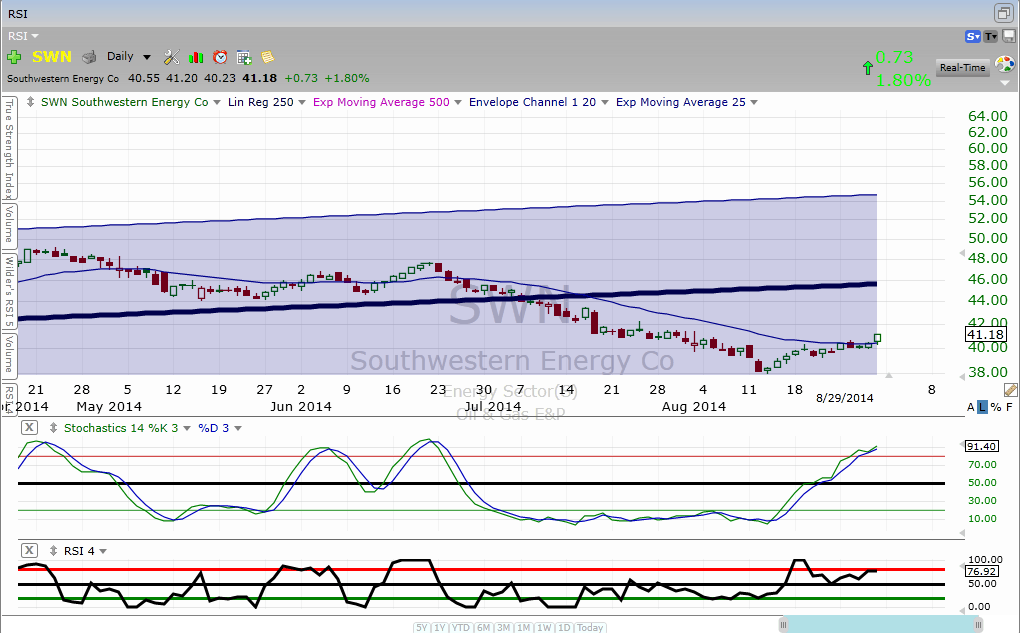

Here are a few energy names I am watching and likely to trade at least one of them on the long side next week.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Taupe: It’s Not Just For The Oval Office Anymore

Whether it’s politics or business one thing remains the same: if you are designated or perceived as the leader, everything you say or do is viewed with an eye searching for obvious and hidden meanings. While at the same time the higher the level or more commanding the position, that search goes from the naked eye to one looking via an electron microscope.

Words matter, the way they are said can matter even more, yet what is just as important is the posture, and yes – that can include even your choice of attire. (more…)

Past Fear, Present Fear

I was looking at the entire history of the volatility index (the oft-cited “VIX’) and found an interesting parallel. Take note of this chart

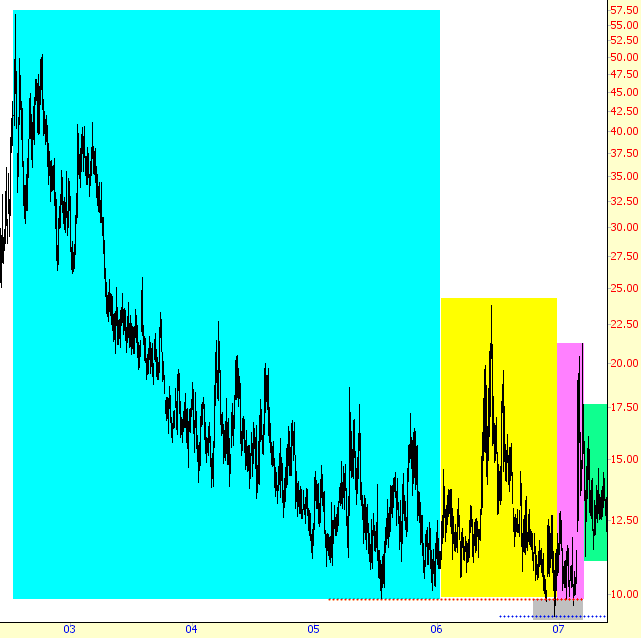

HUI Timing Boxes

In the previous post it was mentioned that the 2013-2014 would-be bottoming grind in HUI has been almost exactly the duration of the 2010-2011 topping grind. Here is a visual to put with that statement.

The current yellow box is an exact duplicate of the 2010/11 box, which came with an over bought MACD crossed down. The breakdown candle implies that September would be the month that a break UP candle comes into play if this relationship has any predictive power.

Taking it further, as also noted in the previous post, the Ukraine noise does not help the sector and indeed could hurt in the short-term, because it keeps the wrong gold bugs on the tout. So NFTRH keeps open some minor downside targets.

Taking it further still, those downside targets would end up being buying opportunities if gold’s macro fundamentals start to improve, which despite the emails I get to the contrary, really has not happened yet beyond a few ongoing positives. But it had not happened yet in 2000 either.

Longing for Change

As exciting as August began for the bears, it turned out to be The Month of Lifetime Highs. The VIX got crushed back to 11, profitless companies like Tesla exploded in value (in TSLA’s case, over $33 billion), and big-boy indexes like the S&P 500 were at levels never before seen in human history.

In light of all this, I’ve dug up a few stocks which still have promising-looking patterns on the long side, without having run off with themselves like so many other long setups already have. I will say, however, as if it weren’t obvious, that I neither own these, nor do I intend to, in light of the price levels on indexes for which “nosebleed” is really an insufficient metaphor.

I am, in all candor, shorter than I have ever been in my life, because the quantity and quality of short setups boggles the mind. Undaunted clarity, or misguided foolishness? Only time will tell. Setting that aside, though, here are a few bullish charts for you: (more…)