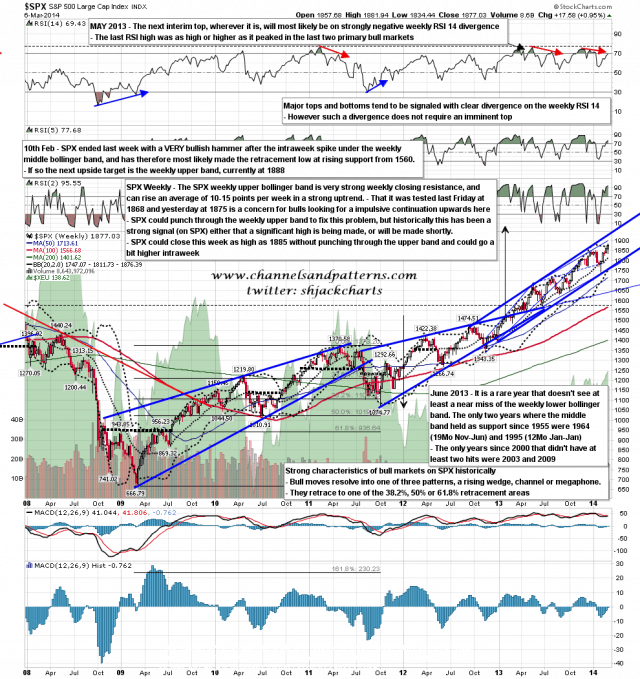

SPX has spent the last three days trading close to the weekly upper bollinger band, and closed yesterday a point above it. I gave the maximum closing range this week without a rare and bearish punch above the weekly upper band at 1880-5, and if anything that looks a little high. With ES at 1884 at the time of writing, further upside into the close today looks unlikely. SPX weekly chart:

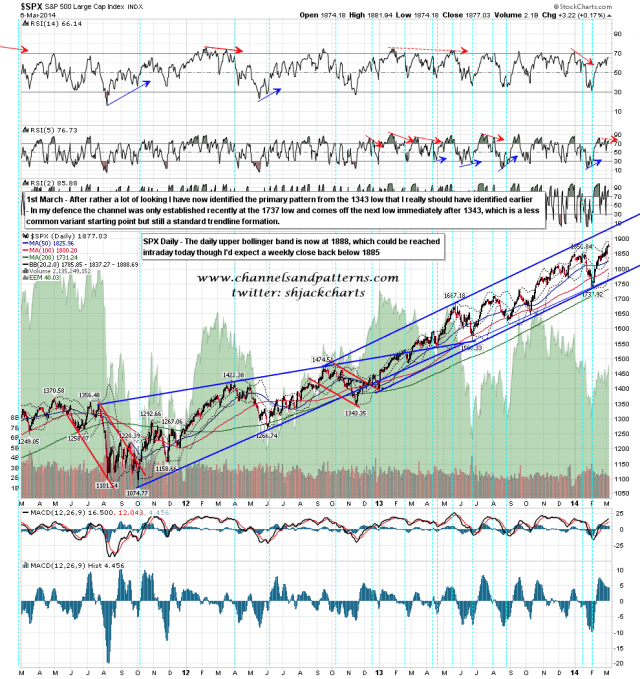

On the daily chart the upper bollinger band is at 1888 and I’d like to see that hit today. If the current post-jobs report persists into the open then that may be hit then. SPX daily chart:

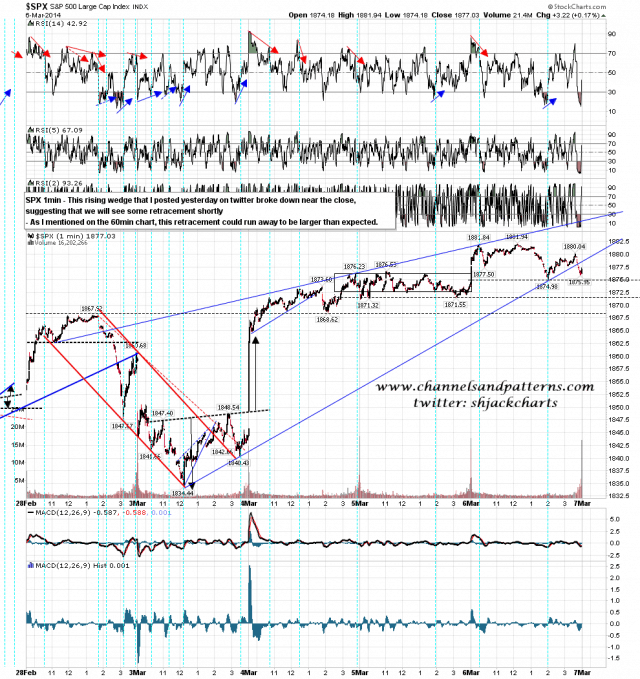

I identified a rising wedge from 1834 yesterday and posted it on twitter. It broke down slightly at the close which suggests that we are seeing a short term high made here and should expect a modest retracement now………..unless we are about to see a major and sustained punch above the weekly upper band, in which case that trendline break yesterday could alternatively be interpreted as a bullish wedge underthrow with an upside target in the 1930 area. That would be a real rarity and I’d be very very surprised to see it, but as ever these alternate scenarios are worth bearing in mind. SPX 1min chart:

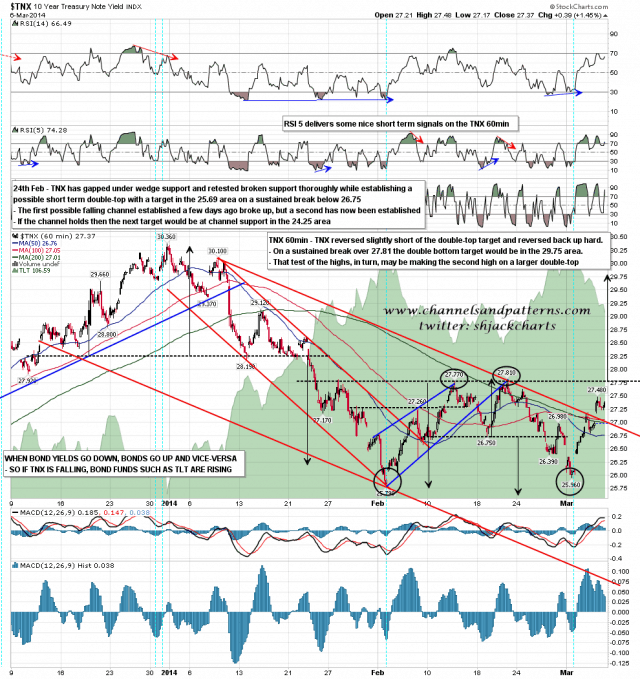

On other markets TNX stopped a little short of the small double-top target, and has most likely made the second low of a larger double-bottom with a target in the 29.75 area on a sustained break over strong resistance at 27.8. If this double-bottom plays out then that may be to test the current highs and make the second high on an even larger double-top. that would play out as tapering begins to bite in earnest. I’ve mentioned often before that the ends of QE1 and QE2 saw very big rallies on bonds, and we may be seeing that setting up again here. TNX 60min chart:

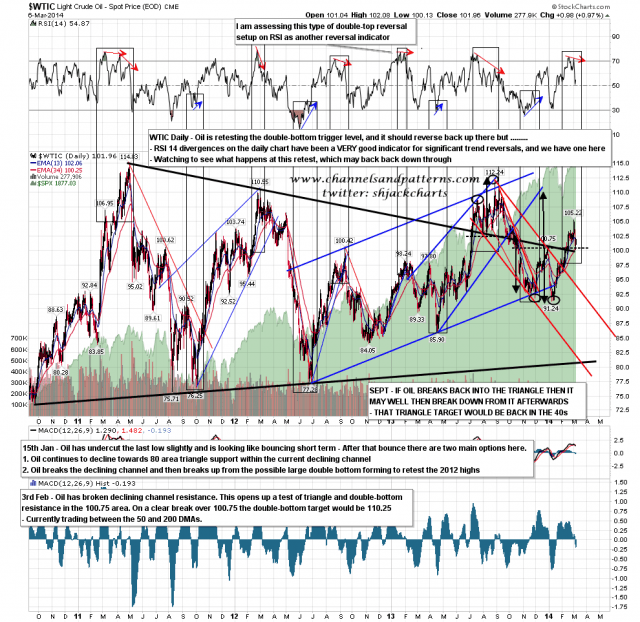

Oil has made it halfway to the double-bottom target at 110.25 and has now returned to retest broken double-bottom resistance. That’s not unusual and would normally be a buying opportunity, but there was clear negative divergence on the daily RSI 14 at the high, and the previous nine instances of this kind of daily divergence from the start of 2011 all marked significant trend reversals, with subsequent moves that were at least $14 from those reversals. That isn’t necessarily going to happen here, but I’m watching this retest with great interest. WTIC daily chart:

ES has gone as high as 1887.50 as I’ve been writing, and could go a bit higher today. I would like to see the SPX and ES daily upper bollinger bands hit if possible and a hit of the 1888-90 SPX area would manage that nicely on both if we see that. I’m not seeing upside beyond there as likely, and expect to see a close today in the 1880-5 SPX range or lower.

If I can I will be doing a weekend post on the US dollar, looking at DX and the three largest USD index components EUR, GBP and JPY.