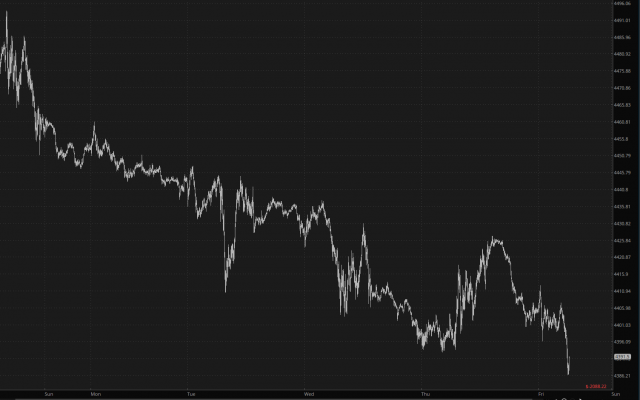

Good morning ,everyone (and this time, I didn’t have to put the word good in quotes). We’ve got a nice solid red morning, and I’m delighted to report that we’ve had a solid week of bleed-out across the board. It all makes sense, considering the white-hot fever of bear-abuse going on beforehand.

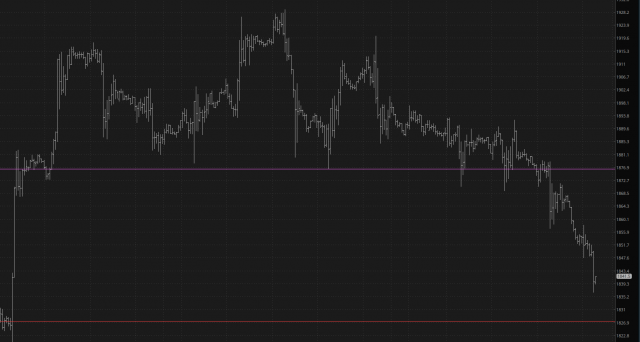

The topping pattern I pointed out repeatedly with the /RTY yesterday has performed absolutely magnificently!

The not-so-good news is that I think it may be close to down. I hate to type those words, because, believe me, the past four days have felt absolutely marvelous, and I’m the last person who wants it to end. If it were up to me, the market would drop 2% every day until the end of time, although that is politically impossible and, mathematically, would get pretty dull near the end.

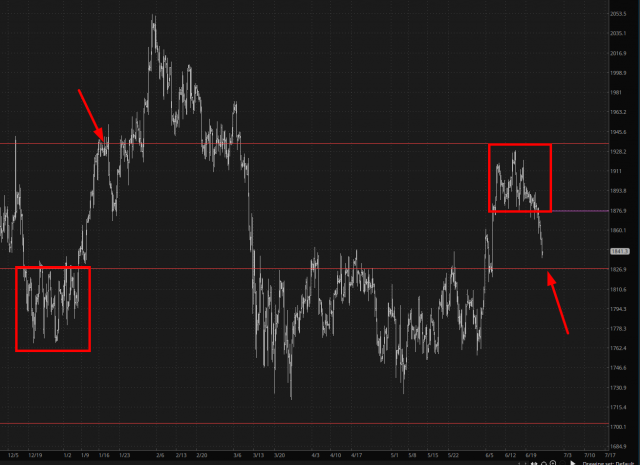

My point, as a chartist, is to look at what I’ve slapped together below. To my eyes (and mind), the pattern we’ve experienced is the upside-down version of what happened a few months ago. The arrow represents the “you are here” moment. That is to say, it seems likely to me that the small caps will find major support here and, sadly, bounce higher.

The, hey-hang-in-there-buddy news is that, following such a bounce, I believe we will penetrate the same red line that is offering supporting right now. In any event, my current positioning is:

- 16 positions, all of which are January 19 2024 puts;

- 15 of them common stock-based, 1 of them an ETF (XHB);

- A cash level of 6.8%

These scintillating sell-offs don’t last forever, but, by God, I’m going to enjoy the devil out of it while I can.