Note from Tim: the Sloper known as Silver Singularity was kind enough to construct an epic post, which I am breaking into two parts. The second part, which is a doozy, comes out tomorrow. Everyone be sure to thank SS for his post, and encourage him to keep at it!

Let’s start by the guiding principle. What can we expect from a leveraged economy in a rising interest rate environment using current and past data/cycles?

Having lived my whole career as a trader in a low interest rate environment combined with monetary stimulus and listening for a long time to people like Peter Schiff, I was finding myself in the camp that the FED and the ECB were toast.

That is to say they, too, were in the same predicament as the BOJ and couldn’t raise interest rates anymore… even a tiny bit.

That if they tried it would immediately implode the system given the gigantic amount of debt the western world had to create to get us out of the hole the 2008 crisis had put us into.

Turns out I and all of those other people were wrong, From 2016 to 2018 the FED achieved to raise rates slowly, but this time we’re witnessing the main event. A huge wave of inflation (that was supposed to be temporary) gave no other choice to Powell to raise rates at the fastest pace in history and to the highest level (by far) of this post-2008 crisis era.

And then… nothing.

At least for now………..

We’ve passed 5% on the FFR, inflation has already made a big retreat from its peak and it seems like the economy is fine when looked under a lot of aspects so far.

Not even talking about the averages that are doing very well after a bad 2022, even if everybody isn’t in the same boat (small caps).

So is everything fine? Is the soft landing/no landing back in everyone’s mouth at CNBC and Bloomberg a possibility?

I guess it is. Everything is a possibility. Aliens invading us next week also is a possibility right?

Well in fact I would say that the odds of a soft landing are about the same as the ones of aliens invading the planet before one of us fails to stay sober and here’s my reasoning.

Rising interest rates alone doesn’t say much without context.

The environment in which interest rates are rising today is different from 2016-2018 because of the high level of inflation we’ve experienced.

Inflation can have (and God knows how much that’s the case since 2021) a huge effect on the nominal growth rate of GDP.

The fact that the COVID crash unleashed the biggest fiscal and monetary binge in history and moreso on a worldwide basis not only helped to fuel inflation and speculation but also created an environment where 5% interest rates would have still been considered “very easy conditions” less than a year ago. (Odd that at that time everybody seemed scared about raising rates, so ironic looking back with today’s perspective!)

Who cares about the short end of the curve having a 5 handle when inflation is 8 or 9% and nominal GDP growth is double digits!

Well, that’s what a blissfully optimistic (NASDAQ) investor would think but nah, that’s really not the case.

As much as we know how happy the FED is when stock prices and nominal GDP go up, such a situation is a nightmare for Powell as it undermines its credibility.

Their 2% “stable prices” objective which I’ve read the other day was Bernanke’s invention to justify MMT at that time (between 0 and 1 would be perfectly fine) is the foundation underlying the justification of all of their decisions.

Powell knows that the longer we stay above the target the higher the probability that trust is going to brutally switch, because that’s how trust works: ON/OFF. And once it goes, you’ve got a much much MUCH bigger problem to deal with now.

That’s where I think bulls and optimists are getting this very very wrong!

Can the FED achieve its goals without sending everything go down the drain?

How sustainable of a situation are we in? Data can help us see more clearly.

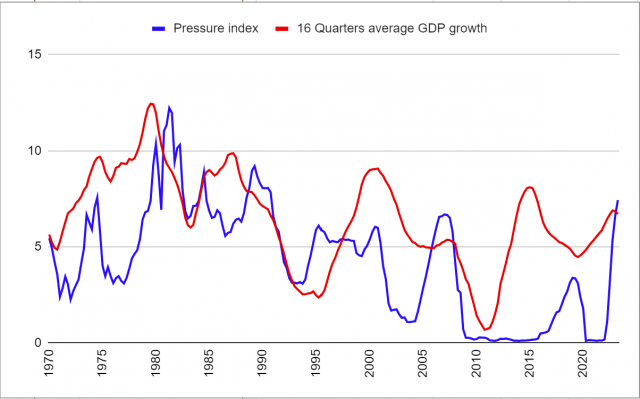

I’ve created what I would call a “pressure index”, it would reflect how much of a burden a certain level of interest rate would be for the consumer (with a more or less rapid lag) and more broadly for the economy (given that it’s a 70% consumption driven): outstanding mortgage level + Federal debt held by private investors (both of which are a direct liability to the consumer)

I should include credit card and other revolving credit but FRED data begins in 2000 and we’re only talking about $1 trillion (compared to almost 40) So I did not bother taking number after number to include in my database for only one trillion more.

That final amount is divided by GDP to end up with a debt to GDP ratio format that I will be able to combine with an interest rate (the FFR in that case). The principle being as followed: if for example my country has 100% of debt to GDP and the interest rate on that debt is 2%, I need at least 2% GDP growth to service the debt without getting into trouble at some point down the road.

Then I want to compare my result to the YoY nominal growth of GDP but a big amount of that GDP growth is fueled by public spending. I want to get a more realistic measure of underlying growth so the formula is as followed:

GDP – (GOV expenditures X velocity of M2)

You get this chart: (I’ve remodeled 2020 and 2021 data for GDP because of too much COVID noise)

Now you can start to see a pattern beginning to appear, when the pressure index goes above the red line it doesn’t stay very long and that’s understandable.

Part Two coming tomorrow………..