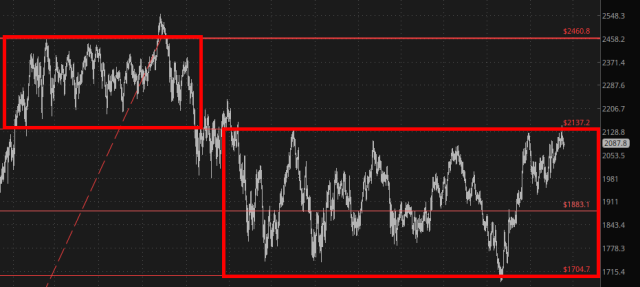

Welcome to Wednesday, everyone. Let’s start off with the Russell 2000 futures, which have been following a delightfully predictable pattern for a solid two years now, having been confined to the lower range that I’ve highlighted. You can see this was preceded by a higher range, whose support now acts as resistance (which, in turn, we recently tagged). The point here being that, given the past two years of movement, it is more likely we weaken than strengthen in the weeks ahead.

In spite of this, the volatility index continues to grimly march toward pre-pubescent levels. Pathetic, ain’t it?

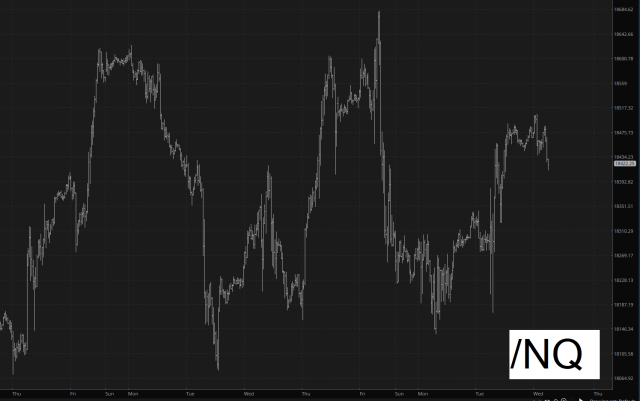

I have three simple positions right now: puts on SLV, EEM, and QQQ. Speaking of that third one, here is a somewhat longer-term intraday chart of the /NQ futures, which at the moment are setting up for a nice mover lower.

Although I haven’t traded crypto since 2021, I find it an endlessly-interesting universe of charts. Looking at the intraday of Bitcoin, you can see how it keeps hammering out record highs (often attended by brief price spasms). It isn’t exactly a ride which is devoid of bumps, but there’s no arguing that the crypto crowd isn’t making significant progress virtually every day, while in turn SBF is hurling himself from one side of his cell at the MCF to the other.