Intel and Yahoo both spiked higher after the close, once they reported their earnings. Yahoo, as I type this, has given up all of its gains, and it’s in the red. Intel, on the other hand, is up over 4%.

This doesn’t surprise me in the least. Yahoo, in my opinion, has always been a maker of some of the crappier products and web sites on the Internet, and I am stunned beyond calculation that they’ve even been as successful as they are. YHOO is all about Alibaba (founded by far and away the World’s Weirdest Looking CEO), and once that firm goes public on the oh-so-superstitious 8/8, they’ll have shot their wad..

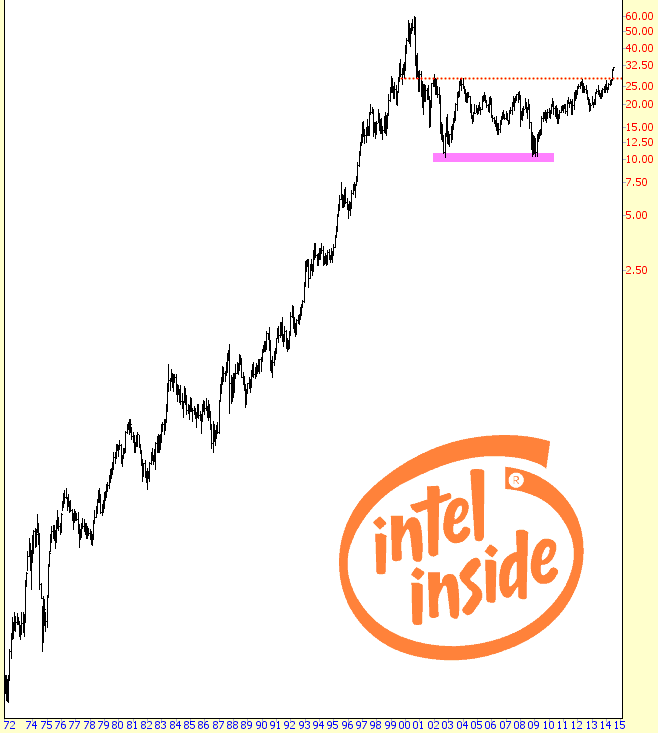

In its life as a public company, Intel has gone through three huge phases:

(a) the money-printing phase: from their IPO in the early 1970s through the Internet peak in 2000, they basically did nothing but go up; hundreds of billions of dollars of wealth were created;

(b) the double-bottom: the Internet crash and the financial crisis each produced important, and similar, bottoms, which I’ve tinted below;

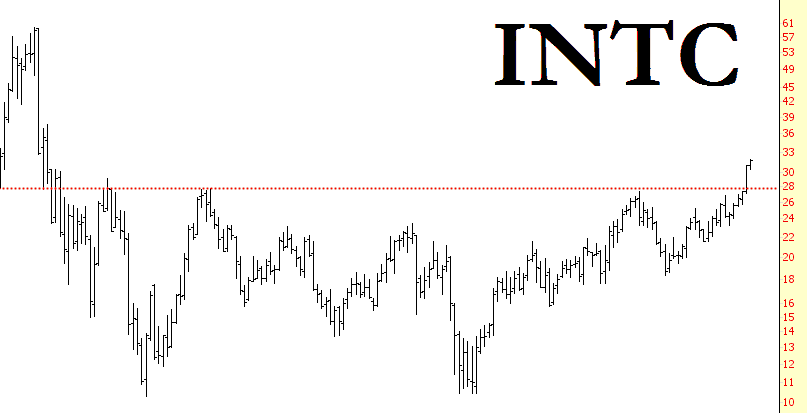

(c) the break-out: the price breakout above the horizontal line, also shown below, affirms Intel’s strength and momentum. Judged at this great distance (a monthly chart of the whole history), you can see how terrific-looking a stock it is.

Taking a closer look at that saucer pattern, you can see more plainly how powerful the pattern is, and how unsurprising the after-hours strength is. In spite of my general bearishness with respect to equities, I think Intel continues to have a very bright future ahead.