Pseudonymous cartoonist “Stonetoss” on Bitcoin volatility.

More Sunday-Monday Excitement For Bitcoin

Haven’t we been here before? Bitcoin rallies on a Sunday after some rumor about wider adoption or some other catalyst, and then bounces off the top of its range on Monday. This time, the rumor was about Amazon (AMZN) accepting bitcoin for purchases, a claim Amazon denied on Monday.

Bitcoin Stocks Rally

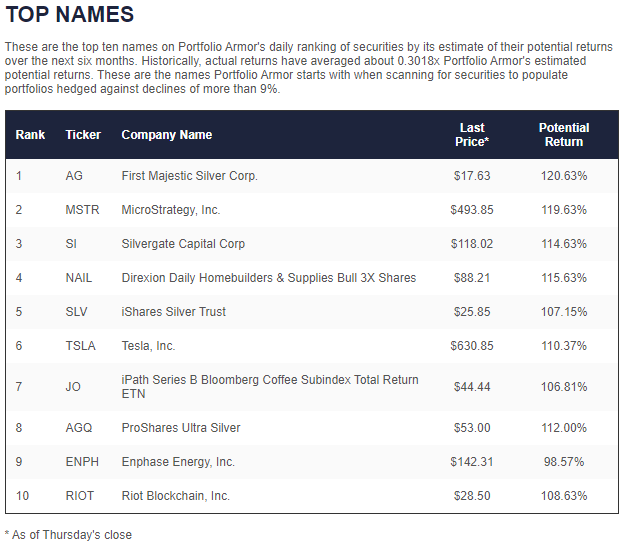

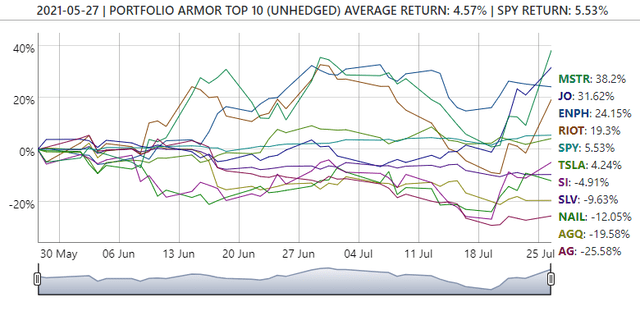

Monday ended up being a big day for bitcoin-related stocks, with a few we’ve mentioned here before, miners Marathon Digital (MARA) and Riot Blockchain (RIOT), and bitcoin evangelist Michael Saylor’s company MicroStrategy (MSTR) were all up more than 20% on the day, with MSTR up more than 26%. RIOT and MSTR were top ten names of ours two months ago.

Screen capture via Portfolio Armor on Thursday, May 27th, 2021.

Both are up double digits since then, but that top ten cohort is lagging SPY so far, thanks in part to lousy returns from silver names the iShares Silver Trust (SLV), ProShares Ultra Silver (AGQ), and First Majestic Silver (AG) (The Sprott Physical Silver Trust (PSLV) isn’t part of our universe now, because it doesn’t have options traded on it currently).

FUD Protection For MicroStrategy

Seemingly no minds were changed about bitcoin on Monday. Michael Saylor still thinks its going to the moon, and Peter Schiff still thinks its going down.

Whatever bitcoin’s ultimate trajectory, we can expect another round of FUD (fear, uncertainty, and doubt) now. Given that, it might be prudent for shareholders of one of Monday’s big winners, MicroStrategy, to add some protection here.

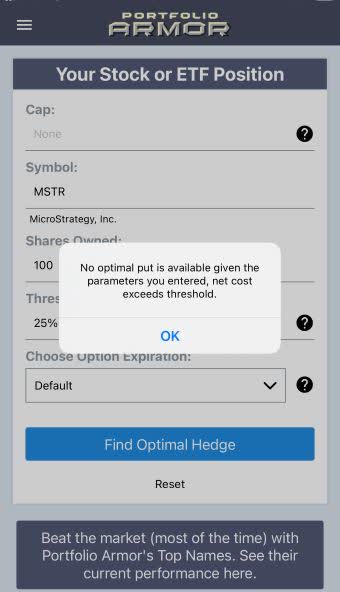

Too Expensive To Hedge With Puts

One challenge with that is that MicroStrategy is expensive to hedge with puts now. If you scanned for an optimal, or least expensive put hedge on it against a greater-than-25% decline on Monday, you would have gotten this error message.

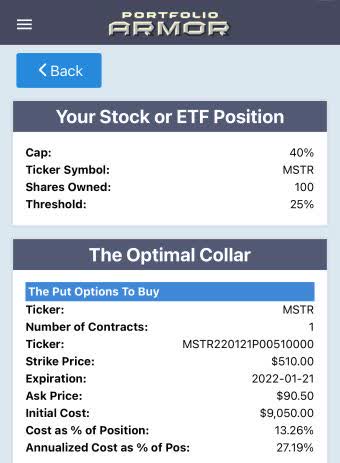

This and subsequent screen captures via the Portfolio Armor iPhone app.

You would have gotten that error message because the cost of hedging MSTR against a >25% decline over our default time frame (approximately six months out) was itself more than 25% of position value.

Cost-Effective To Hedge With An Optimal Collar

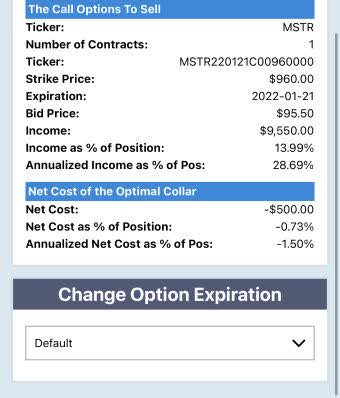

If you were willing to cap your possible upside at 40%, it was possible to hedge MSTR against a >25% decline over the next several months with this optimal collar.

Here the net cost was negative, meaning you would have collected $500 when opening this hedge, assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid). If you placed both trades within the spread, you would have collected more than $500.

It may be worth scanning for an updated hedge to see if you can get a similar or better one with current prices.