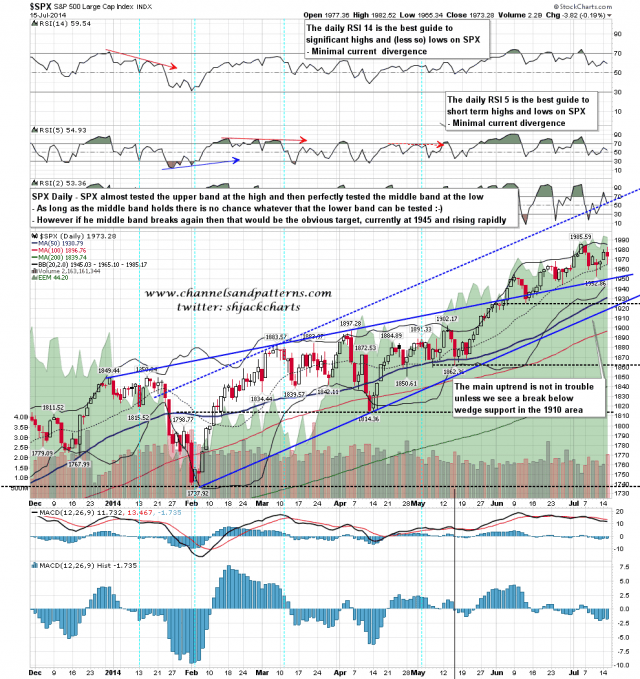

That was a very pleasant change of pace on SPX yesterday, with almost a test of the high, and then a decline to test the daily middle band, and since then a recovery in the afternoon and overnight back to test yesterday’s high. Short term this puts SPX at a fork in the road.

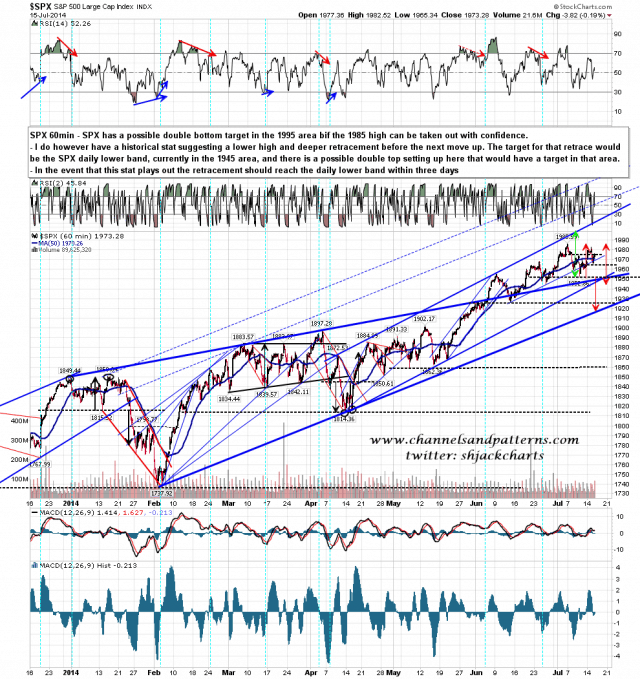

On the SPX 60min chart there is a possible double bottom targeting the 1995 area if the current 1985 high can be broken with confidence. There is also a possible double top setting up with a target in the 1945 area on a break below yesterday’s low.

The historical stat I have been watching since last Friday suggests a test of the highs here and then a fast decline to test the daily lower band, currently also at 1945. The daily lower band is rising fast however and may well be over the last low at 1952 by the time it would be tested. That fits the stat too, as only one of the three previous instances made a lower low at the lower band touch. SPX 60min chart:

Will this short term bear scenario play out? Maybe, though it’s hard to get excited about bearish setups nowadays. What I would say though is that if this stat does play out, it adds nothing to any larger bear case. none of the three previous instances were anywhere near a significant high, and in all three instances new highs were made soon afterwards. SPX daily chart:

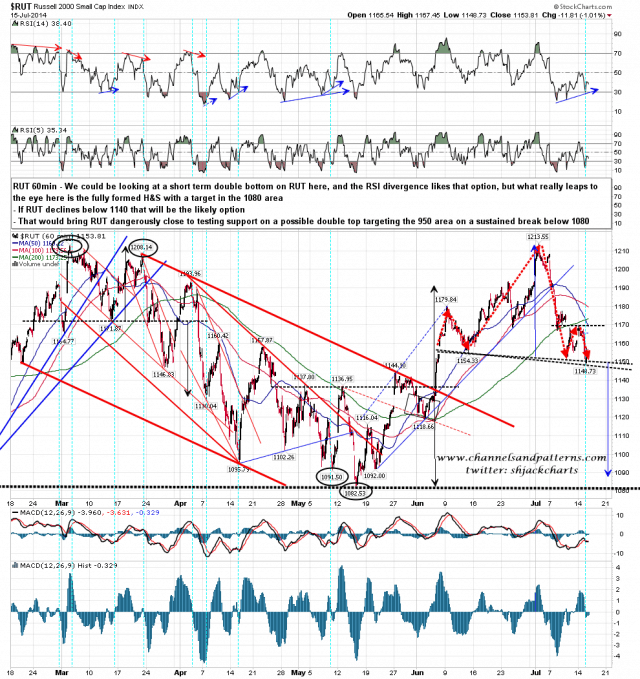

So what else is there to suggest that this short term bear scenario might have a shot here? The Russell 2000 chart. I shorted the start of Yellen’s comments yesterday morning because there’s really nothing that she can say that would please bulls here short of a major policy change on QE. QE3 is winding down, and likely to end altogether in October, and the Fed has already indicated that they will seek to keep interest rates low for years to come. There’s really not much left to announce that could be interpreted bullishly unless policy on QE changes.

What she said that was interesting though was that small caps appeared overvalued. What was she talking about? With the P/E ratio on RUT beaten down this year from the 100 area to a modest 76 it’s hard to say, but if there are any more comments along these lines today it may trigger an important support break on the RUT chart, where there is a clear H&S targeting the 1090 area. if that plays out on RUT on the next few days it’s hard to see other indices rising much in that time, and that touch of the daily lower band on SPX would look pretty reasonable. We shall see. RUT daily chart:

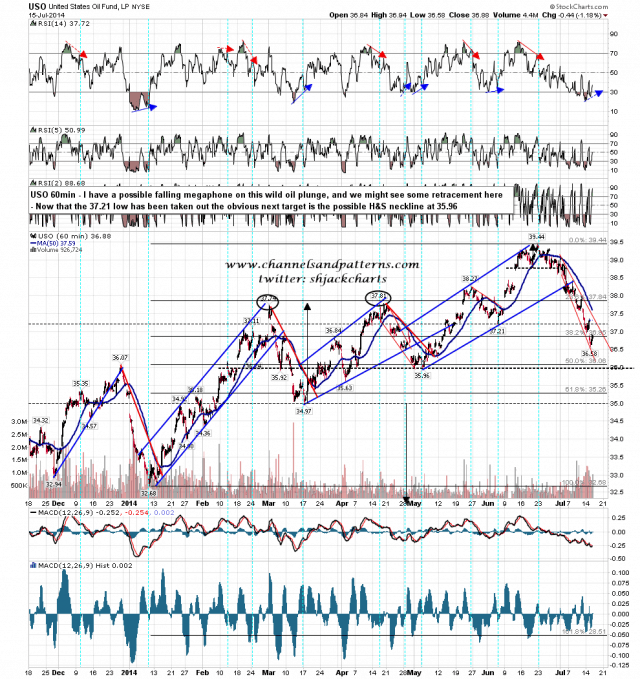

The move down on oil has been very fast. I have a possible falling megaphone on USO and we could see a bounce here. I have a possible H&S neckline in the 35.96 area that I’ll be watching. USO 60min chart:

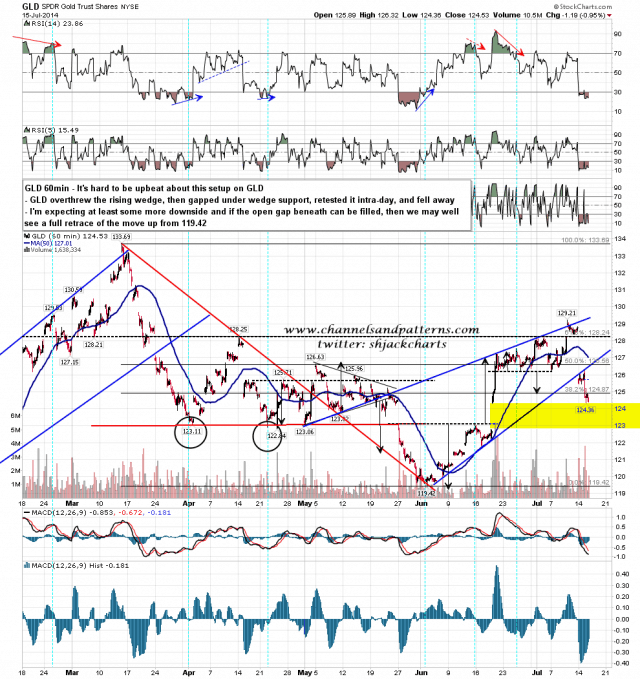

GLD made a significant support break yesterday and retested the broken trendline before falling away. More downside seems likely. GLD 60min chart:

ES has reached 1977.5 (1984.5ish SPX) overnight and looks very short term overbought. I’m expecting to at least see some retracement before that area can be taken out with confidence. That retracement might well develop into a move towards the SPX daily lower band, if the daily middle band, which has held as intraday support on two of the last three trading days, can be broken with any confidence. Short term support is still at the 50 hour MA, currently at 1970 SPX.