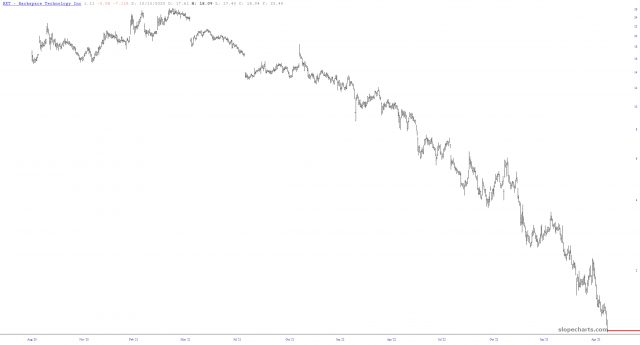

The United States of America has been facing a looming debt ceiling crisis for several months, and the impact it could have on the stock market is a cause for concern. The debt ceiling is a limit on how much the government can borrow to meet its obligations. It is essentially a cap on the amount of money the federal government can legally borrow to fund its operations. The current debt ceiling is set at $28.5 trillion, and the Treasury Department has warned that the country could hit it by the end of the summer. If the debt ceiling crisis is not resolved, it could have negative effects on the stock market, which in turn could have far-reaching consequences on the economy.

The stock market is a reflection of the economy, and any instability or uncertainty can cause fluctuations in stock prices. If the debt ceiling crisis is not resolved, it could lead to a downgrade in the country’s credit rating, which would make it more expensive for the government to borrow money. This could lead to higher interest rates, which would increase the cost of borrowing for businesses and individuals. Higher interest rates would also discourage investment, which would lead to a slowdown in economic growth and job creation.

(more…)