Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

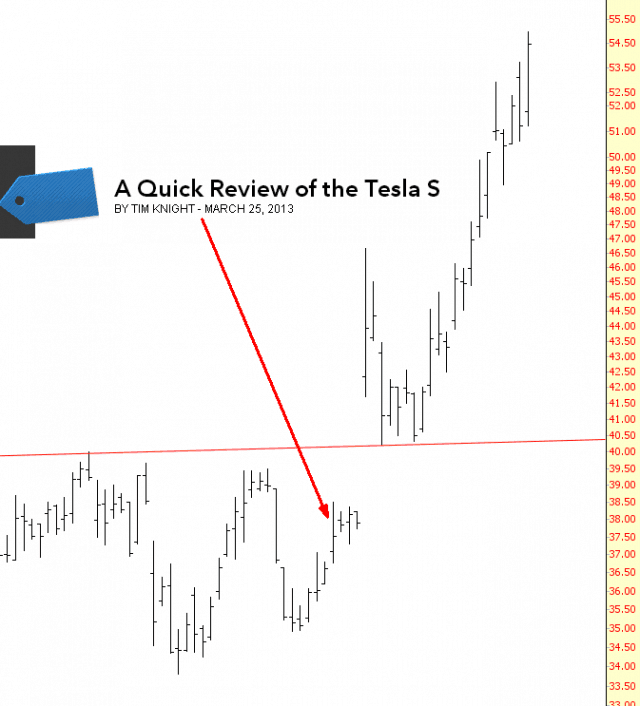

Elon’s Golden Touch Continues

Most of you read my glowing review of my new car, the Tesla Model S, late in March. It’s only been a month, but TSLA is up about 50% since then. They report earnings next Wednesday, so it’ll be interesting to see if the report is staggering enough to support these valuations. I continue to believe Elon Musk has brought us the car company of the future.

Consumerism Reigns

Well, people, there’s only so long I can plausibly offer up good short ideas in the face of a market which pukes to new highs each day. So below are a couple of retail-oriented stocks that have powerful bullish formations. First, there’s Macy’s (as an aside, I’ll note that Nordstrom, symbol JWN, has a similar pattern) (more…)

When Will Gold Exhaust Itself?

In the span of just a couple of days – April 12 and 15 – gold plunged tremendously, and in the TEN days it has had to repair the damage, it’s only managed to undo the drop from the 15th. The damage is severe and, in my opinion, simply part of a larger trend. (more…)

TANSTAAFL

Back before the first world war there was a period when many bars in San Francisco gave away free food to customers. The only catch was that the food was heavily salted, with the intention that the diners would become thirsty and order plenty of drinks to wash the food down. I understand that this may be the origin of the observation that ‘there ain’t no such thing as a free lunch’, sometimes shortened to TANSTAAFL.

Any decent outcome tends to require a risk, and that’s particularly true in traded markets. There is never any certain outcome to a trade, the best that can be done is to trade when the odds favor one outcome over another. (more…)