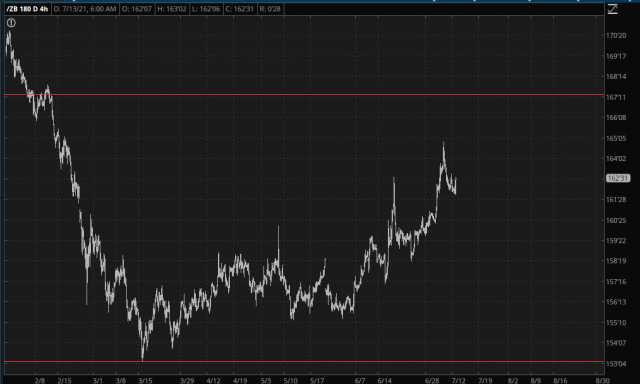

The hot inflation numbers are leading to strength for bonds, which is having plenty of secondary effects. Here we see the /ZB futures, which as of this moment are holding on to a modest gain for the day.

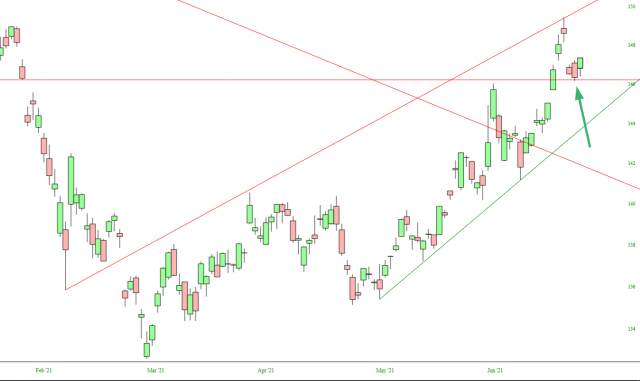

Looking at a broader view, and this time by way of TLT, we can see a well-formed base. The peak was last Thursday (and I mentioned we’d probably sell off some, given our relationship to the ascending channel) but I think we’ve burned off enough steam. I can see this pushing higher from here for days to come.

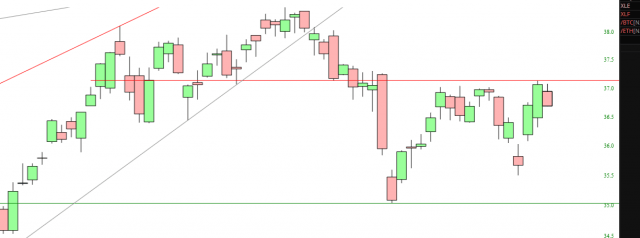

In turn, the banks are weakening. I would note this is especially interesting since, pre-market, both GS and JPM had blow-out earnings, and they are both down. Here is XLF:

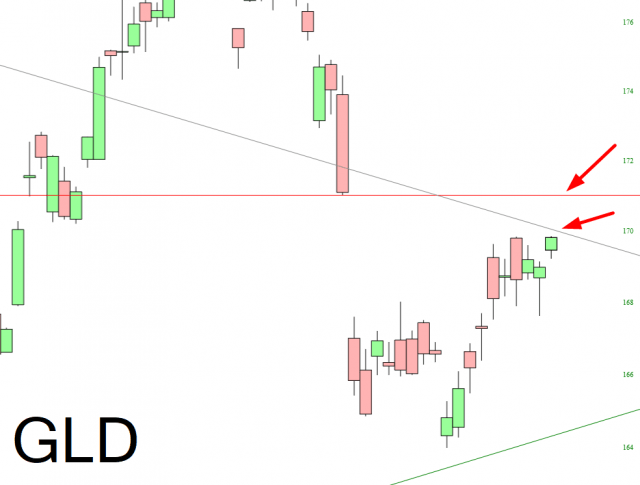

The one asset I’d like to see push higher is gold, which is up, albeit not by much. It needs to conquer the descending trendline and, more importantly, the price gap.

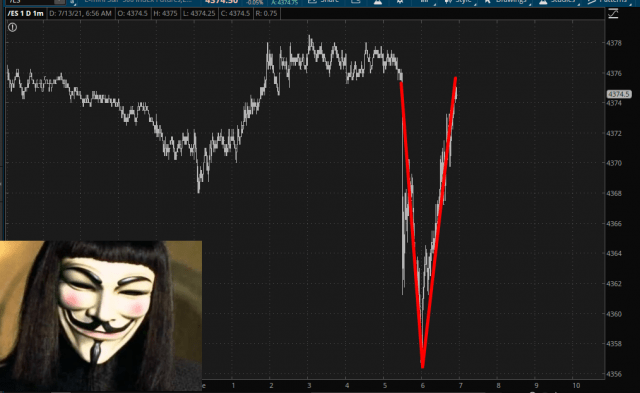

As for equities, the inflation-shock-selloff lasted about as long as I guessed (e.g. not long) and the entire CPI report has been rendered moot by the Powell Printing Presses.