterest – – the proverbial cold shoulder – – makes the poor fellow shrink. It’s natural, it’s orderly, and it’s understandable.

Enter the government.

There are two parties of interest to us in our balloon-based model: Congress and the Fed. They each have distinct powers.

Congress has the power to create empty balloons. In our model, this is the SA – spendable assets. They can make as many of these things as they like. They can wander into our balloon world and hand out trillions of empty balloons, each of them with their legally-prescribed 1 cc of air resting inside – – and distribute them to whomever they deem worthy. Maybe everyone whose net worth is less than 50 cc of balloons gets to have 5,000 free balloons.

Keeping in mind that the “wealth” of the world is represented by the cumulative volume of all these balloons, it is clear that the “wealth” of the world isn’t changing a single iota with all this balloon distribution. New skyscrapers aren’t appearing. New oil tankers don’t show up floating on the ocean. A thousand houses don’t spring up out of the blue. It’s just – – – – a whole buttload of balloons, which subtly but genuinely diminish the true value of all the balloons as a whole.

The Fed, on the other hand, isn’t handing out balloons at all. What they’re doing is sending out a bunch of Fed employees to wander around the crowd with these suckers:

Hot air blowers. Hundreds of ’em. And the Fed employees, when they are instructed to do so, wander around, looking for certain assets, and point the above tool right at them.

The Apple balloon. The Amazon balloon. The Tesla balloon. Zoom. Peloton. Houses in Palo Alto. Whatever strikes their fancy. As Glenn Frey sang back in the 80s, the heat is on, and as it persists, the balloons subjected to this incessant warmth.

The giant, growing balloons are quite a sight. They attract the attention of everyone who can see them, whether they are holding them or not. Swelling assets are good, right? Things must be going well. Whether folks have these giant balloons or if they only have a few shriveled-up ones stuffed into their pocket, the sight of all this activity, growth, and wealth must create an overall feeling of prosperity.

But it isn’t quite like that. First of all, the only beneficiaries are the handful of lucky ducks who are clinging on to these things. Second, even more important, the vast majority of people don’t comprehend that the collective true wealth of the world hasn’t changed one little bit. It just looks like it has. But, proportionately speaking, all the other balloons, be they tied or untied, represent less collective wealth than they did before, simply because they have been crowded out by the oh-so-hot spheres that are starting to blot out the sun.

One final footnote in this curious little mental model I’ve conjured up: the energy that’s heating all those blowers isn’t free. It’s loaned by outside parties. As long as the loans keep coming, the blowers can keep blowing. However, if there comes a point where lenders aren’t willing to hand over the juice for these things, well, those hot air blowers are no better than paperweights.

Just because it’s such a big topic lately, why not take a moment and ask ourselves: where does gold fit into this picture? Well, in a zen-like fashion, gold simply……………is.

Notice that I haven’t forced it into this balloon model. There’s a certain amount of it available. It has persistent value. And if the balloons get larger and larger, well, that’s fine, it’ll take that more of them to exchange for the same amount of gold. Because the gold isn’t swelling up. It simply exists, available for exchange for a proportionate amount of something else.

So that’s where I’m at. It’s not exhaustive. It isn’t the Unified Field Theory of finance. But it is, I think, an interesting way to think about the world we live in today. I’d be interested in your own carefully rendered thoughts and ideas on this system I have imagined.