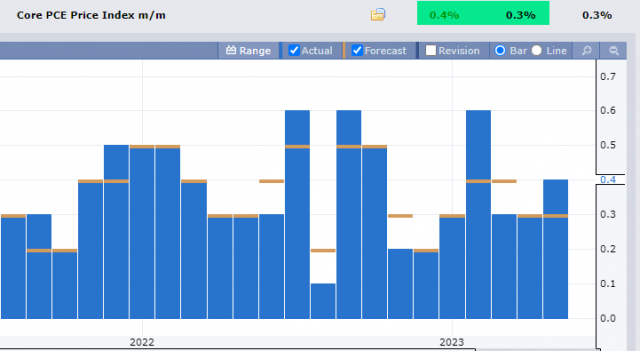

Happy Friday, Slopers. Well the chatter is that the debt ceiling thing has to get put to bed either today or tomorrow (yes, Saturday) before the wheels start to fall off. There’s certainly zero fear in the markets about anything going awry. Every single quote is green, and that’s even with the PCE numbers coming in hotter than forecast.

In general, the market has gone positively nowhere for the past twenty-four hours. The /ES has just been meandering in a crazy-tight range.

More broadly speaking, the biggest opportunity for the bulls would be an unalloyed breakout above the peaks we’ve seen over the past year, which would be particularly good for tech stocks. The /ES, as shown below, is still mired in a range dating back to the glorious days of June 2022. For the bears, I think the most we can hope for is another move to 3800 in the “best” of circumstances.

Since Nvidia (and, more generally, semiconductors) absolutely dominated yesterday, I’ll show this chart of the index itself, the $SOX, whose trendline does a much better job portraying the “kissing the underside” of the trendline than the SMH does.

Finally, regarding the debt ceiling, I’ll say this. Let’s say you had a neighbor who:

- Was irresponsibly deep in debt;

- Had tremendous expenses and obligations;

- Had maxxed out every card and credit line he’s got;

- Was begging and pleading the banks for a larger credit line so he could pay his bills and keep living;

- And, as history had proved, would in due time run through all his new credit, once it was finally granted, and go right back to pleading with the authorities for more credit, since one day, he swore, he’d get his act together, but just not now

What kinds of words might you use to describe him? A bum? A deadbeat? A loser? Yeah, me too.

And that, in a nutshell, is the United States of America as we find it today.