I fell out of love with this market in a big, big hurry. I have been spending half my time castigating myself for not dumping everything on May 20th, and the other half grinding my teeth at the sort of thing that happened yesterday (e.g. big tease, and then spent the rest of day the soaring).

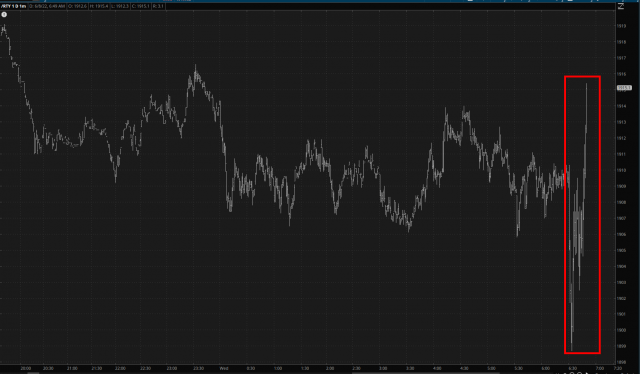

Having been thus burned, I didn’t even consider any trading at all for the first half hour. Good thing, too. The same sort of crap is going on. Huge bids out of the blue for absolutely no reason.

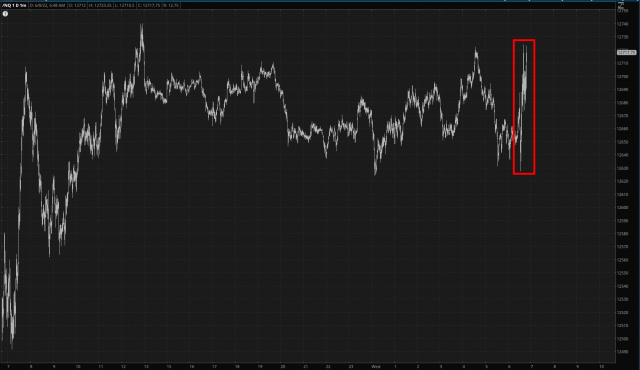

Here we see the /NQ which was nicely down and, just like yesterday morning, exploded into the green for absolutely zero reason at all. You’d think everything in the world was perfect.

Medium-term, yeah, I know, we’re in a slowly-descending channel, but that could be broken without much effort. The whole market feels crooked again, and it’s incredibly annoying.

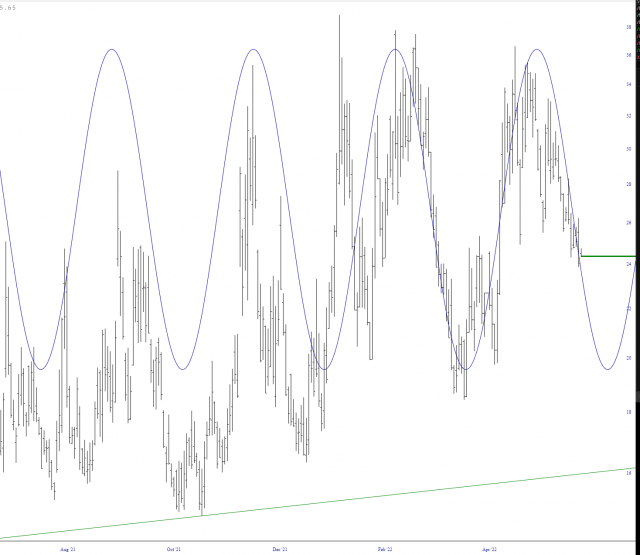

I do have something insightful to say, however, lest you think this is just a whiny, bitchy post. I happened to notice that the VIX seems to be following a fairly regular pattern, so I put it to the test with the sine wave tool. Yep, sure enough, my hunch was right. Take a good look at the chart below. Intriguing, isn’t it?

What it seems to call for is the VIX to bottom around the third week of June or so. That would, of course, be just past the FOMC next Wednesday as well as the over $3.1 trillion options expiration event next Friday. I’m also hearing a lot of chatter about June 14th being an important date.

So there you have it. It feels like we’re just going to have to keep waiting this goddamned thing out. I miss what things were like a month ago. This market blows donkey.