Good morning, everyone. The CPI is out, and, just like the PPI, it came in hotter than expected. I still think it’s a total joke that this “hot” CPI is 3.7% annually. Are you KIDDING me? I sincerely think it’s 3.7 a MONTH. Again, I’m serious. I spending a couple hundred thousand bucks on stuff a year. I know what things cost. And I’m a cheap sumbitch, so I’m sensitive to it. INFLATION ISN’T 3.7%!!!!!!! Good Lord!

In any case, the equities have softened up, at least for the moment.

Not that the permabulls at ZH made it easy to be confident for a bear. This Goldman Sachs-obsessed equity cheerleader is slathering their popular site every single day with doe-eyed, gushing stories about what a great time it is to be buying assets, and how Goldman said THIS and Goldman said THAT. These guys used to despise Goldman Sachs (as I do), but now they think they’re just peachy.

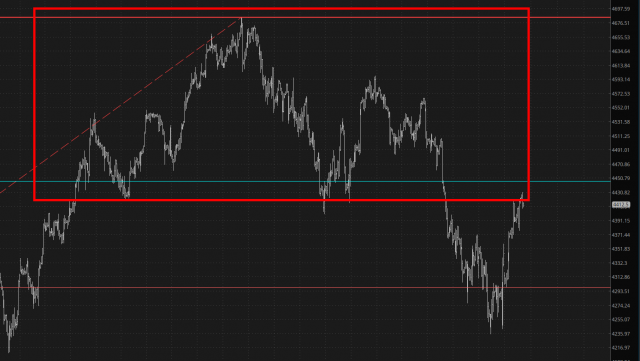

As I was walking my dogs this morning, prior to the CPI, I gave myself a little pep talk, bracing myself for a huge “up” day like everyone on the planet expects. In my head, I went bullet point by bullet point about why it’s important to hang tough. I also told myself, fundamentally, the reason I didn’t make a fortune with the Dow Utilities (in BOTH directions) was that I didn’t have enough FAITH in my own charts. Great patterns are VERY VERY RARE, and we must exploit them to the hilt.

And, for the love of God, the patterns I am seeing in stocks are as bearish as can be. So long as prices stay BENEATH these setups, they are absolutely marvelous, and I’ve got to believe in my own talents and now freak out just because the likes of Zerohedge are pumping the masses into buying.

At the same time, we must not be reckless. Over the past week, EVERY instance of a drop has been met with buyers, although with decreasing fervor.

I come into this day with 16 short positions, NONE of them expiring earlier than next year, and about 10% cash. Let’s go get ’em.