Welcome to a new week, and that one awkward time of the year when we’ve just emerged from weeks of on-again, off-again holidays only to face in just a matter of days ANOTHER freakin’ holiday. Groan. Ah, well. Let’s focus on what’s before us.

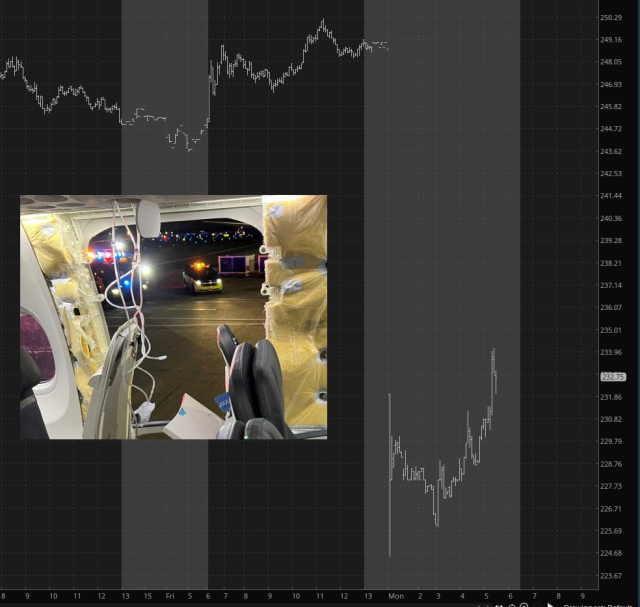

The big news today, of course, is that on top of overcharging the government for its “defense” contracts, Boeing has found itself in the business of selling planes whose parts come flying off during midflight. In a rational world, this would crater the stock 90%, it’s down just about 8% this morning, since they figure that Yellen will introduce the Boeing Support Finance Program or some such thing. In any case, a drop is a drop, so I’ll take it.

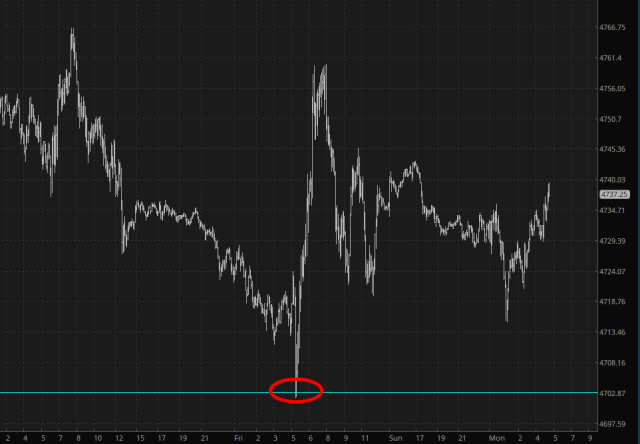

As I observed last week, the enemy of the bears (if I dare use the plural anymore) is the Fibonacci support level, which has proved itself to be a rock wall for the /ES…….

……as well as the /RTY…….

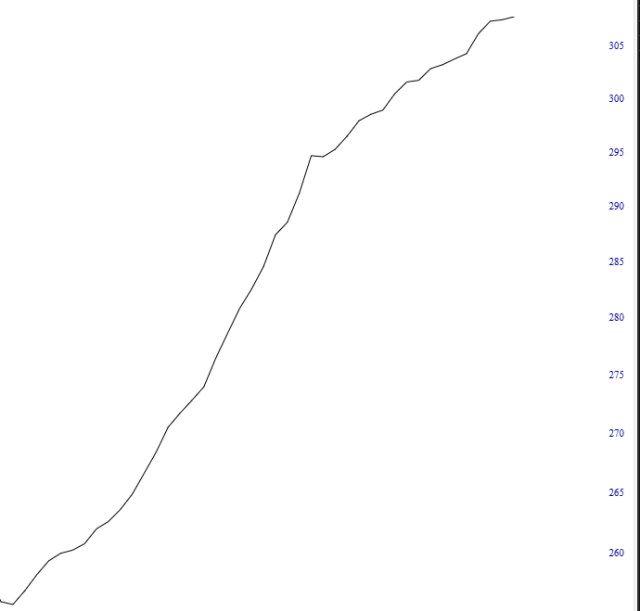

We may well just dick around above that level until Thursday comes along, which is the first meaningful news event of the week. Specifically, we get our monthly CPI report. For many, many years, no one gave a crap about this report, because inflation was non-existent. These days, it’s the most important report in the known universe, and the last one (Dec. 13) caused an absolutely wretched and devastating rally. Here’s the CPI over the past few years, and as you can see, everything is getting More Expensive All The Time.

As I’ve mentioned before, though, there’s one tricky thing that the empty-headed American public doesn’t tend to grasp: the damage is DONE. See the chart above? It isn’t going down. Ever. The higher prices are PERMANENT (kind of like our $34 trillion in debt). Just because inflation goes from a supposed 6% (actual: 30%) down to 4% (actual: 20%) doesn’t make things good again.

It’s sort of like getting raped in prison, and the chap doing it decides to rape you only 5 times a day instead of 8. It’s an improvement, yes, but it’s still a bad thing, and the memories aren’t ever going away. All the same, people like Tom Lee are mincing and prancing around the tee-vee screen, chirping on about this great news, when in fact it isn’t (although my crude analogy and Mr. Lee might be an inappropriate combination, since I am offering up my analog as something objectively “bad”).

In any case, I stand along with my five short positions, ready to take on the week. If there’s one surviving bear out there besides myself, I offer you good luck.