Let’s get back to the basics.

The chart below is a bull market. It happens to be the S&P from the year 1995, which was an incredibly steady, smooth, ascending-all-the-time market.

Next, we have a bear market. This, too, was quite smooth and steady. As with the chart above, sure, there were times when a little counter-trend movement might take place for a week or two, but on the whole, it was smooth sailing.

Beautiful charts, aren’t they?

Fast forward to the present. Over the past ten months, we’ve had THIS garbage. And garbage is too kind a word for it. Crap. Bile. Refuse. Wretched treacle. Take your pick. It sucks.

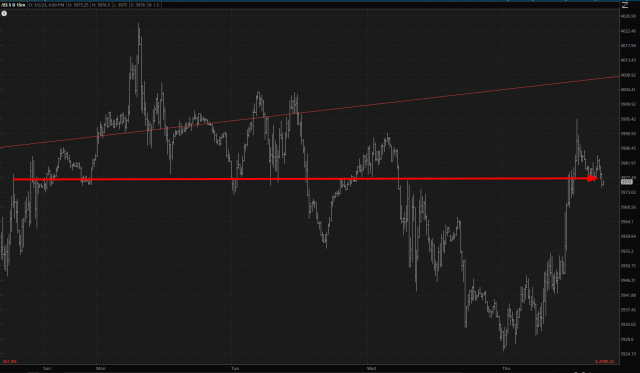

And, even on a shorter timescale, the crap is fractal. This is about the past week. The /ES, as of this snapshot, had no net change, and it jerked bulls and bears alike endlessly.

My man Blackadder offers this professional assessment of this circumstance:

The reason is quite clear, at least from the perspective of someone like me, a swing trader. With a truly trending market, you:

- Get into position;

- Monitor it week by week and month by month;

- Fine-tune here and there along the way, but on the whole, just sit back and let the market do its thing and move, over a period of months, in your direction.

We bears got a taste of that from November 2021 through June 2022. So we had about a half year of a good, steady bear market (although NOTHING like the smoothness shown above) and the profits proved the point. My ‘peak profit’ was June 16 of last year, and I haven’t come anywhere close since then. In other words, I’ve been busting my ass for about nine months with nothing to show for it but lost ground.

What’s dastardly about these up/down/up/down/up/down markets is that:

- As it looks like the market is going your direction, you get more and more into position (at increasingly bad prices, obviously) and more and more confident, because things are going your way;

- However, as they turn, the losses start coming in. And the losses get worse and worse, and when you can’t take it anymore, you start dumping the worst/most damaging of your positions and get out at lousy prices;

- Then, in a short while, you’ll be going back to step (1)

This kind of thing grinds accounts into total hamburger. The only reason I’m not wearing a barrel and standing on a street corner selling apples is because my positioning is relative conservative. If I was a balls-to-the-wall kind of trader, I’d have blown up my account eons ago. This “chop” is absolute death.

I am composing this post on Thursday evening, and Thursday itself was a microcosm of precisely what I am talking about.

- Before the open, things looked great. Tesla was getting zapped hard, all the equity futures were down, and my portfolio was up substantially right from the get-go.

- I started beefing up positions here and there and getting more aggressive. I was already starting to lose ground, however. Then, out of the blue, some Fed speaker made some remark which the algos misinterpreted, and the market went straight up. I cut positions left and right, and I went from almost no cash to a full 33% cash. I went from 21 positions to 16 (some half the size they were).

- By day’s end, I went from a good increase in portfolio value at the opening bell to a much bigger loss in portfolio value by day’s end.

- And, naturally, now that I’m nice and light, all the futures are red as I am typing these words. So if we open down hard tomorrow, I won’t have that much to show for it.

This kind of madness has been repeated in a hundred different forms since last June. The market seems absolutely incapable of making up its mind. We have, over a period of time sufficient to create a new human baby, gone absolutely NOWHERE in equity values, even though there has been staggering chop in between.

My words are not actionable. I write them, I suppose, for at least a couple of reasons. One is to vent. And two, more importantly, is to give some solace (or at least a feeling of not being quite so alone) to someone out there in the same boat. Because, I gotta tell ya, this sucks. To work so hard, day in and day out, and just be engaged in a Sisyphus impersonation, is unrewarding in the extreme.

Oh, and for the handful of you who invariably declare what a great market this is, and how great you’re doing in it, no matter what the circumstance, let me just say for the rest of the group that, yeah, we’re real proud of ya, and you just keep that up there, slugger.