Golden lads and lasses must,

As chimney-sweepers, come to dust.

Gold is ontologically a commodity, store of value, and currency. We have all heard the bullish gold arguments. The charts say otherwise.

Gold as a commodity:

Above is the ratio of gold to the commodity index. Note how this ratio made the first of two tops much earlier than gold; it is losing momentum. Also note the second T. It has expired on point. I interpret the accurate inverse T as framing the time period in which gold underperformed. Finally, the pattern during the T rise resembles the many fractals I observed that preceded market crashes.

Gold as a safe haven:

Plotted above is the ratio of gold to a precious metals index. The bubble burst October of 2008, at the peak of the market panic.

Gold as a currency:

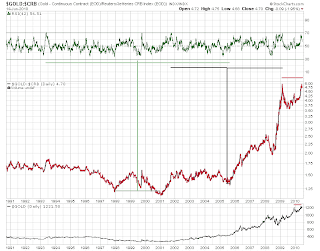

Gold to the dollar versus gold. This is a bullish chart confirming that gold had a great bull run. However, in the eight years I have plotted, I have only noticed two divergences, one positive one negative. The positive one occurred a mere few weeks prior to gold breaking the 1000 level. A very pronounced negative divergence is present in recent history.

GOLD – THREE PEAKS AND DOMED HOUSE:

Most

numbers match up well, but I just placed select ones. Point 25 will

probably coincide with a stock market decline and a piece of news that

justifies the gold safe-haven trade; then, sell the news. Based on this

analysis, the target price is 680.

Also note the historical

inverse relationship between gold and the US dollar:

One

of these two will win out, and my bet is the dollar (although due for a

ST pullback.) There will be a

flight to safety in US Treasuries when the bear market in equities kicks

off; foreign investors will need dollars to buy treasuries, which will

also boost the currency's value.

These studies (and others) lead me to conclude that Gold in the next few years will be in a bear market. I also believe we are inches from its peak; a false break above the recent high. The fundamental forces of deflation and an appreciating US dollar will be the main causes of this bear market.