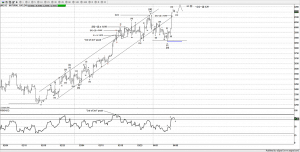

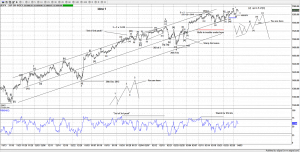

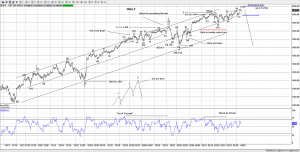

I have been watching this idea for a few days and waiting for a move higher to finish this potential larger WXY correction idea, this last leg up looks like a 5th wave of wave C, of a larger wave [Y].

Although simply put, its a 3 wave movement from $3.14, much similar the prior 3 wave movement from $3.07.

Hence its what we Elliotticians call a WXY correction. From $3.25 i suspect its now in a small 5th wave of C, so as its pushed to a new high its met its minimum objection, although the [Y] = [W] target has been met as well.

If i am correct about this idea, and i don’t see any reason why atm, then we should be very close to a strong reversal and suspect this whole advance from the April 2012 lows gets completely retraced.

But even if the larger idea is wrong, there appears to be a 5 wave advance from $3.25 nearing a conclusion, if you look at the RSI it argues for a 5th wave much like the peak into the wave [W] peak back in Oct 2012.

Ideally a small minor high for a small 5th wave then a strong move under $4.10 is want i want to see

I suspect there are many ways traders could take advantage of a potential reversal in this market, i personally prefer the futures market, although traders could look at options

I personally don’t know of any decent ETF, that really moves 1-1 with the price of NG, so i strongly suggest seeking out ways to trade this before you enter any trades