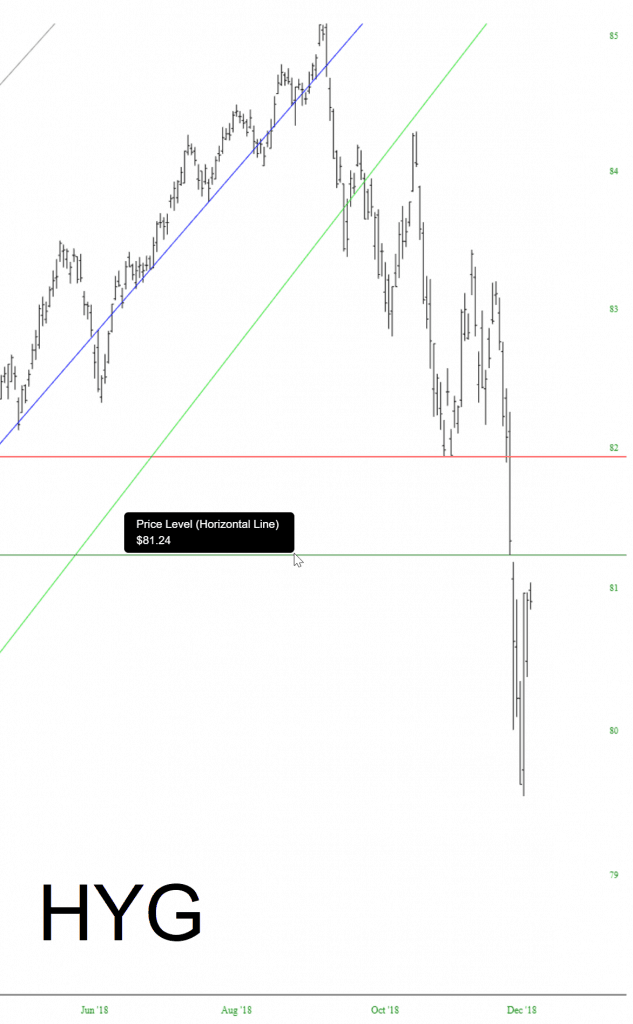

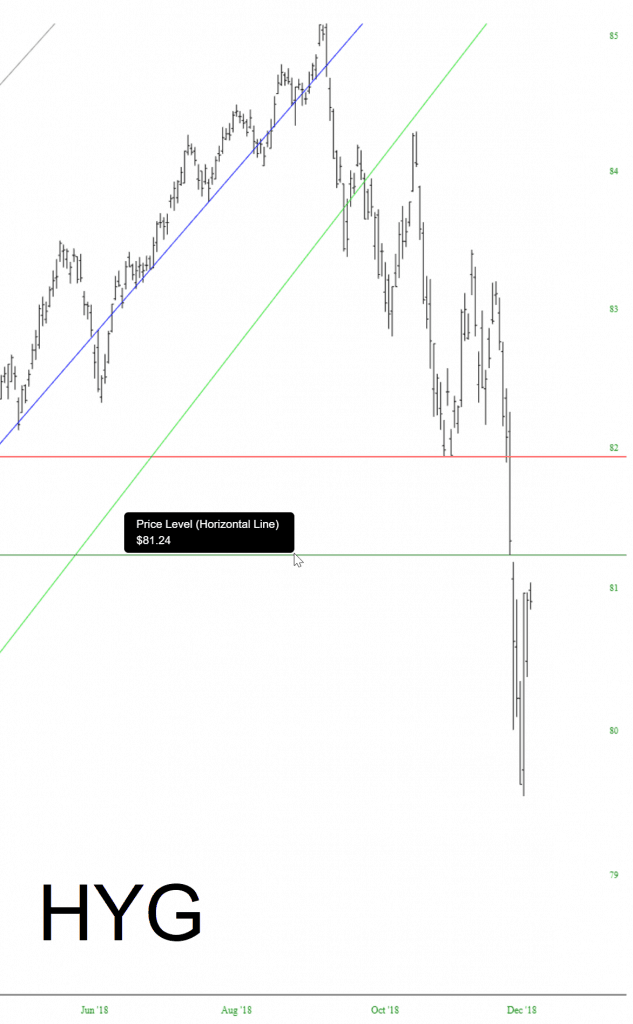

As we collectively try to fight the boredom of the end of the trading year, I offer you a simple and straightforward idea: shorting HYG with a stop at 81.25, just above its price gap.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

As we collectively try to fight the boredom of the end of the trading year, I offer you a simple and straightforward idea: shorting HYG with a stop at 81.25, just above its price gap.

For this post I’m going to talk a little bit about a different strategy that goes long in a nondirectional path based on the volatility level of the instrument in question.

For options trading, the price of the options depends on again a) the delta or the change in the underlying, b) theta or the inherent time decay of the option, and c) the supply and demand on the option contract itself which is estimated by the volatility of the underlying.

(more…)