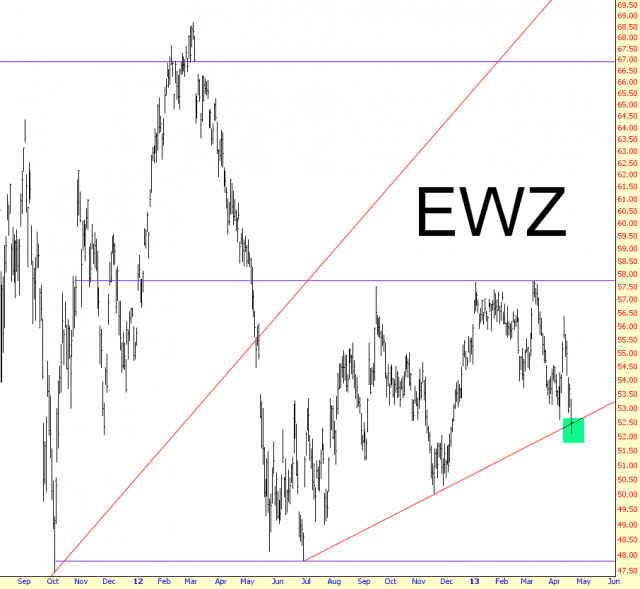

I’ve been quite prolific lately, so I’m going to take it easy on myself tonight and not do any long post at all. I’ll simply say that the chart of the Brazil ETF, shown below, has broken a trendline, so this is yet another example of a breakdown in the market which, chip by chip, is really starting to wear away.

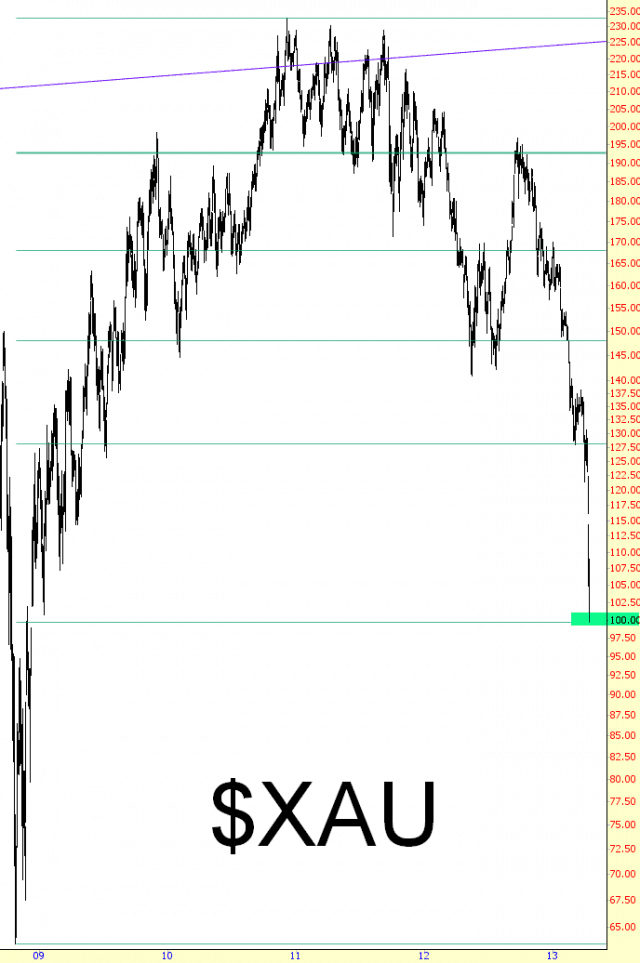

My own portfolio is 80% committed, with 80 shorts and – – gasp!!! – – one long which is, of course, GDX. We’ll know in a big hurry if I jumped the gun on that one or not!