Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

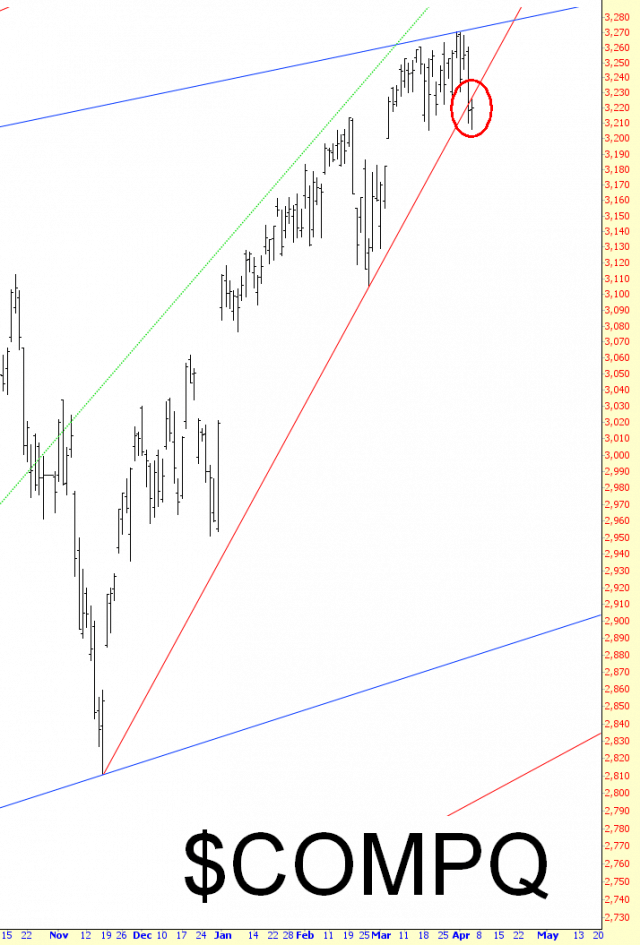

A Tighter Trendline for NASDAQ

The NASDAQ Composite has slipped beneath a new, medium-term trendline I just drew. I think a modest bounce is at hand, and I’ll short into the strength, but meanwhile, I’ve reduced my positions from 100 to a mere 62, with a 66% commitment (the rest in cash). Some day-trades in precious metals helped augment profits, but I am presently long nothing, although I do think some sustained gains in precious metals could be at hand in the coming weeks.

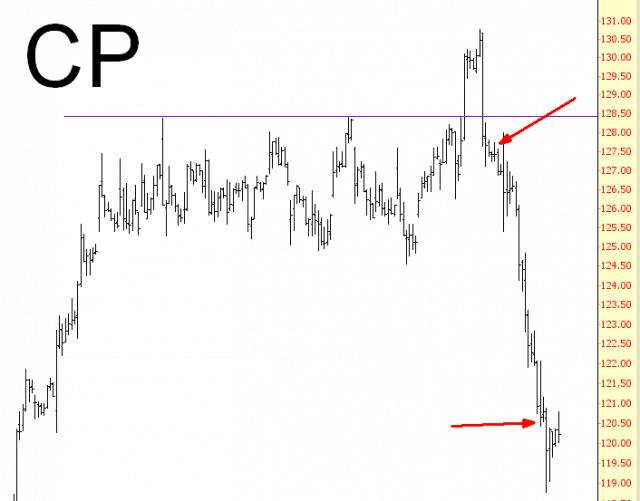

A Good Example of a Short-Term Cover

I am covering some shorts today, because I think a bounce is in store for some of them; a good example is Canadian Pacific (CP), shown below; I think it’s got lower prices ahead, but for now, I’m taking very short-term profits and waiting to short again at higher prices. My earlier trade was entered around, shown with the arrow, and covered minutes ago, shown with the second arrow.

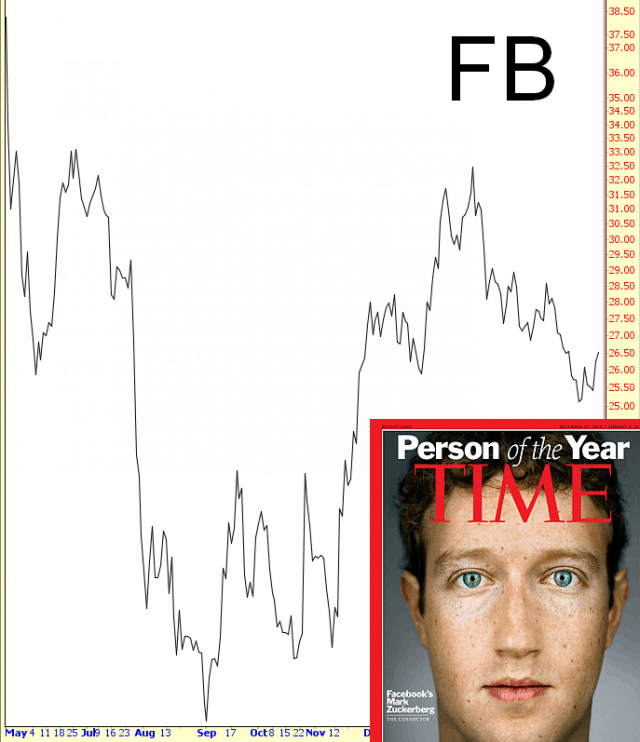

Facebook Phone Pushes Stock to Record!

Heh. Just kidding. No one gives a flying crap, and FB is still down 40% from its IPO eleven months ago. Kermit the Frog Zuck is introducing the phone at this very moment.