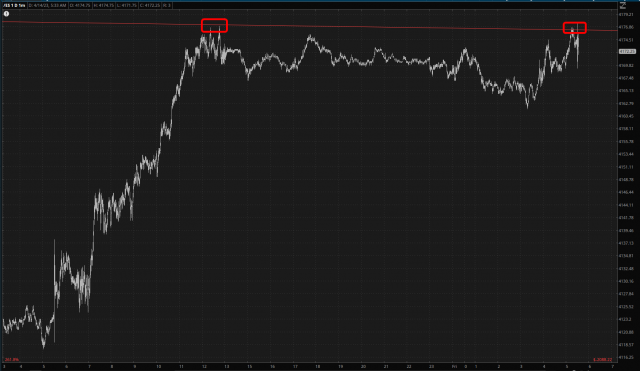

Happy Friday, everyone. Well, once again the market tried to push the /ES above the resistance trendline, and although it wouldn’t take very much at all to succeed, it hasn’t quite happened yet (as of this typing, at least). This is the third time this week an attempt has been made.

Looking closer, you can see how the /ES did manage, by a pixel or two, to sneak past it, but as of this composition (about 5:45 in the morning) the /ES is a little bit down. Not exactly riveting stuff.

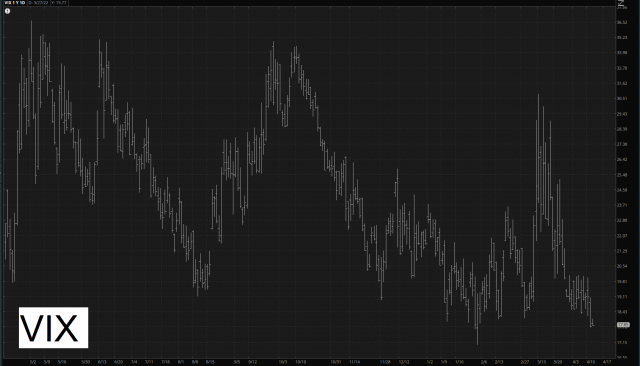

The VIX, of course, has been beaten to death and is now almost down to the 17 level. Pretty pathetic, on the one hand, but also illustrative of the upside potential. In the past couple of years, this is about as low as she goes.

One bright spot for me this morning is Boeing, in which I am long August $220 puts. It is down about $15 pre-market.

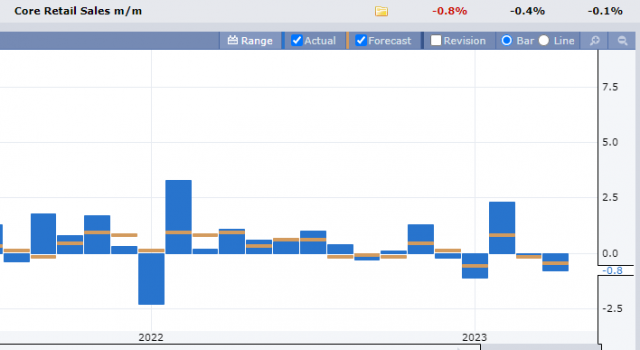

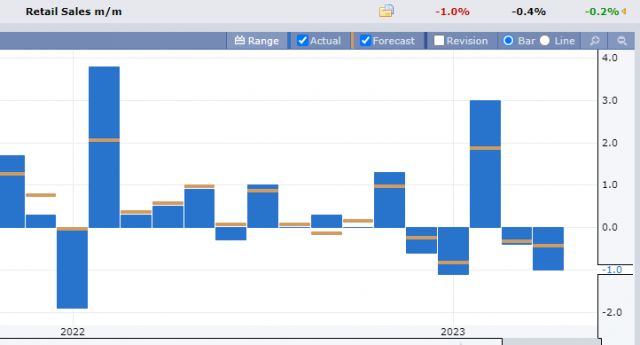

This entire week has been packed with economic reports, and this morning’s were focused on retail, which both came in soft. I guess people are tapped out (or maybe just don’t have any more room to store crap they don’t need).

Here on Slope, and on my Twitter feed, I see that yesterday was an extinction event for many bears. It’s lonelier now, but at heart, I’m a fairly solitary creature. I am quite heavily positioned right now (only 5.9% cash, and I’ll probably even deploy that) and am crossing everything I’ve got two of for good luck.