I made my living writing Artificial Intelligence Algorithms for the financial markets in the 90’s and 2000’s. I developed one technique (and software program) for finding big (Kahuna) trades before they happened. Currently, most of you are enjoying the TLT short, which I will demonstrate was a predetermined Kahuna trade for July. Then I will show you the next Kahuna trade coming, going short XLF in July/August.

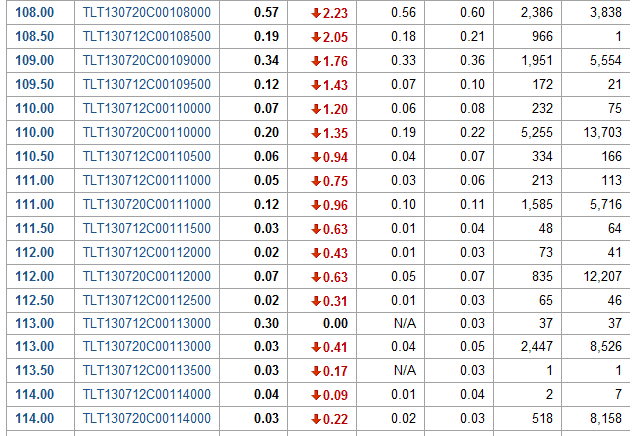

First, let me show you how the short on TLT was well telegraphed in advance. Please observe the TLT options open interest configuration for July (the current month). The first grid is the call open interest around the original strike price for the start of July. The second grid is the put open interest around the same strike prices. Notice how overwhelming the put open interest is to the call open interest. In this way, you know the “smart money” knows for the month of July, TLT was going to be taken down.

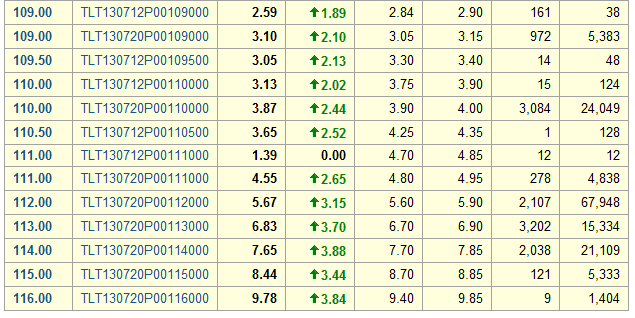

Now, being lazy (not really), I wrote a program that scans the stocks/ETFs of my choice for the months of my choice to figure out the next Kahuna trade. Please observe a partial printout of the scan for August. Here I am looking for the “next” Kahuna trade after TLT.

We start by looking in the OIRATIO column and looking for any large negative or positive ratios. While EEM and FXI are nicely negative, these trades are not new. What is new is the large negative ratio (-0.667) for XLF. Next notice the OIPUTBELOW number for XLF. 487405 is significantly more put open interest than the call open interest columns.

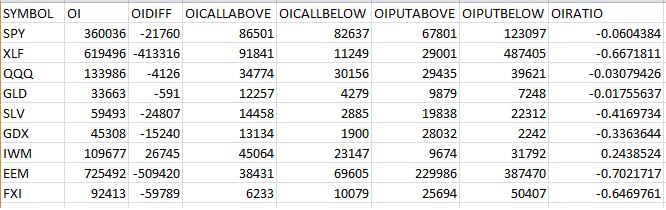

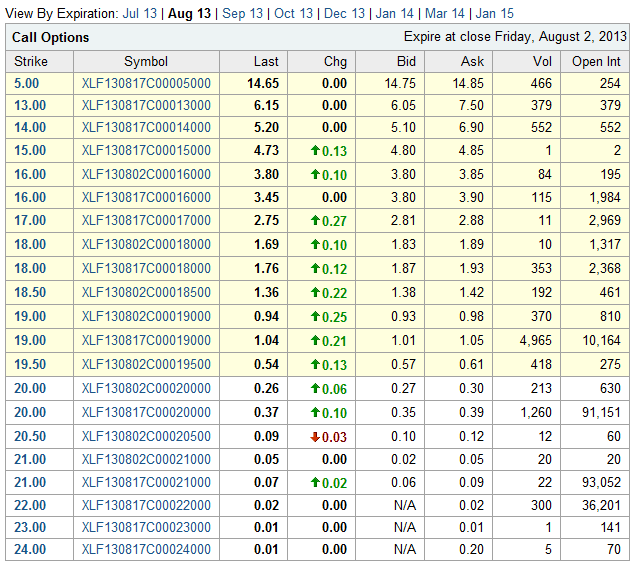

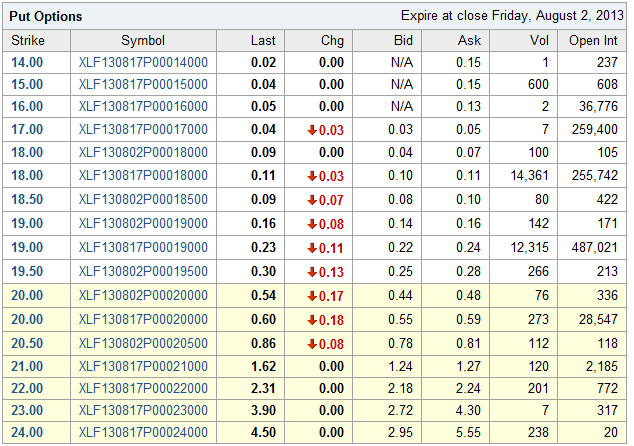

Now that we have a possible candidate trade, we go to Yahoo Finance and check the actual options configurations just to make sure my program did not pick up a red herring. Below is the XLF call and put option open interest for August. Note the huge put positions for the month of August.

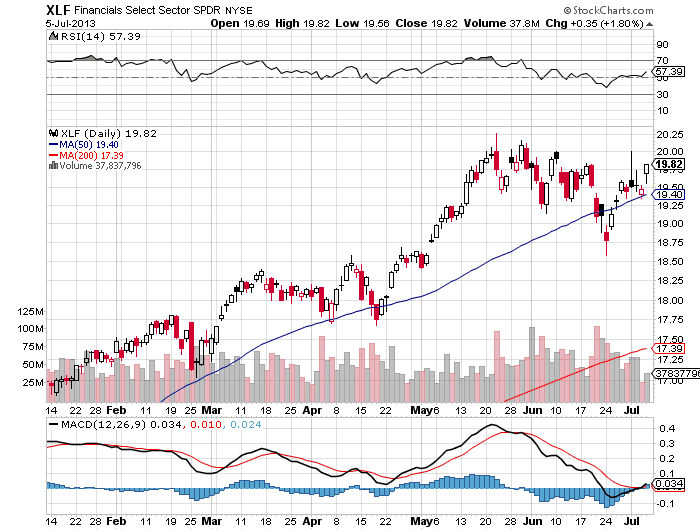

Next we check the chart for XLF. If XLF reaches its recent highs, we should see a significant negative divergence for the MACD. Plus the rally has been on declining volume with some distribution days mixed in.

Now, I am not saying when you should enter the short on XLF. Each of us has a different trading style. All I am saying is the smart money (or someone dumb enough to throw away almost $12 million) is betting on XLF short for July and August (August XLF options expire August 2).

An interesting sidebar is that XLF July options expire July 26 whereas XLF August options expire August 2, only 1 week later. Yet the big money is on August 2, so the week containing July 31 is important to the big money.

By the way, as far as Artificial Intelligence goes, we used to gather reams of data and throw neural networks on them to perform algorithm based filtering of the data to present the best trades to us. Nowadays, that is overkill for our purposes.

Also, you all are smart enough to know no system works all the time, so please use this knowledge with discretion.