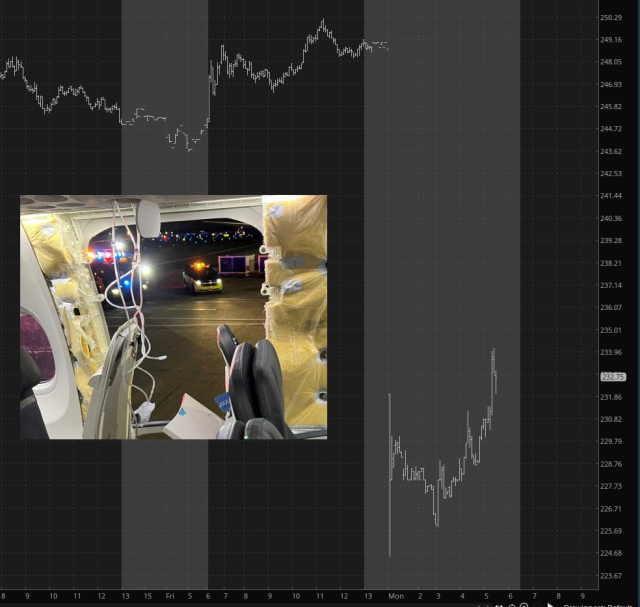

Original post here: Solid labor market data tempered optimism for a potential rate cut, putting pressure on stock prices. The substantial jobs report on Friday presented a mixed picture. In December, nonfarm payrolls grew by 216k, maintaining the unemployment rate at 3.7%, with hourly earnings increasing by 0.44%. However, enthusiasm was tempered by revisions, with October revised down and November. This marks a trend where 10 of the last 11 months have seen downward revisions from the initial nonfarm payroll figures.

Initially, stock index futures reacted negatively to the news, but a turnaround occurred at the opening bell, leading to a rally until around lunchtime. However, most of these gains were later retraced. In a down cycle, we are likely to see rallies being sold, indicative of a downtrend. Despite the volatility, the major averages mostly closed in positive territory. It is crucial that the markets close positively on Fridays. Our economy is primarily consumer-based, and a positive market close on Fridays tends to boost consumer confidence, encouraging weekend shopping.

(more…)