Disclaimer: Prices can go a lot higher regardless of “Narrative”. Everyone who has a vested interest in higher prices are selling the stories that will try to make it so.

That is why it is counter intuitive to consume too much financial content. Even mine. That is also why my podcasts are so short vs what you see out there in the marketplace. The market already has priced all below news into prices already. That is also why I note that listening to earnings is for entertainment only. The price action is king.

When you can ingest “NARRATIVE” data like earnings and sell side packaged news and still function as a trader and win, you are making huge progress in the psychology of trading. So, before I get into the narrative data, I want to point out charts and “What Stuck out” section first! Because price action and charts are more important than news and narrative. I would say the healthy ratio of attention or head space for a good trader is at minimum 90:10. 90% price action and psychology vs 10% news, earnings and narrative.

On Monday’s podcast I will cover both. All of the below, as well as the narrative stories. But below are just the charts and price action.

Stuck out over the weekend

$NDX Nasdaq 100 ratio chart to QQEW 0.00%↑ Equal Weight Nasdaq

Here is the Semi-conductor index $SOX:

The Semi Conductor index has tested this Red resistance line only three times since the peak of Dot-com. Here we are again!

Closeup”:

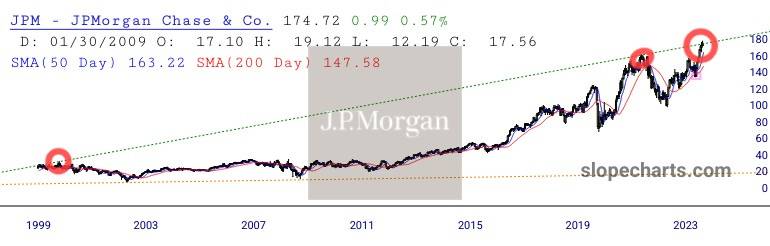

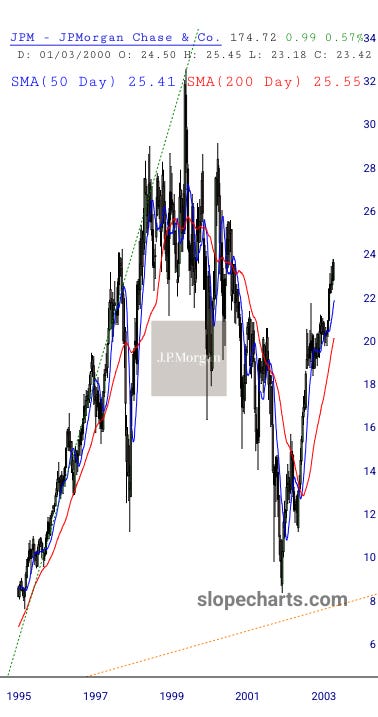

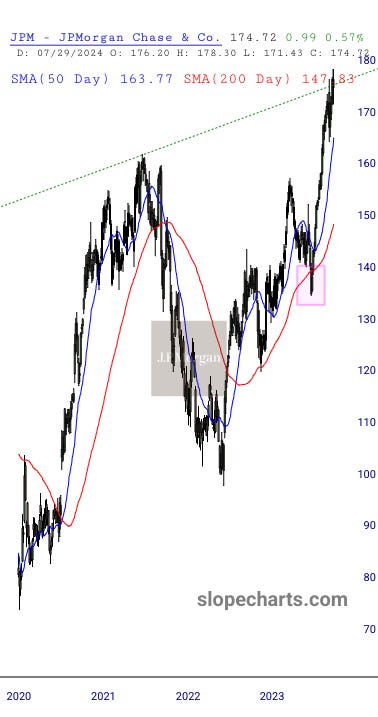

I now present to you JP Morgan, JPM. Maybe it is nothing. Maybe this trend line will be made irrelevant as it roars higher? We just breached it. Since the year 1998, it has only touched this line twice (dotcom and covid) upon which sold off along with broader markets. Well here we are…

$XLF #BANKS#WALLST

Here is #Apple AAPL 0.00%↑

This purple trend has been tested 6 times since the Dot-com crash. It got close during the Great Financial Crisis in 2008, but no cigar. 3 times since the bottom of New Yrs Eve 2022. Maybe it is nothing. But if that trend line breaks down, watch out for your retirement accounts! Look at the second chart. We pierced below it on Friday before defending it.