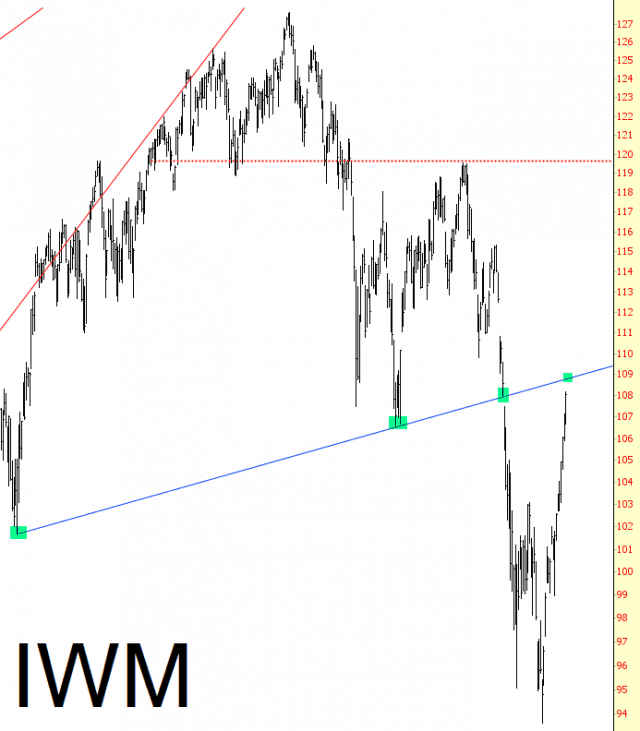

It’s quite apparent that a cabal was assembled on February 11th whose purpose was to Completely Break the Spirits of All the Bears, and they’re succeeding marvelously. This morning alone has been a total whipsaw, with the initial surge-and-purge completely faking out dullards like myself. I must point out the Russell 2000, which has been the king of this miniature bull market, is roaring toward the underside of a critically-important trendline.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

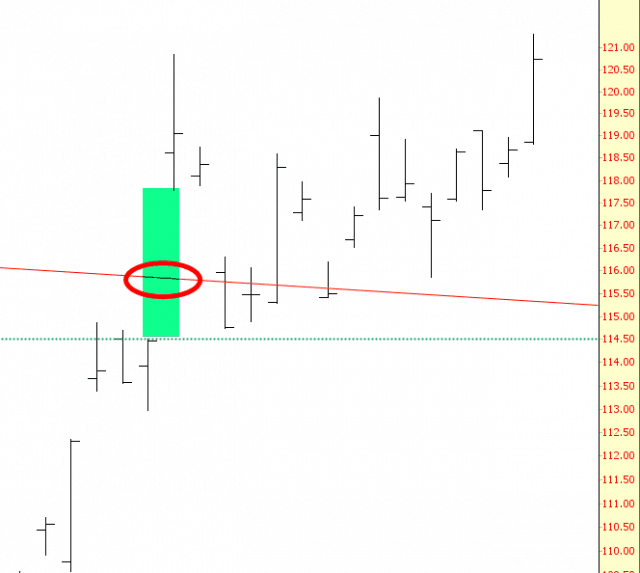

Possible Rally High Area

News is an odd thing nowadays. On the one hand NFP was a big beat, so the economy seems to be in better shape than everyone thought, so a recession is less likely -> BUY!. However that means that interest rates are now much more likely to increase again this year and that the ZIRP era is more likely to be drawing to a close -> SELL!. We’ll see how that develops in RTH.

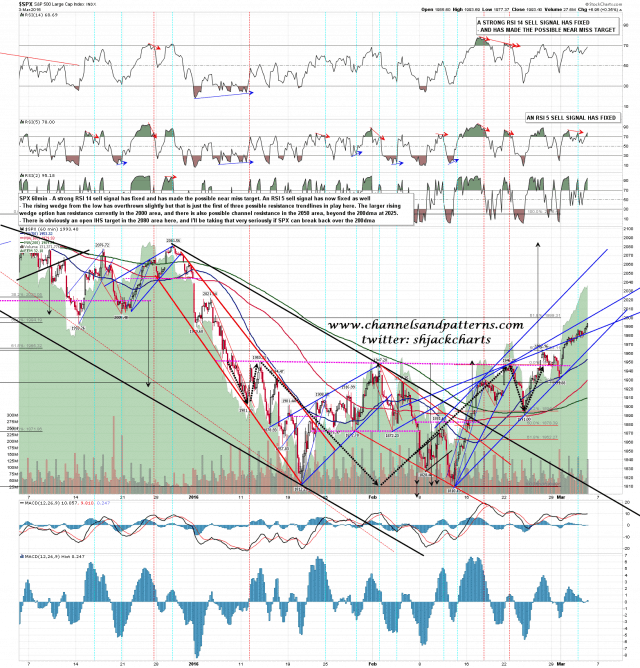

In the short term SPX looks likely to open in the 1995-2000 area that I was looking at yesterday morning (DONE AT 1996) and that may hold. If so then I’d be looking for at least a strong retracement, and possibly new lows for 2016. There is a lot of negative divergence here and this is the obvious area to fail. SPX 60min chart:

Initial Reaction

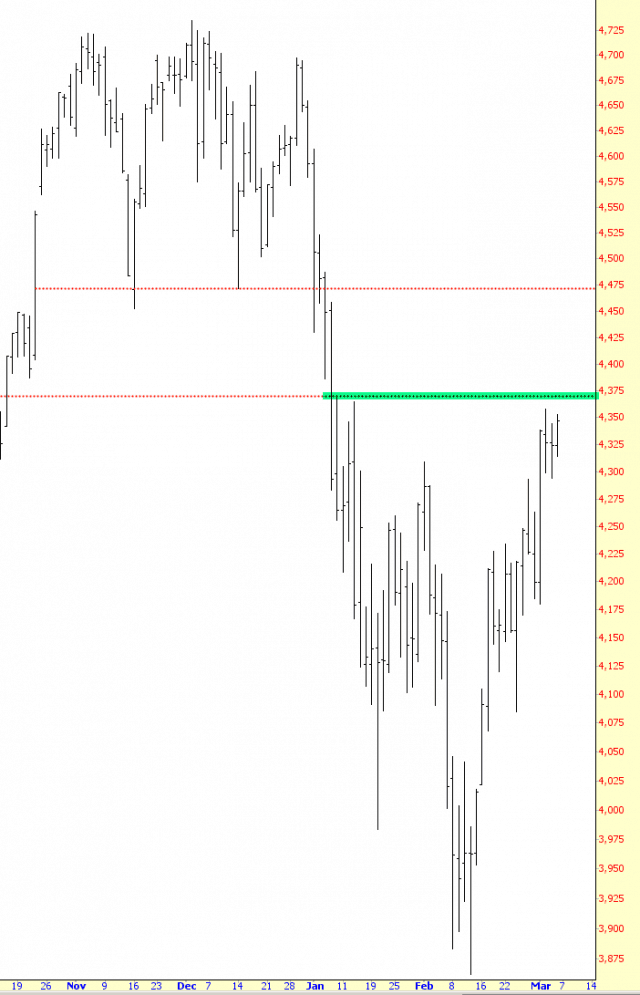

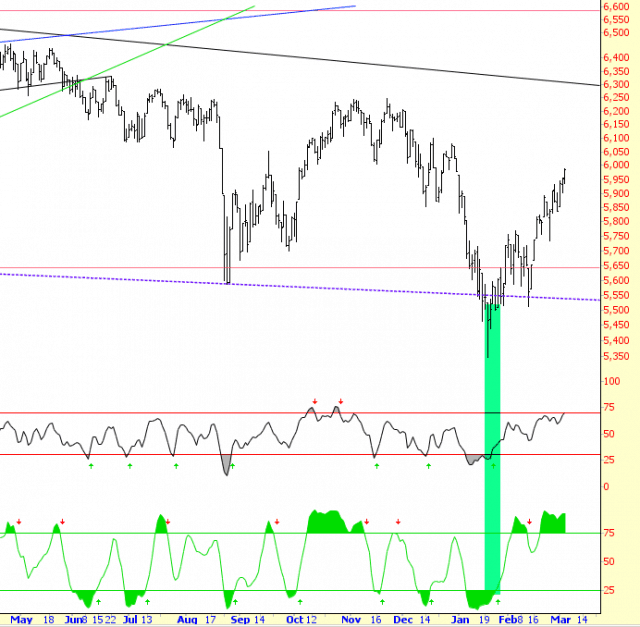

The jobs report came out, and it was very positive – – thus, equities are powering higher. Below are the NQ and ES, respectively, with tints where I perceive their next resistance levels to be.

Wayback Machine

Although this is bound to cause delight amongst a few folks, the past three weeks have been utter torture for me. There have been many reasons for this, but one of them, of course, has been the brutal counter-trend rally which seems to have strength drawn from another dimension.

Of course, what’s maddening is that it wasn’t a secret that things were badly oversold on February 11th. Indeed, I took the time yesterday to read every post from 2/11 to see what people were saying. I figured everyone would be screaming at me to get out. Nope. Everyone – – both authors of posts (Springheel Jack, for instance) as well as the commenters were all jumping up and down about the next leg down, be it 1750 (conservatively) or the 1500s. So the atmosphere was definitely “bearish now and bearish to stay.” Of course, the oversold state of the market is plain as the nose on my face now:

The Channel Mattered

Back on February 11th (known for the rest of my life as The Day I Should Have Covered Everything), gold did something very important: it jumped above a channel that had been confining its price action for literally years. I’ve circled the descending trendline which constitute the upper boundary of that channel. Gold, represented here by way of GLD, “escaped” its downtrend.