There are three meditative activities in my life. One, when I’m walking my dogs; two, when I’m in bed at the end of the day getting ready for sleep, and three, when it’s warm enough, when I swim. This time, it was the dog walk.

You see, whether I do well or poorly on a given day, I am in a constant state of judging myself. Even during very successful periods, I’ll ask myself: what do I think of my behavior? When I do poorly, of course, I judge myself even more critically, trying to reason out what I could have done better.

Given what transpired over the past week, I was in a particularly contemplative mood. After trading was over on Friday, March 24th, my portfolio was sporting a modest profit for the quarter. A week later, after the close on the 31st, it had turned into a modest loss. It isn’t a good feeling, and although the delineations that mark one quarter to the next are arbitrary in the context of the flow of trading, it’s still upsetting to work hard for three months and have less than nothing to show for it.

After dwelling on it for a while, it dawned upon me the essence of my error, which was my uneven respect for Slope’s Fed Spread indicator, which I publish (typically for premium members) each Thursday afternoon and was initially described last summer. As was plainly stated on March 16th:

Thus, the gargantuan spread that my fellow bears and I were drooling all over just a week ago has vanished instantly, and indeed there’s a small GREEN tint there now (indicating the market is, my God forgive me, somewhat undervalued at these levels).

My use of the word “somewhat” was uncalled for. I was talking my book. It wasn’t somewhat undervalued. It was massively undervalued, as the predictive chart, shown in the same post, made quite plain. We’re talking a multi-hundred point reversal.

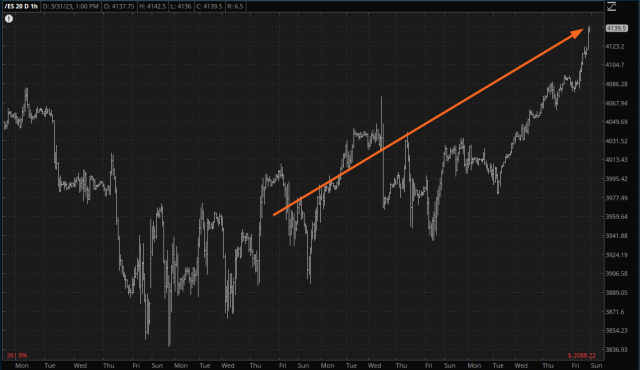

To my partial credit, I did use this circumstance as a rationale to take the foot off the gas, but not nearly enough, and not consistently enough. Should I have absolutely closed everything and gone totally to cash or, even more extremely, gone totally bullish? Well, umm, frankly, yeah. The pathway was plain as day, as the behavior of the /ES clearly showed:

Let’s keep in mind that this data point only comes out once a week, so it isn’t exactly meant for rapid-fire trading, but even the daily chart illustrates that the Uh-Oh post was absolutely prescient, and I foolishly didn’t pay it the heed that it deserved. I was happy to pay attention when it pointed down, but not the other direction. Big mistake.

This isn’t just about self-flagellation, however. It dawns on me how valuable this indicator is, and how stupid I’ve been to share it with anyone besides paying members. So, besides berating myself into trying to get through my thick skull that this thing should be heeded irrespective of my own deeply-held bias, I’m going to keep this strictly behind the paywall from now on. As a compromise, I’m going to do this Thursday post for ALL paying members. Yes, Bronze and Silver folks, you, too.

NOTE: As a reminder, you can get a month of Gold membership for all of 99 cents, as well as a permanent 20% discount if you continue. Click here to take advantage of this special offer.

All right, Tim, you screwed up, we get it. Now what?

Well, interestingly enough, the market’s rally has been so powerful it has actually overshot the target price, which means we’re absolutely not under-valued anymore, so that’s good news. Indeed, looking at this chart of the Fed Spread, it’s actually a pretty damned cool topping pattern. The cold fact of the matter is that, as always, we’ll have to wait until Thursday afternoon to see what the next move is.

So does it mean, then, if the present price level is about the same as the target price? (I say again, we’re actually a little HIGH right now). For the sake of argument, what if the Fed Spread stayed right here for the next six months? Does that mean just don’t trade at all?

Not to my way of thinking. If I knew for a fact that, for the purposes of this thought experiment, that the market was going to be flat-lining for the next six months, I would cheerfully short stocks, because in that environment I know I could find good opportunities. It’s the “tide that lifts all boats” situation (like last week) which is death for a bear.

The bottom line is that not only could this pain have been avoided, but it could have made a profitable quarter even more profitable. As it stands now, the week ahead is tremendously important for three reasons:

- There is a ton of economic data coming out, including the jobs report Friday;

- We are coming off the entire bank disaster Fed liquidity spigot, which means Thursday afternoon’s Fed Spread will be extremely interesting;

- The market is dangerously close to a big new leg to this bull run, provided certain thresholds are crossed).