Since my Admiral Ackbar prediction came true (twice) this week, I figured a Star Wars cantina would be appropriate. Enjoy the music while you have your drink. We serve your kind here.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Involuntary Incarceration

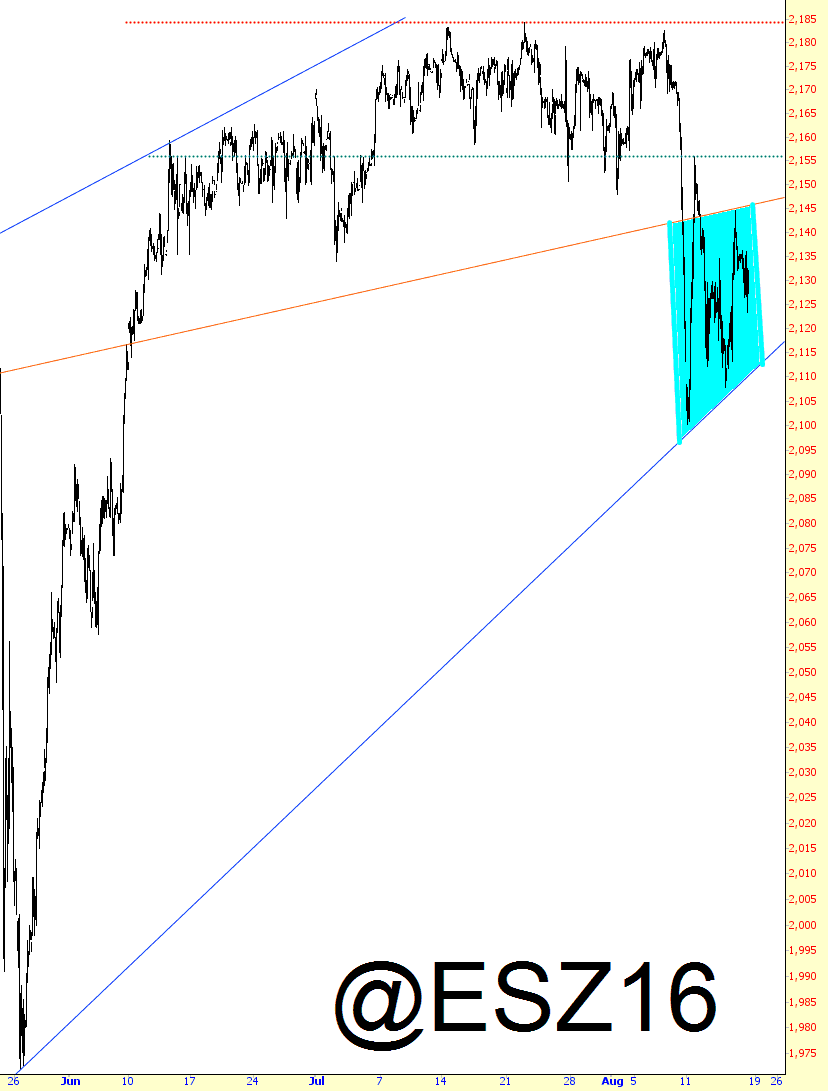

So far, so good today – – crude oil (down over 2% as of this moment) is helping, and the market overall is weak enough to keep Tim happy. What’s key is that we break out of this zone to the downside. Who knows – – – maybe that crusty old biddy Yellen will be, ironically, the salvation for the bears next Wednesday. We’ll have to see about that. Here’s the intraday ES:

The Market in Three Pictures

Back On The Three Day Rule

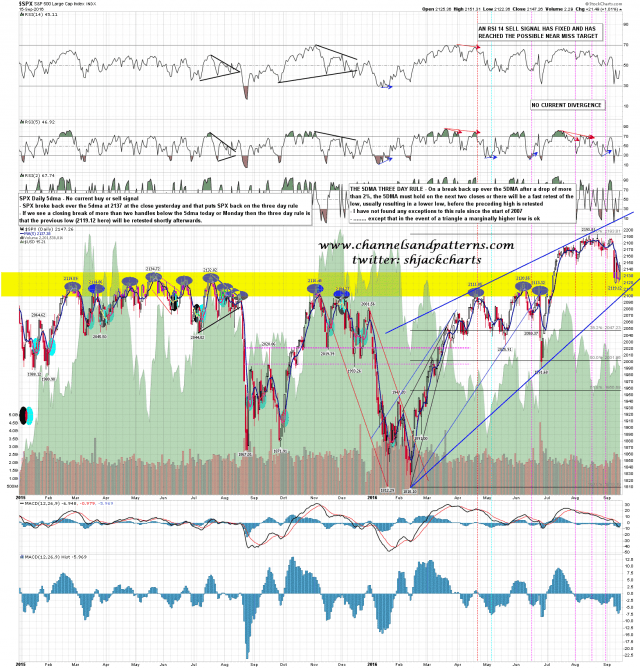

A very nice day for calls yesterday (buffs fingernails modestly) with RUT following through on the falling wedge I called in my AM post, the possible trend up day I called playing out, and then calling the likely (and actual) high of the day in the afternoon just after it was reached on twitter (shjackcharts). Hoping some of you guys caught some of that and the perfect SPX rising wedge from the low that I posted on twitter with the high call.

SPX broke back over the 5dma yesterday and that puts SPX back on the three day rule. On a break (2 handles +) back below there at the close today or Monday, that would require a retest of the current retracement low at 2119 and likely lower low. With the 5dma at 2137 at the close yesterday that wouldn’t be a big move though. SPX daily 5dma chart:

Cracking Crude

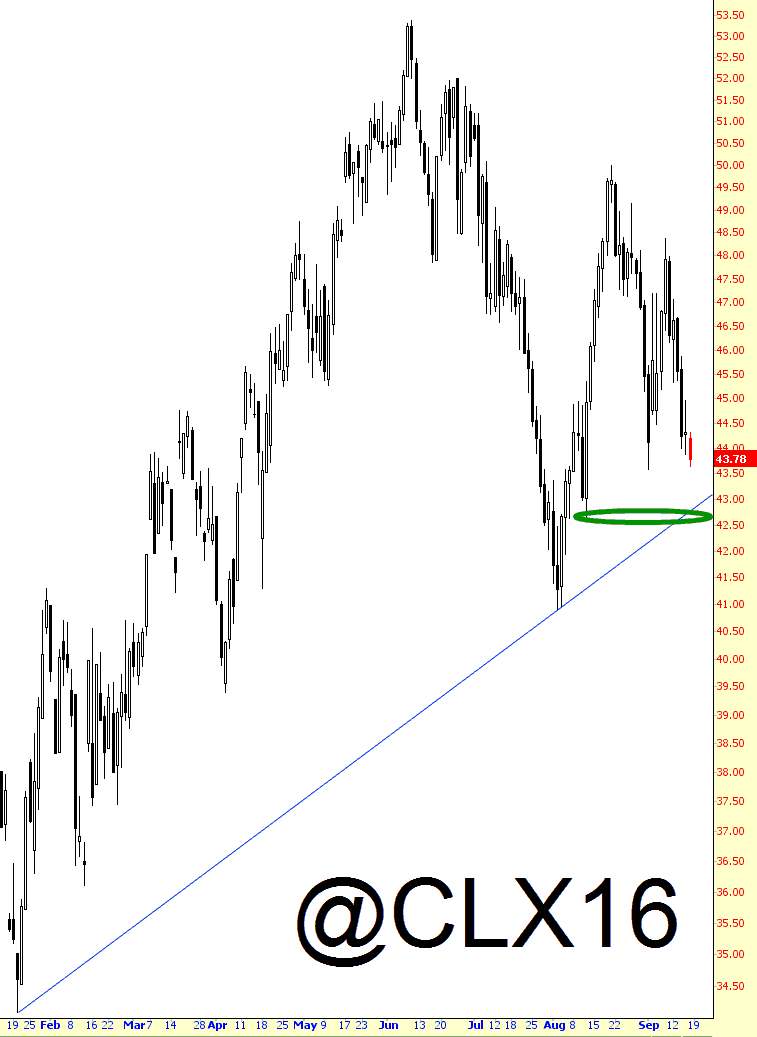

Good morning (well, technically) everyone. This is mostly a comment cleaner, as you chatty Slopers have racked up about 400 comments from my last post yesterday. My dogs are staring at me, though, eager for their way-too-early-every-morning stroll through the pitch black streets of Palo Alto. Thus, I will share this one chart of crude oil, which has the new front month of November. My view is that breaking 43.59 is the next important event, since that’ll slice us through a trendline that’s been in place the entire year.

As I was typing this, a slew of economic data came in, and early reaction seems to be not-so-thrilled. I certainly hope it sticks, since it’ll mean my prediction of a “second trap” (mentioned in the prior post) will have proved itself prescient.