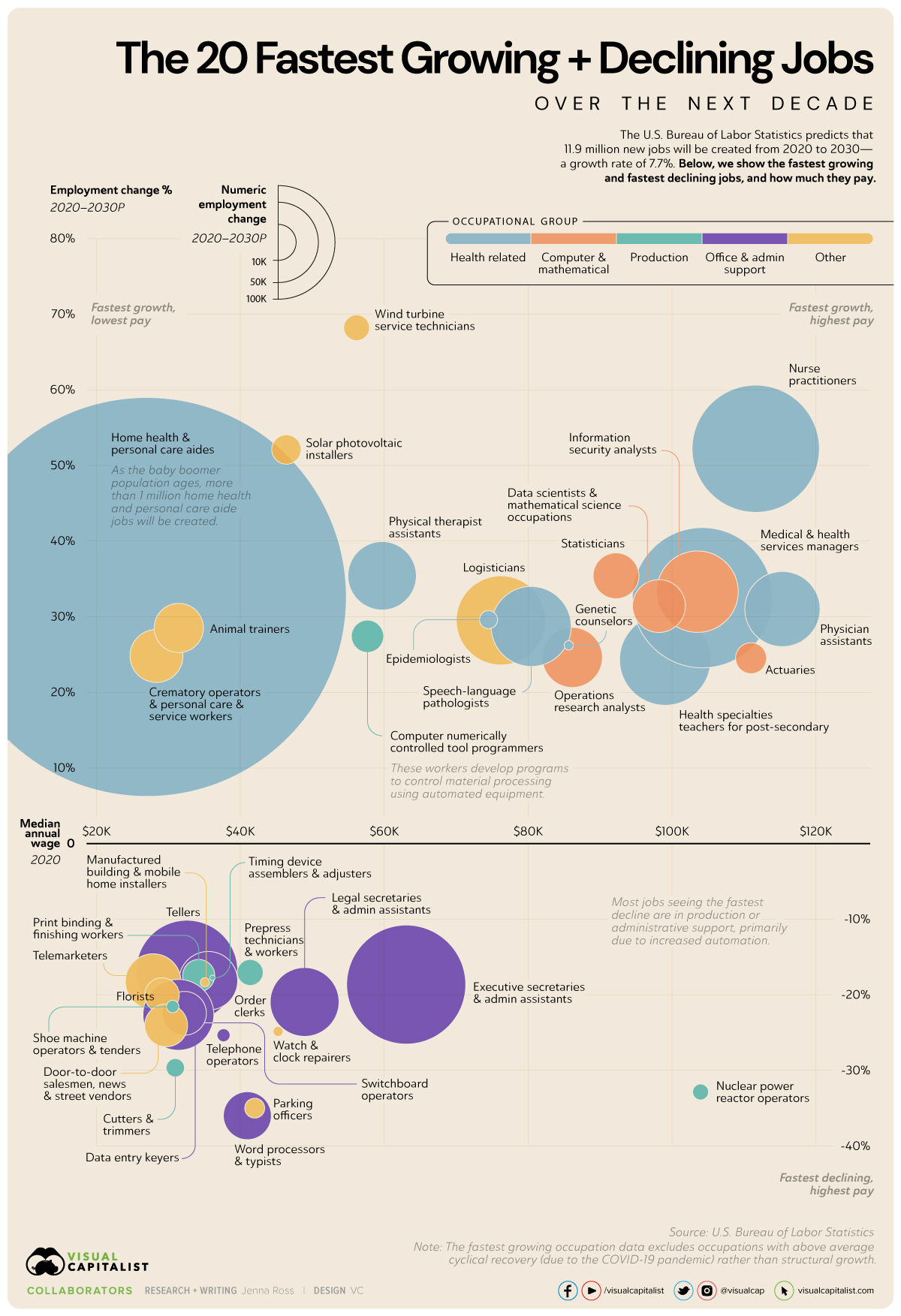

Here’s a fascinating look at what jobs will be growing and shrinking, and where they lay on the pay scale, from low (left side) to high (right side). Let’s just say Jeff Bezos won’t find many takers for his rocket rides in this demographic.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

So I’ve decided to revisit SlopeRules, with application of my strategy “ADX, Long with uptrend, exit with downtrend.”

The description: Enter when ADX goes above 20 (go long). Exit when profit is >1-2% AND when ADX is below 30 (after a rise, ADX falls back down to below 30).

I applied this rule to several coins, by trading volume as of 9/12/21. I looked at the most recent 60 day period INTRADAY – meaning no gaps between days. Most coins show a >97% win rate (with the most recent period for some being a loss, because they have not yet met the closing criteria). By definition these trades can sometimes require a holding period of days to weeks, until the price of the coin rises to an all time high.

We look at the 7 most traded coins, excluding coins not available in the US and the stablecoin Tether which generally stays at a value of 1. Keep in mind there is bias, in that this will work in a bullish crypto market, but will not work in a bearish crypto environment, in which a different system is required.

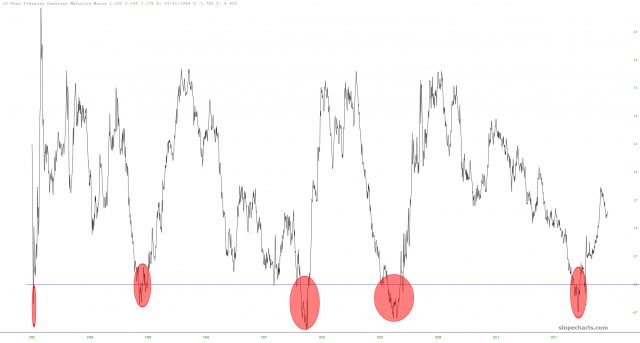

(more…)Here is a chart we haven’t looked at in a very long time. The symbol is FR:T10Y3M in SlopeCharts, and it shows the 10 year rate minus the 3 month rate, which has been a flawless predictor of recessions. We watched it as we approached the “trigger line”, although little did we know precisely what would be to blame for the ensuing recession that did, in fact, take place.

Weekends do not get in the way of Slope making progress. We work harder on the weekends than the weekdays! As such, I am delighted to report a substantial improvement and a very new approach in the CryptoStream portfolio.

Let me explain the genesis of this new approach. I found two things persistently frustrating about the former way we handled portfolios:

The new approach solves both of these problems. You simply hand-enter whatever coin you want, instead of seeking it out randomly, and with this new approach, you can enter as many different tranches of the same coin as you like.

I have completely reworked the documentation to take these improvements into account, which you can see here.

(more…)Foot Locker has completed its topping pattern, having broken both its ascending trendline and pushing below its price gap.