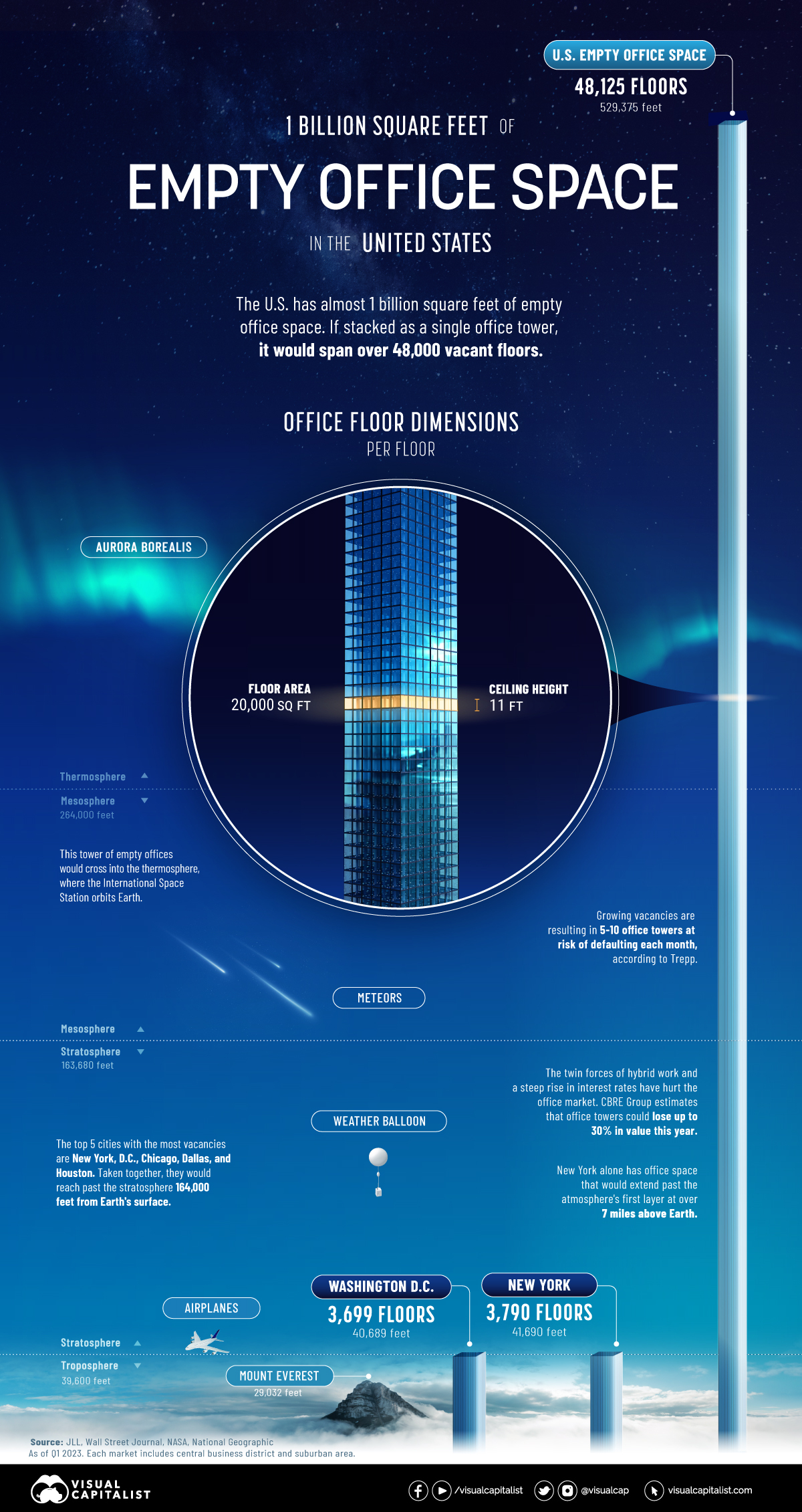

Here’s a novel way to look at how much office space is empty. It is equal to a office building measuring 48,125 floors high, so those at the top would give a high-five to the International Space Station as it passed by.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

In the same manner as I did with the prior post about indexes, I wanted to offer some reflections on what I think recent ETF action might mean for markets in general. Below are seven major ETFs, in alphabetical order of their symbols.

The first, based on the Dow Industrials, has had an interesting failed bullish breakout. A few weeks ago, it looked like the Dow was going to finally smother the bears to death, once and for all. What has happened instead is that, twice, the bulls have tried to launch this thing, and it failed spectacularly on Thursday and Friday. In spite of all the trillions of dollars that pig Yellen has provided, the bulls have apparently run out of gas.

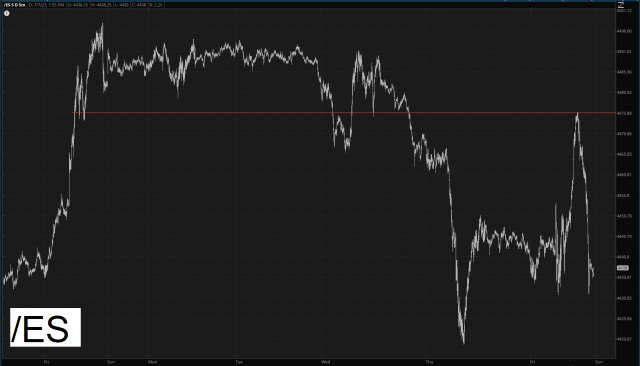

Thursday and, surprisingly, Friday were “healing” days for my trading psyche. Perhaps H2 2023 will be better than H1 (God knows it couldn’t be worse). I wanted to say a few words about the six indexes below.

The All World Index is still in the grips of its “face-off” between the pink and green patterns. It’s clear that the explosive move out of the green bullish base has sputtered. That’s all well and good, but what really needs to happen for the bears is for price action to erode into the price range defined by that green tint. This would negate the bullish base.

On the heels of Thursday’s fall in equities – – which felt like the first time the market sold off in decades – – it was interesting to watch the action on Friday following the jobs report. We got a pop higher, a sell-off, stabilization, and then a vomit-inducing explosion higher. Interestingly, once prices reached the mass of overhead supply, they fell throughout the balance of the session.