I normally don’t make a habit of “pre-announcing” improvements to the blog, but the reception of the new Slope has been marvelously warm, and I’m inclined to let you know I’m not resting on my laurels but am intent on introducing most enhancements this month. Among these are: (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Dear Prudence

Last week sure was a lot more fun than this week. It seems that every day is guaranteed to bring a new lifetime record in the S&P 500 and the Dow 30. What stung particularly badly today was I was short a number of retailers (such as LTD and ROST), and that caused some damage I’d rather have avoided. Things are stretched, but nowhere is it written that they can’t get more stretched. (more…)

Import/Export Prices Still in Downtrend

A Couple of Good Options Plays

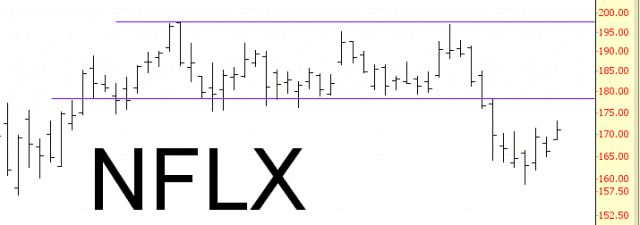

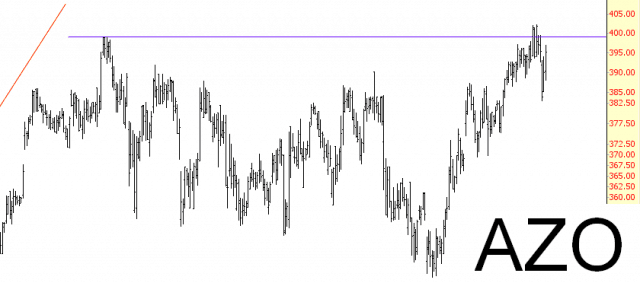

Now that I’m trading options again, I’m focusing on simple directional plays: buying puts on stocks that (a) have a clear technical pattern that suggests a move lower; (b) a price high enough such that the dollar move makes the potential percentage change meaningful.

In other words, I’m not interested in buying puts on a $15 stock; I’m focused on multi-hundred dollar issues. Here are a couple of stocks on which I own June puts. The big moves are probably coming after earnings are announced: April 22 for Netflix, and May 20 for AutoZone.

The Low Point of the 1970s

The past six months have been vicious, brutal, and unrelenting for the ursine set. It’s time for a few minutes of comic relief. Watch the following………...if you dare.