One single overarching characteristic that separates seasoned traders from all of the noobs and spectators is that they have grown to be a lot less reactive to market events. This applies equally to large and sudden moves to the up- or downside. The market has a knack for pressing our collective buttons but once you’ve been around the block a few times you start to see a pattern and like a seasoned poker player you begin to recognize a few tell-tale signs that monkey business may be afoot.

As in all things in life one often exchanges one set of problems for another. With more experience there is a risk of becoming too complacent or to cynical when signs of trouble arise.

I always make an extra effort to emotionally detach myself from my own book as well as my prior analysis/commentary in order to not fall into this trap.

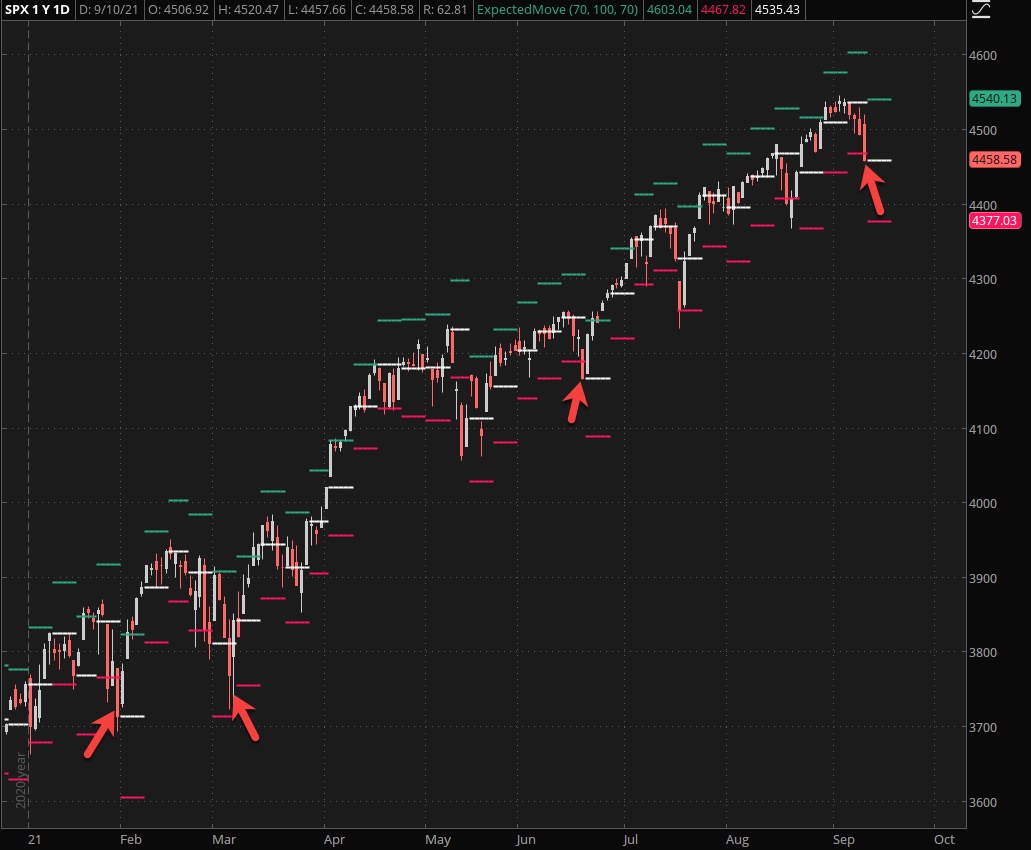

Looking at last week’s price action I could not help but feel a bit skeptical about the acceleration we started to see since Tuesday all across various verticals (i.e. finance, tech, and even bonds).

What stood out distinctively however was the fact that we closed the week far outside the lower expected move threshold. The chart above shows us only the auto-calculated thresholds and the real one (based on the prior Friday’s closing ATM straddle) was actually a few handles higher.

Big tech had been lingering listlessly for well over a week and the current drop through the tentative support line I have drawn does not come at a huge shock.

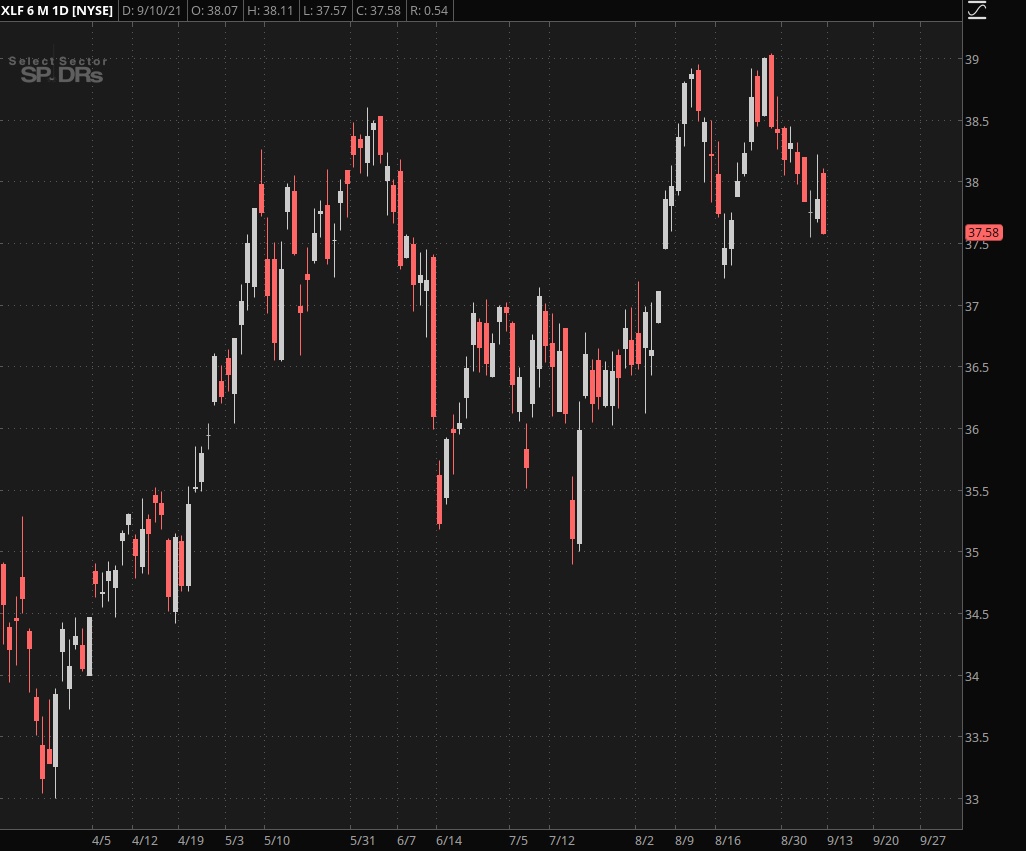

Finance has been in the doldrums for over a month now and if one were to look for short victims this is the sector I would be looking at.

That said – before considering any bearish endeavors let’s take pause for a moment and dig a bit deeper.

Continue reading this post over on Evil Speculator…