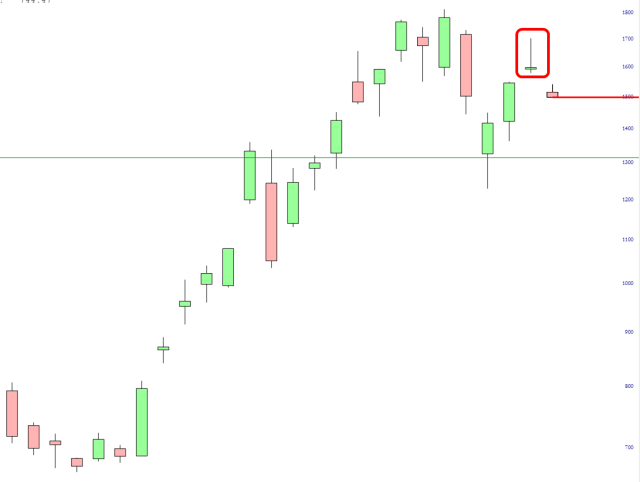

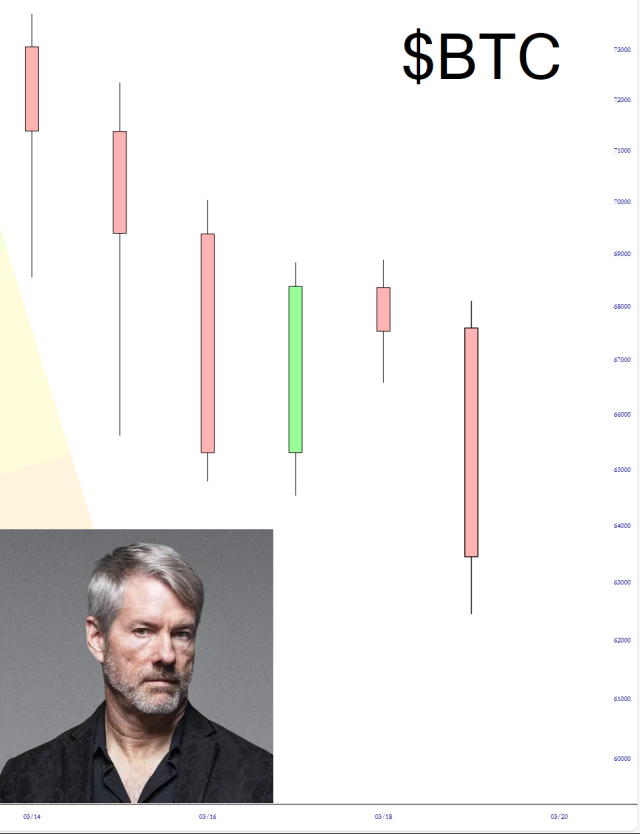

Microstrategy (MSTR), a former software company which has transformed itself into a Bitcoin holding company with sky-high premiums, has gone up over 1,000% over the past fifteen months. I wanted to point out a rather unusual island reversal pattern that has just taken place.