Happy new week, everyone. I’m relieved we’re past Thanksgiving and can get back to normalcy. I wanted to make a couple of remarks about two big commodities out there – gold and oil.

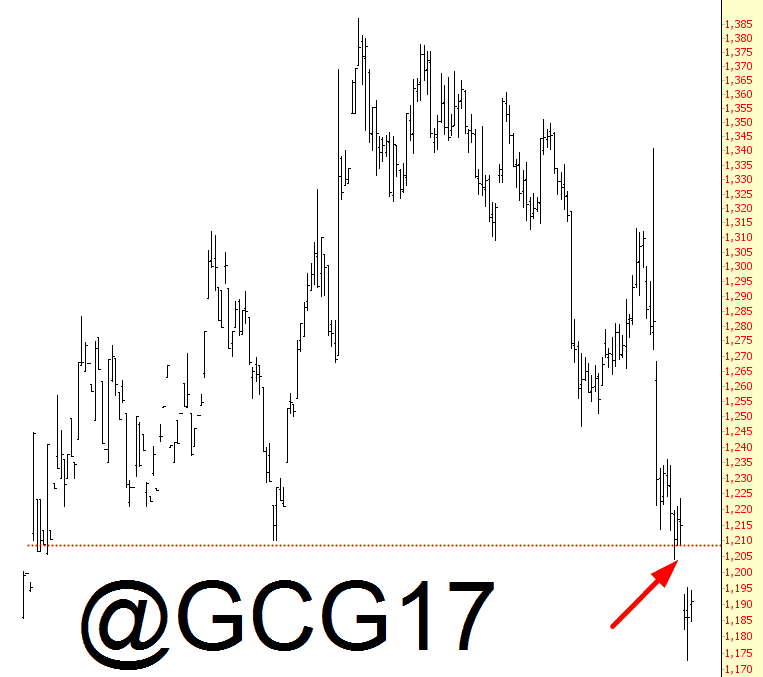

As for gold, it’s been having a wretched time since July 6th, from which it’s fallen about 15%. It is finally getting a little bit of strength, but I think it’ll be short-lived. The most logical place for it to crawl back would be the gap I’ve pointed out below, just about $1200. After such time, I think the weakness will continue afoot. I have no precious metals positions at all right now, but if gold strength continues, I’ll be looking hard at GDXJ again for a short sale.

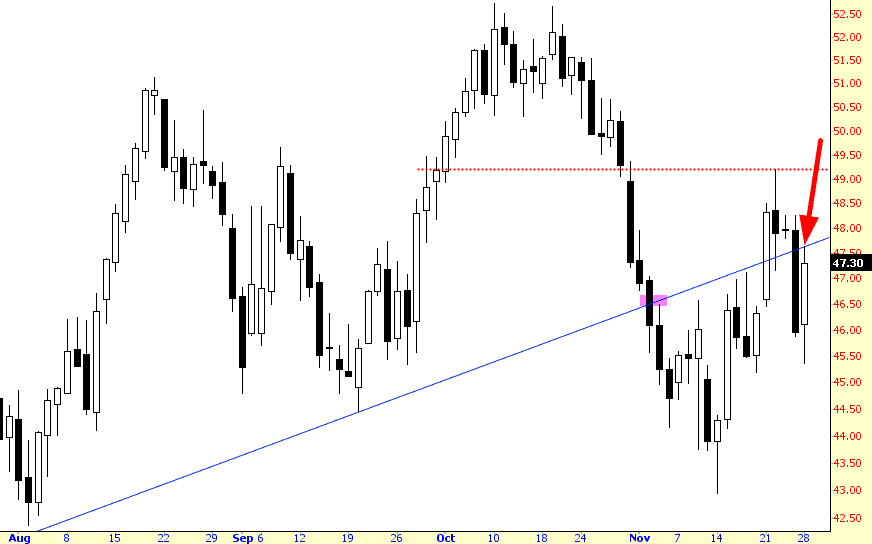

As for oil, it’s fascinating to me that no matter what crazy rumors or news goes flying around, it is clinging to its broken trendline like a magnet. That trendline is indeed the “mean” these days to which it keeps reverting, with today’s high tagging it right to the pixel. The “big event”, of course, is only 48 hours from now, when the OPEC news finally hits. I remain short energy stocks (seven different ones) and am keeping my fingers crossed for an OPEC disappointment similar to last year’s. If OPEC lets oil bulls down, I think it’s going to be “adios” to the trendline.

Oh, by the way, one of my kids 3-d printed this for me last night: