I’ll admit it. Being here in Durham, NC on the eve of the CPI gives me the willies. It was in this very room on October 13th that I witnessed the jaw-dropping reversal which took place and, as can can clearly see now, kicked off a four-month puke-fest of bullishness without nary a downtick in sight. It’s unnerving.

In spite of that, as I laid out this weekend, I’m just about fully loaded up on bearish positions, although, as always, I’ve got an ungodly amount of time on these options before expiration. In a way, tomorrow morning shouldn’t matter that much, but such traumas are hard to shake.

It’s annoying, however, that the market did its usual Reversal For No Particular Reason schtick, as we can see here with the ES (after the briefly exciting drop lower on Sunday):

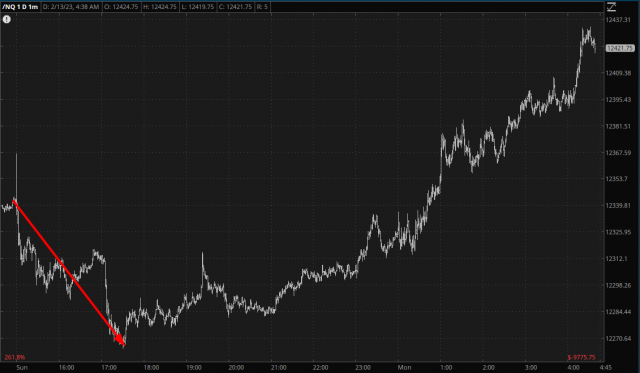

As well as the NQ, with a multi-hundred point reversal:

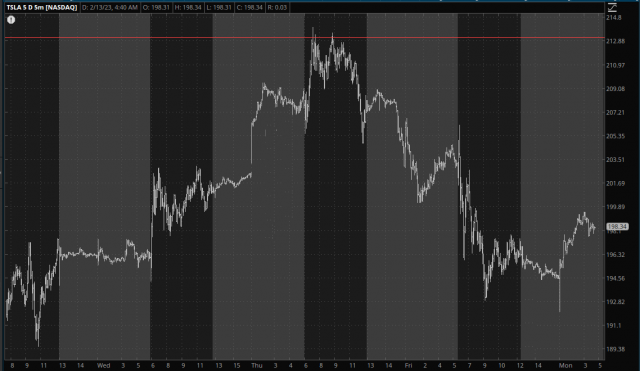

It seems to me that Tesla (my own canary in the coalmine) isn’t really buying it. Yes, it’s up a little, but I’m thinking the die is cast (this chart spans about a week, as opposed to the two charts above, which are only about a day).

Now, if you’ll excuse me, I have to continue healing from my brief exposure to popular culture last night and simultaneously accepting how out-of-step I am with the rest of the world while simultaneously recognizing the truth of something I’ve believed all my life, colloquially known as Sturgeon’s Law, which is that 90% of everything is crap.