It’s all well and good that the market is finally showing some weakness. I’m loaded to the gills with ninety short positions (all small, representing roughly 1% of my portfolio each, with the rest in cash), but how long do we hold on? How far will the market be permitted to slip before beard-face & company intervene?

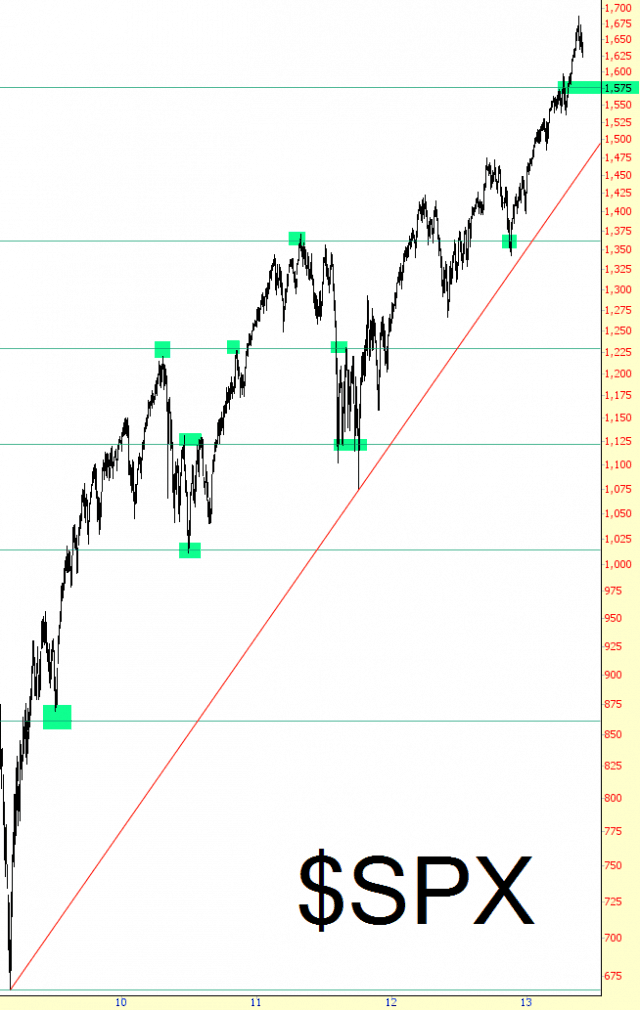

The wild-eyed, S&P-is-going-to-600 is not here to answer that question. Indeed, if the past four years have taught me anything, it is to keep any bearish dreams profoundly modest. Having said that, I think reaching 1575 is the most reasonable goal.

Yep, 1575. Whoop-de-freaking-do. Even if we get there, that’s a mere 6.5% off the peak price we’ve seen. But, look, we take what we can get, right? I’m sure deliciously lower prices are in store in the years ahead, but for now, I’m happy to shave off a single point at the time.

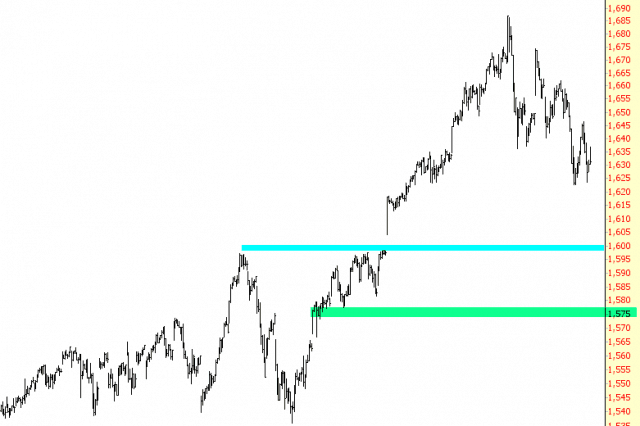

I didn’t pull this number out of AJC’s ass, however (and if I did, Lord knows I would not have examined the number with any thoughtfulness). I draw it from a number of places, including the fact that a couple of thoughtful Slopers have held up this number as well. First off, it happens to be at the same level as the peak back in 2007, which, even now, is more significant than I think most people believe.

Some may argue that 1600 is a more realistic goal, since there’s an important gap there, and it’s a Big Round Number. My belief is that we’re going to overshoot that by a small amount.

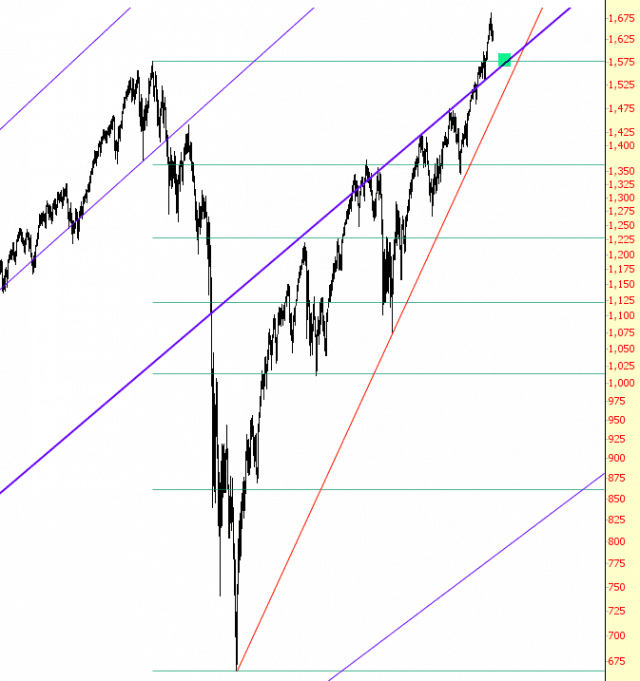

The strongest reason is that the Fibonacci fan lines, which go back many, many decades, will represent powerful support, which I’ve tinted below.

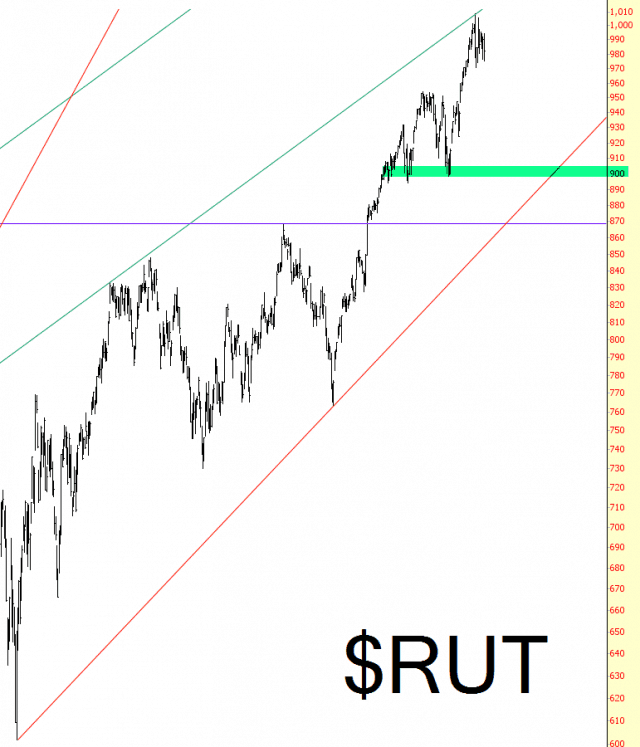

Small caps, which have been weaker in general, will probably beat the 6.5% drop somewhat; I think a drop from the peak price of as much as 10% is possible.

So I’m telling myself right now that, as good as it will feel (assuming we get there) to have a bunch of profitable shorts at 1575, that will probably be the right time to cover them and prepare for another bout of buying. Whether or not that’ll mean yet another lifetime high on indexes remains to be seen.

Lastly, as a special bonus, here is video evidence that Russians have a monopoly on guardian angels: