Wow, what a day!

Allow me to start by sharing with you a tweet I sent out about thirty hours ago:

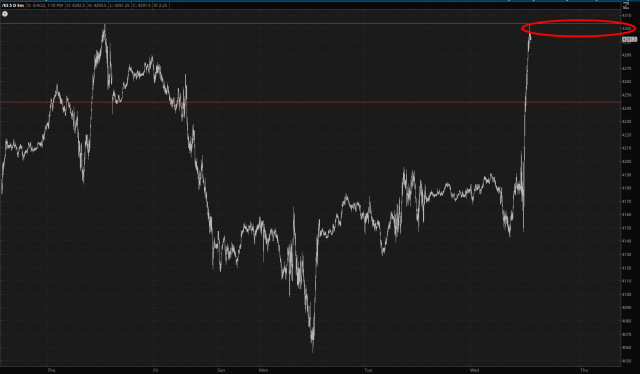

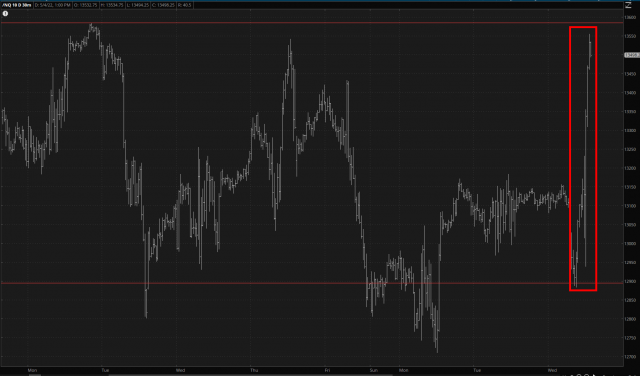

May I direct your attention here, please:

In anticipation of this mega-rally, I went totally into cash with my personal portfolio (and sidestepped getting my testicles chopped off). In my “regular” portfolio, I put my hands on my hips and just waited it out. Yeah, it was a shitty day for that portfolio, but I’m not a freakin’ day trader. It’s no accident these options have months of time left on them.

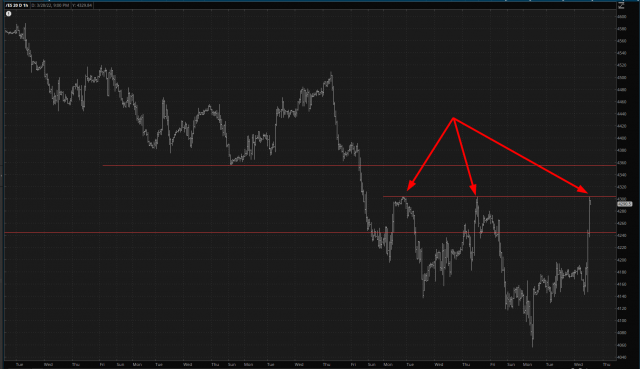

So as pleased as I am at my Nostradamus-level of prophecy with respect to 4300 – – – ummm, fellas, that’s really all I want to stomach. Take note of how importance this 4300 level is to the /ES:

What strikes me as bizarre, and I haven’t had a moment to even explore it – – is – – what the HELL magic happened 5 minutes into Powell’s press conference that caused this bottle rocket? I mean, I listened to every word, and it was the same tired pabulum and how he’s doing everything for the common man, and they have a dual mandate, and they’re a friend of the people, and all that other nauseating bullshit. Indeed, for the first half hour after the FOMC release, it looked like the bears were going to absolutely kick ass. But, instead, we traversed the ENTIRE RANGE in the final 100 minutes of the trading day.

So in summary:

- I freakin’ nailed it with my hope/guess of a mega-rally;

- I sidestepped a devastating loss by GTFO in my personal portfolio;

- I got a hearty kick in the nuts in my normal portfolio, which I frankly expected and have sustained many times this year before. So – – blow me, Mr. Market.

I hope to hell we’re not in for another vomit-inducing rally like we had back on March 14-29. Enough is enough.