So I’ve decided to revisit SlopeRules, with application of my strategy “ADX, Long with uptrend, exit with downtrend.”

The description: Enter when ADX goes above 20 (go long). Exit when profit is >1-2% AND when ADX is below 30 (after a rise, ADX falls back down to below 30).

I applied this rule to several coins, by trading volume as of 9/12/21. I looked at the most recent 60 day period INTRADAY – meaning no gaps between days. Most coins show a >97% win rate (with the most recent period for some being a loss, because they have not yet met the closing criteria). By definition these trades can sometimes require a holding period of days to weeks, until the price of the coin rises to an all time high.

We look at the 7 most traded coins, excluding coins not available in the US and the stablecoin Tether which generally stays at a value of 1. Keep in mind there is bias, in that this will work in a bullish crypto market, but will not work in a bearish crypto environment, in which a different system is required.

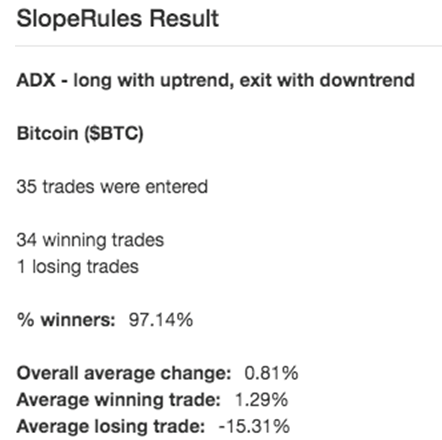

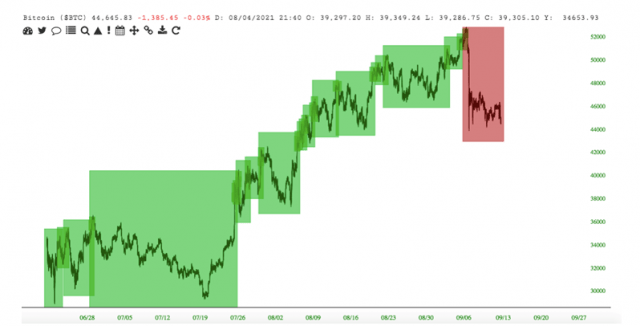

Here are the results for Bitcoin, the coin with the most volume today:

The average trade results in a gain of 1.29%. 34 trades are performed – overall 30.9% gain in the last 60 days with compounding. The latest trade is a “loss” because the exit parameters have not been met yet.

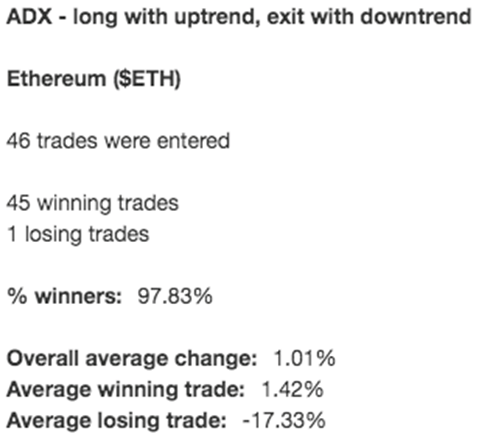

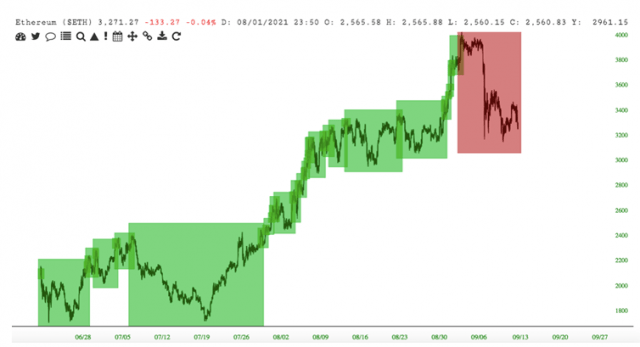

The second coin is Ethereum. Here are the results. The average gain was 1.42%. Over 60 days, you would collect a 58% gain overall (with compounding)

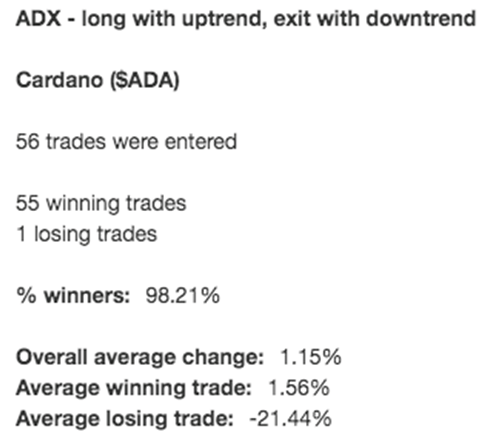

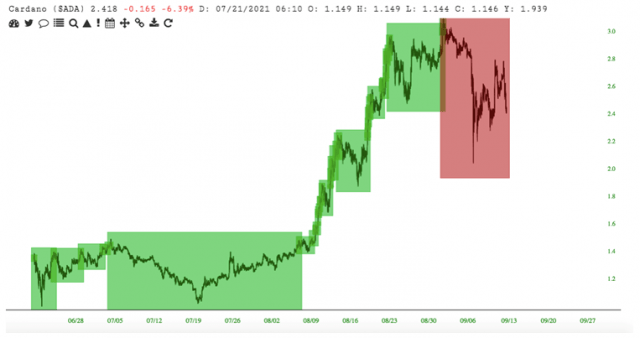

The third coin based on volume today was Cardano ($ADA). This has an 84.3% gain with compounding over 60 days.

The average gain is 1.56%.

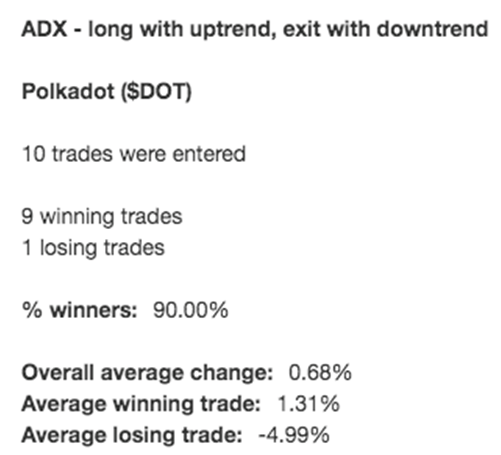

The fourth coin is Polka dot ($DOT). Average gain is 1.31% Note that on trade took nearly all of the 60 day period to become profitable. Overall 6.9% gain in 60 days with compounding.

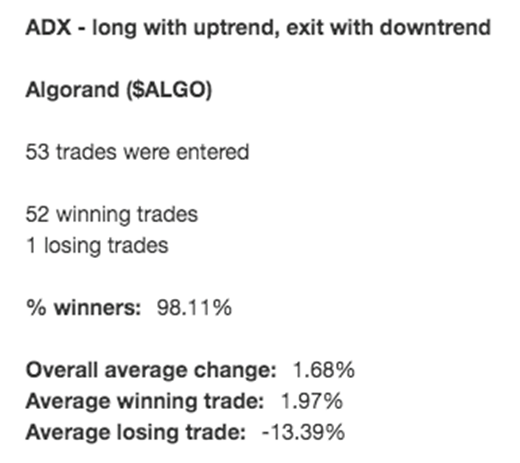

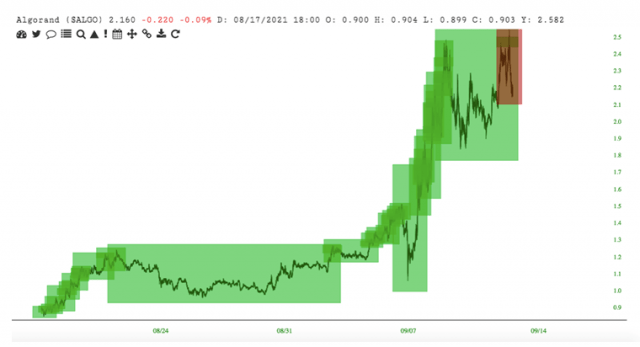

The 5th coin is Algorand (ALGO). Average gain is 1.97%. Overall a 243% gain with compounding over 60 days.

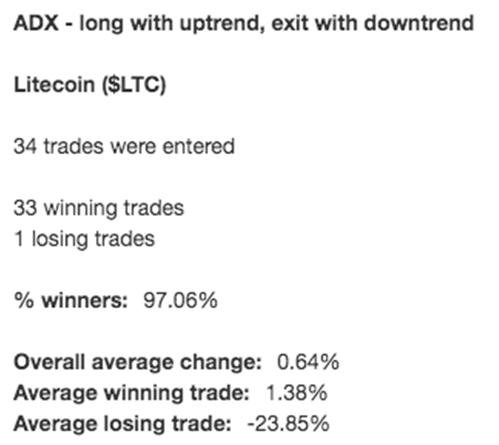

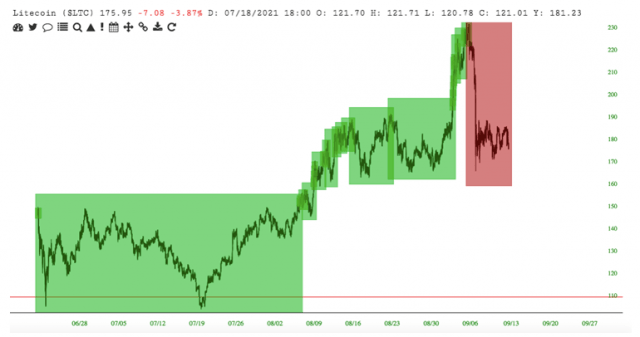

The sixth coin is Litecoin. Average gain is 1.38%. Overall a 120% gain in 60 days with compounding.

Does this method work all the time? No. For Dogecoin (7th coin in terms of volume, excluding non US coins), it peaked on 8/21 within the last 60 days, and has not recovered. So this strategy has not yet worked in Dogecoin. This may also point to relative weakness in this coin. Overall here there is a small, 5.5% loss compared to 60 days ago.

With SlopeRules you can gain entry and exit points that usually result in profitable 1-2% gains. You can see with the 7 coins with highest volume, these would make for impressive gains for a portfolio, given that some coins will need to be held for 1-2 months to be profitable.

Overall if you invested $7000 over 60 days (in 7 coins above) you would have $11,760 with such a strategy, or a 68% gain in 60 days.

If one can program in a bot to do the above, it may prove versatile and effective. Be aware again this is no guarantee, and if the market goes into bearish territory different rules will be needed.