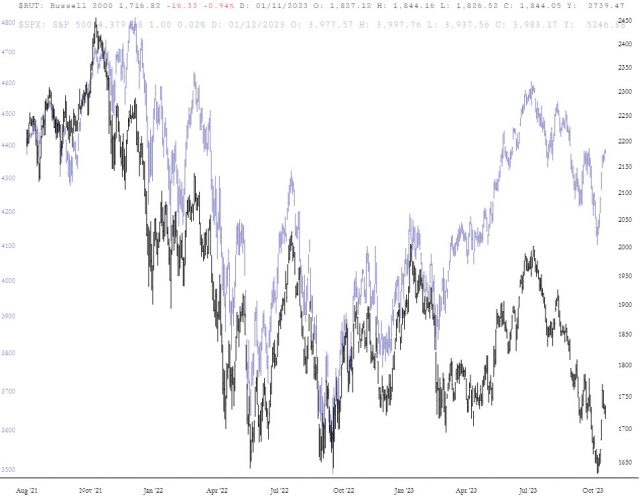

Since the start of 2022 RUT has been negatively diverging from SPX. This divergence continues to mount, as today can testify to. As I am writing this, RUT is down roughly 1% on the session and SPX is flat. You can see how striking the divergence has become in the chart below. To highlight the continuing nature of the divergence, see that RUT topped last Friday has been moving down steadily throughout this week. In contrast, SPX has continued to charge higher.

One key component of RUT is the financial sector. Below you can see a chart of KRE, tracking the regional banks in the U.S. This ETF may give us a clue as to whether we are going to see any further significant weakness in stocks this month.

Two key levels I’ve highlighted in the chart below are value high at 41.95, and value low at 39.26. The strength to begin this month took KRE over value high. The weakness that we are seeing this week is threatening to drop KRE back below value high. If that were to occur we would then have a 80% chance of moving back down to value low by the end of November.

Lastly, I will highlight a Slope favorite this year… XLU. The excellent topping structure of XLU has been widely documented prior to this fall. The sharp decline that we saw in September/October in XLU was followed up by a sharp retrace. While there were numerous POC clusters in this long term topping structure, I have highlighted below what I felt was the key cluster of POCs acting as support for the large topping structure. The retrace that we saw over the course of the past month has moved back up into this cluster and thus far reversed. I consider this a key level of resistance now until it is broken.

Editor's Note: I would like to say once again how grateful I am for TNRevolution's presence here and the excellent posts he's been creating for all of us lately.