During these three-day weekends, I’ll sometimes lean on my Panic Prosperity and Progress book for an interesting morsel of content for my readers. Part 1 can be found here. Enjoy:

The key to this plan was to create a “short squeeze.” For those unacquainted with short-selling, it works like this: in regular stock investing, a person buys a stock at a given price with the hope that the price will rise and, in doing so, generate a profit. Thus the old adage, “Buy low, sell high.”

Conversely, a short-seller seeks to turn this goal on its head: “Sell high, buy low.” The pursuit of profit is the same, but the timing is reversed: a person sells a stock at a price he believes is high and, in the future, he hopes to buy the stock back at a lower price.

There are certain risks to shorting stocks, though, in contrast to standard long positions. If a person buys a stock, that stock is his forever. There is nothing that can be done to take it away, unless the company itself is purchased (which typically involves a premium and is an agreeable outcome to the shareholder in such a case).

When a person sells a stock short, however, he cannot synthetically sell the stock out of thin air (a practice sometimes referred to as “naked shorting”). The investor instead has to actually find a broker that has the stock in the first place and is also willing to sell it in his behalf. Once this is accomplished, the short-seller is at risk of the stock being “called away” or demanded.

The reason for this possibility is easy enough to understand: suppose a given person (“Client A”) uses a broker that had 100 shares of stock X in his possession (owned, obviously, by another client – in this example, “Client B”). The broker agrees to sell the stock from Client B’s account based on the pledge that Client A will buy those 100 shares back at a later date. All of this happens without Client B’s knowledge.

Further suppose that, a month later, Client B wants to sell his 100 shares of stock X. Given the circumstnaces, the shares are simply not present in the account to be sold. So the broker forces Client A to “cover” the short (buy the shares back at the market price), thus restoring the holding to Client B’s account and allowing the regular market sale to take place. This situation puts the short-seller in a vulnerable position.

This takes on an added twist in 1907, long before the age of electronic transfers and records. The notion of owning a stock was still very much tied to the physical possession of a stock certificate, and in the relatively modest stock market of the day, there simply was a much smaller universe of traders and stocks around.

Augustus Heinze’s brother, Otto, was the main brain behind the idea of cornering United Copper, and as the Heinze family was already in possession of a large quantity of United Copper stock, it was in their interest to see the price rise. It was Otto’s belief that they were in a superb position to put the short-sellers in a very uncomfortable spot: by buying stock in the open market, Heinze could push the stock higher.

As the stock rose, more and more of the shorts, eyeing their growing losses, would want to get out of their positions. It was Otto’s belief that, in many cases, most of the stock that the short-sellers had borrowed were, in fact, already in Heinze possession, and that the short-sellers would have to purchase shares directly from Heinze in order to close their positions.

The other aspect to this idea was that Otto believed there were very little shares locally available on the market, because the stock had already been so heavily shorted. The Heinze family would have, in a way, a short-term monopoly over all the available inventory of United Copper stock and thus could demand an exorbitant price from the short-sellers that were desperate to cover their position and cap their losses.

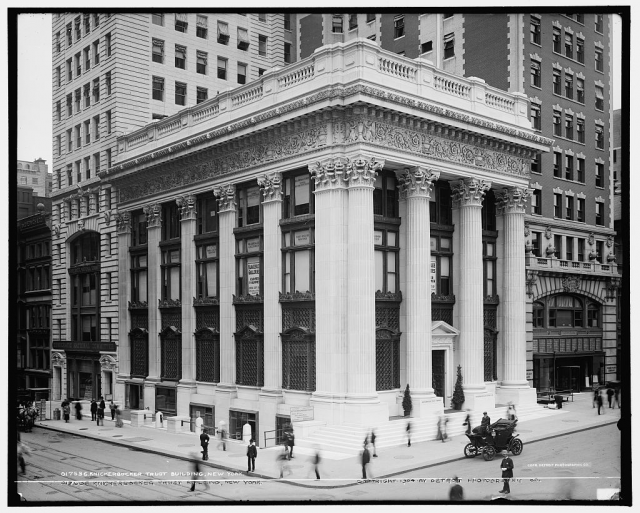

As rich as Augustus Heinze was, cornering a public company was an expensive undertaking, and they needed financial backing to improve their chances of success. Otto and August Heinze, accompanied by the notorious banker Charles Morse, met with Charles Barney, the president of the Knickerbocker Trust Company, the third-largest trust in New York. Barney had successfully backed prior Morse schemes, but he was reluctant to provide funding, as their scheme was going to involve more money than Barney was comfortable lending.

Thus, on their own, they decided to try to corner the stock anyway. On Monday, October 14, 1907, they started buying United Copper in the open market, pushing the price from $39 to $52 in a single day, an increase of one-third. The next day, Tuesday, Otto issued a demand from his brokerage, Gross & Kleeberg, that all borrowed shares be returned.

The hope at this point was that short-sellers would scamper around the city, find absolutely no stock to buy, and helplessly show up at Gross & Kleeberg to be told what exorbitant price they would have to pay.

Instead, it turns out there was ample available stock in the open market, and the short sellers who wanted to get out were able to cover their positions at regular market prices. The demand for the stock pushed it somewhat higher to $60, but once the market began to realize that the strong demand from Heinze was not going to push them collectively against a wall, the share price started slipping.

By the end of the Tuesday, it had fallen to $30, even lower than when the squeeze began the prior day. The Heinze brothers and their affiliated interests were in sudden and unexpected trouble. In a word, the market had called their bluff, and the selling of the stock was spectacular.

By Wednesday shares were fetching a mere $10, and Otto Heinze was financially ruined. His brokerage house, Gross & Kleeberg, was itself forced to close based on a single client’s horrifically bad trade.

Much of the trading going on during this pandemonium was taking place on the Curb market which was, quite literally, the curb of the street outside the New York Stock Exchange (the “curb” would eventually become the American Stock Exchange, which itself was referred to as “the curb market” for decades to come). The Wall Street Journal reported of the day, “Never has there been such wild scenes on the Curb, so say the oldest veterans of the outside market.”

There was another Heinze casualty of the disastrous United Copper scheme: the State Savings Bank of Butte Montana, which was owned by none other than F. Augustus Heinze. The bank held a large amount of United Copper stock as collateral for some of its lending, and with the collateral dramatically devalued, the bank declared its insolvency.

The Bank Runs Begin

At this point, any financial institution associated with Morse or Heinze became immediately suspect in the public’s eye. One of the banks, Mercantile National, insisted that Heinze resign, which he did. In spite of this, fearful depositors rushed to the Mercantile to withdraw money as fast as they could. Other banks, including New Amsterdam National and National Bank of North America were crowded with people demanding their money back, mainly because of their association with Morse.

To tamp down the embers of the panic, the New York Clearing House (which was a consortium of the city’s banks) demanded that both Morse and Heinze resign all of their banking interests, which the men did. This was to little avail, because by the end of the week, a sweeping tide of anxiety was making its way across the city.

Famed tycoon J.P. Morgan was far away from all this tumult. A devout Episcopalian, he was attending a church retreat in Richmond, Virginia. He was hosting a number of bishops in the Rutherford mansion, which he had rented for the occasion. Morgan was seventy years old and had largely retired from the world of finance, but he was kept abreast of the reports from New York about the gathering clouds on the horizon of Wall Street.

By the end of Saturday, Morgan could no longer ignore the news, so he summoned his private rail car to take him back north (making sure the bishops were provided a comfortable journey in a second rail car). He arrived in New York City and went directly to the sumptuous new marble library he had built for himself on the corner of 36th Street and Madison. The library was already replete with bankers from the city who were eagerly awaiting his guidance, since Morgan had successfully guided the US Treasury during the Panic of 1893.

As the discussion lasted until late Sunday evening, Morgan and his men examined the books of the trust most widely-believed to be at-risk, which was Knickerbocker. After examining the company’s books, they decided it was already insolvent and could not be saved if the bank run continued the next day.

On Monday, October 21, nothing seemed particularly out of the ordinary at Knickerbocker Trust Company. In spite of having 18,000 depositors and $67 million in deposits, the bank was not confronted with a line of clients when it opened for business. However, a steady and unending stream of customers pressed against the teller windows for the entire day, withdrawing all the money in their account one by one. By the end of the day, the management of Knickerbocker knew they needed help, so they called on J.P. Morgan.

Discussions with the management lasted until the early hours of the next morning. Morgan recognized that having the city’s third-largest trust fail would be unhealthy for the fragile psychological environment in his financial world, so he sought to help with conditions. Primarily, lacking faith in the present management, he insisted upon the resignation of Knickerbocker’s president, C.T. Barney. Morgan pledged $12 million in support to short up the bank’s diminishing cash reserves.

The next morning, Tuesday, October 22, was much worse for Knickerbocker. Unaware of Morgan’s financial backing, persons with cash in the bank were eager to get it out, and a line of them stretched long down Fifth Avenue. By the afternoon, all of the cash in the bank was completely exhausted, and Knickerbocker declared itself insolvent with $52 million in liabilities.

At this point, fears of financial contagion began to spread. The New York Times reported of Knickerbocker, “…as fast as a depositor went out of the place, ten people and more came asking for their money and the police were asked to send men to keep order.” An immediate effect of the growing fear was that interest rates for very short-term loans (typically used for stock purchases, known as a call rate) skyrocketed from 6% to 60%. Very few banks were willing to lend in such an environment, and those that were willing wanted fantastically high compensation for it.