Every now and then, some company will produce a commercial that’s designed to stir up nostalgia and humor among the masses: typically, the commercial will be pushing cars, or soft drinks, or some other consumer item, and it will show cliched scenes from decades past. For each crowd shot of each decade, everyone – and I mean everyone – will confirm rigidly to whatever stereotype exists for that decade. So the 60s crowd will all be hippies and flower-power, the 70s will have everyone disco dancing, the 80s will have everyone playing Rubiks Cubes and Pac Man, the 90s will have everyone dressed for a grunge concert……..

And then they get to the present day. There will be a crowd for that too, but they’ll always be sensible. So every decade in the past characterizes its inhabitants as trend-worshiping lunatics, whereas the present is always……..always………normal. Still cool, yes. But normal. And that ends the commercial for the latest Coke or the most recent Ford, or whatever else it is.

But humanity isn’t like this. If you want to find out how consistent people are, trying to write a 450-page history book about the past five centuries. You’ll get an idea how consistent people are.

And yet people think that, at long last, They’ve Finally Figured It All Out, and that Everything Is Going To Be Fine From Now On. And they are wrong every time.

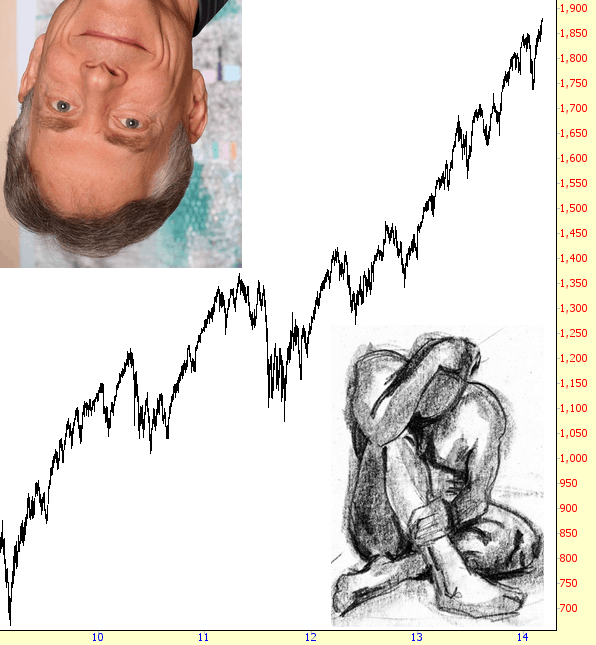

As you might imagine, the fifth birthday of this insane, interminable, agonizing bull market prompted me to offer these thoughts.

I did a bit of digging, because I was curious what I was saying at “the bottom”. Well, I find the post, and it was titled – appropriately enough, in retrospect – Tim-Bull. I didn’t declare “this is the bottom! Buy and hold for the next five years!” But I was definitely way more bullish than normal. It is sort of painfully amusing looking at adjacent posts. In one I state:

I did a bit of digging, because I was curious what I was saying at “the bottom”. Well, I find the post, and it was titled – appropriately enough, in retrospect – Tim-Bull. I didn’t declare “this is the bottom! Buy and hold for the next five years!” But I was definitely way more bullish than normal. It is sort of painfully amusing looking at adjacent posts. In one I state:

Overnight /ES trades have done well for me, and I have definitely positioned myself for a “just in case” by shorting 40 /ES at 687.50 with a stop above 691.25. At the moment I’m typing this, it’s at 684

Isn’t that sort of ghoulishly painful to read? 684! My God. And another painfully amusing read is my Lottery Plays, posted on March 6th. I daresay many of those stocks are ten times more expensive today.

But perhaps what caught my attention the most is what I said on another March 6th post, when I was lamenting how the market couldn’t sustain a rally for more than a few minutes. It is, word for word, letter for letter, exactly what I’ve been saying lately about the inability lately for the market to sell OFF for any length of time:

It used to be that rallies couldn’t seem to last more than a week. Then they couldn’t last more than a few days. Then they couldn’t last more than one day. Now it’s at the point where they can’t last but a few minutes.

Seems amazing to thiik that was a problem, doesn’t it?

I’m long past the point of being sick of this bull market. I’m numb to it now. It’s sort of like being confined to a North Korean torture chamber. You’re going to get tortured every day. Where’s the surprise in that?

But I don’t blame the bulls for being arrogant, cocksure, and complacent. I mean, if the market had been falling for five solid years (ha! hoo hoo! whoo, let me catch my breath!) I’d be every bit as obnoxious.

From the movie Cold Mountain:

If you could see my inside, or whatever you want to name it; my spirit, that’s what I fear. I think I’m ruined. They kept trying to put me in the ground but I wasn’t ready. But if I had… if I had goodness, I lost it. If I had anything tender in me, I shot it dead! How could I write to you after what I’d done? What I’d seen?