I mentioned last night on twitter that at the end of the day there was an unusual situation where ES was holding the weekly pivot there as solid support, and TF had established the weekly pivot as solid resistance. This is a rarity and can’t last long unless they just chop sideways together.

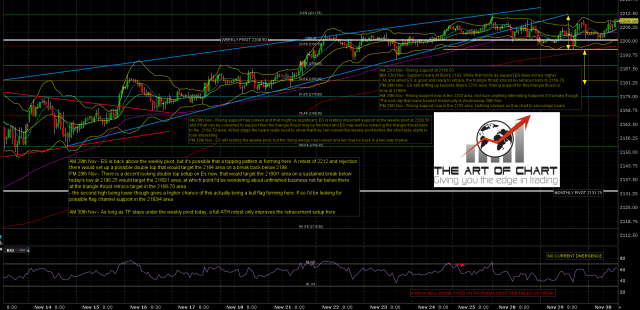

ES built on that weekly pivot support to make a new all time high this morning. Was that bullish? No, as there is nothing inherently bullish about a high retest. Every double top setup requires one and they aren’t bullish. The thing I was watching was what TF was doing with the weekly pivot there ………ES Dec 60min chart:

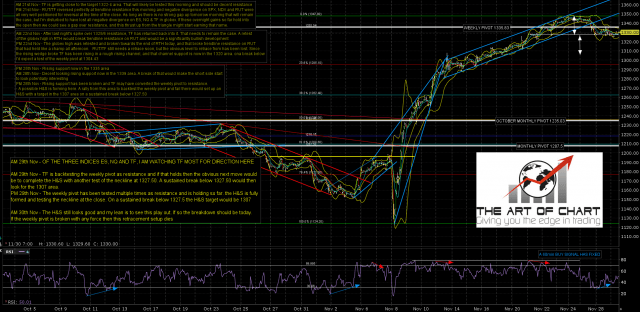

TF held the weekly pivot all night as resistance and there is still a very nice looking H&S fully formed there to add to the double top setup here on ES that has improved considerably in quality overnight. Since the open I have shorted 1335 twice so far on TF (just under the weekly pivot at 1335.8) and it rejected over five handles both times with twenty minutes, so that is still solid resistance. TF Dec 60min chart:

The TF H&S needs to break down today really if it’s going to, but as long as that weekly pivot is holding as resistance today then this is a nice setup for a very overdue modest retracement. and I’ll keep shorting TF at 1335 until the H&S delivers or the resistance fails. If there is no retracement today then the chances of seeing a retracement here drop dramatically, as while the historical stats for today are definitely bearish, the first day of the month tomorrow tends to be a bad day to be relying on a bear setup to play out. The H&S on TF will also by then be starting to look more like a hearse limo, a rarer and less predictable pattern.

As an aside this setup is a good illustration of a problem trading correlations that I’ve talked about before. I’ve been expecting ES to drop on the basis of the TF short setup, but I didn’t short ES, I shorted TF. That’s because I know from experience that correlations shift all the time. If you’re so confident that USD is going up that you are thinking of shorting gold, don’t do it, cut out the middleman and go long USD. There’s less chance of your trade being lost in correlation translation.

Stan and I are doing our monthly public (and free to all) Chart Chat at theartofchart.net on Sunday and you might like to attend if you enjoy top quality TA or have any interest in where the prices of a wide range of tradable instruments are likely to be going. If you’d like to attend then I’ll be posting the link to register tomorrow.