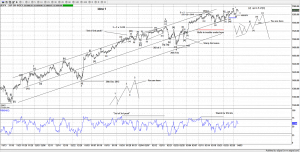

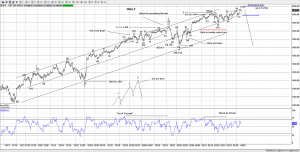

The rally from the Nov 2012 lows appears to be in wave 5, or i suspect it will be a 5 wave advance.

In Elliott Wave terms we call that an impulse wave, it looks virtually text book, although as its pushing higher, it still don’t look completed, I am currently working 2 ideas.

Idea 1

The market is about to push higher in a small 3rd wave of what we call a triangle “thrust”, so today should see more upside above 1581SPX, so some sort of “burst” to confirm this idea and negate Idea 2.

Holding above 1558SPX keeps the market bid, so no matter which idea, it is still bullish above that area, and short term aggressive traders can look to buy dips and use 1558SPX as the risk control point.

A potential target for the end of wave 5 is around the 1590-1600SPX, but its subject to wave structure and counting a 5 wave advance from the wave [e] point of the triangle (blue line).

Idea 2

This is the preferred idea and a potential ending diagonal (non Elliotticians call them bearish wedges).

Although this is limited to 1581SPX as above that area wave [v] would be longer than wave [iii] and that’s a rule violation for the pattern, so its actually quite simple, if a move above 1581SPX, it suggests Idea 1 and the triangle “thrust” option is working, failure to break above 1581SPX suggests the ending diagonal option.

Currently the market has not tipped its hand, but by the end of today’s close i am expecting to have some sort of edge to which idea is working.

No matter which idea as long as its above 1558SPX the market is still bid.

I wont bore you with the daily chart idea, as that is not important, whats important is the structure appears to be a 5 wave move from the Nov 2012 lows and i suspect a reversal is close, we simply need to let the market commit and confirm which short term idea is in play.