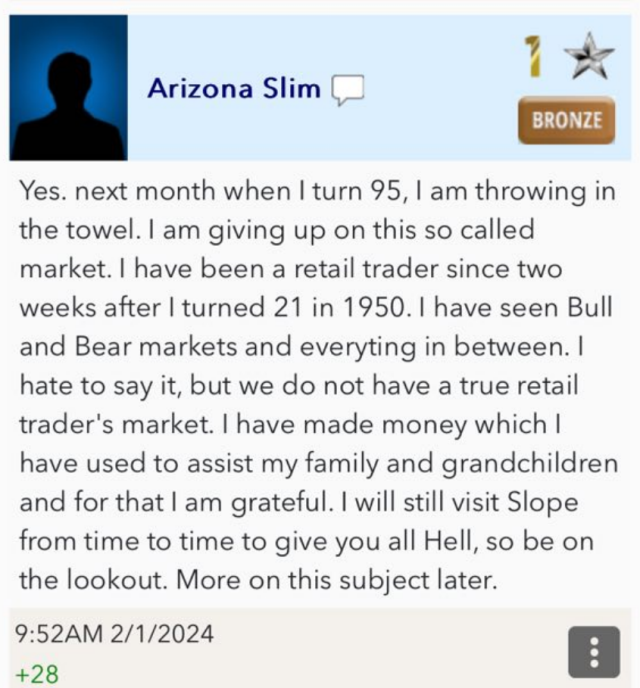

Although I don’t hang out in the comments section much, I always read the most popular comments each evening from the Daily Digest. I noticed that tonight, far and away the most like comment was from Arizona Slim, the elder statesman of Slope.

First off, Slim is a staple of the Slope experience, so it’s sad to know he’ll be dialing back.

Second, though, his statement that – – and I’m reading between the lines a bit here – – true markets are dead – – that’s something I’ve been thinking about quite a lot. I also think it’s cool that this conclusion is drawn from 73 years of experience (!!!!!!!!!!!!!) And here, I used to think that starting in 1987 was a big deal! Just to put it in perspective, in 1950, the existence of the transistor was a mere three years old. So, a lot has changed, to put it mildly.

The notion that a relatively organic equity market is a thing of the past isn’t just an amusing debate topic for me. It’s literally an existential issue. The entire purpose behind what I do – – charting, studying the markets, technical studies – – is predicted on the idea that the hive-mind of human behavior is something that can be interpreted through patterns, analogs, past behavior, and critical levels of support and resistance. If, instead, the market is overall governed (conquered, even) by exogeneous forces that seek a specific outcome and will spend whatever it takes to get that outcome……………..well, I guess I could always skim swimming pools for a living.

This is something I’ve grappled with a lot lately. I entered the world of trading in 1987. In fact, my first trade was, appropriately enough, on Black Friday, 1987. Sadly, that is almost PRECISELY when the government decided it would be a great idea to get into the Stock Market Manipulation business. It started off with goddamned Alan Greenspan (who, Lord help us all, is still roaming the Earth as he approaches 100 years old). The response to the 1987 crash was the Plunge Protection Team.

Next, the response to the Internet Bubble bursting was the Fed (again, Greenspan) creating the Housing Bubble. The response to the bursting of that bubble was the introduction of QE and God-knows how many horrible new programs. It seems quaint, really, to think that in 2008, Congress actually debated (and initially shot down!) a mere $800 billion in “help”. These days, the Fed has carte blanche to print as many trillions as they feel like printing.

In a word, the government has become extremely government with blatant manipulation at any level. If that’s true then, yes, Virginia, there is no Santa Claus. He’s been smothered in his sleep.

Back in 2021, I was so distraught at the non-tradability of equity markets that I actually became a crypto trader for a while, and it was a breath of fresh air to actually experience an absolutely organic market once more. Once the all-too-brief bear market began in November 2021, I was more than happy to jump into stocks once more. That was smothered in its sleep in just seven months, however, ending on June 16 2022, and the manipulation has been progressively getting worse since then.

What I am trying to say is that Arizona Slim’s departure aligns perfectly with what so many “quitters” lately have said to me. They’re not saying, “Where’s the bear market?!?!” What they are saying is, “I can’t trade this anymore.” They don’t even mention bull or bear. It’s just too alien now, and they just can’t stomach it anymore.

As I sit here now, the markets are raging, as they always do, to lifetime highs across the board. It seems that manipulation isn’t a bad word anymore, because…………….it works! But what it also means is that fewer and fewer people want to actually engage in the markets on a day-to-day basis, and the cynic in me still believes that the longer they try to prop this thing up with tricks, the more cataclysmic it’s going to be when the tricks stop working. At that point, we’ll be left with nothing but $50 trillion in debt and a bunch of newspaper clippings about the days when stocks were at lifetime highs every single day of the week.